Answered step by step

Verified Expert Solution

Question

1 Approved Answer

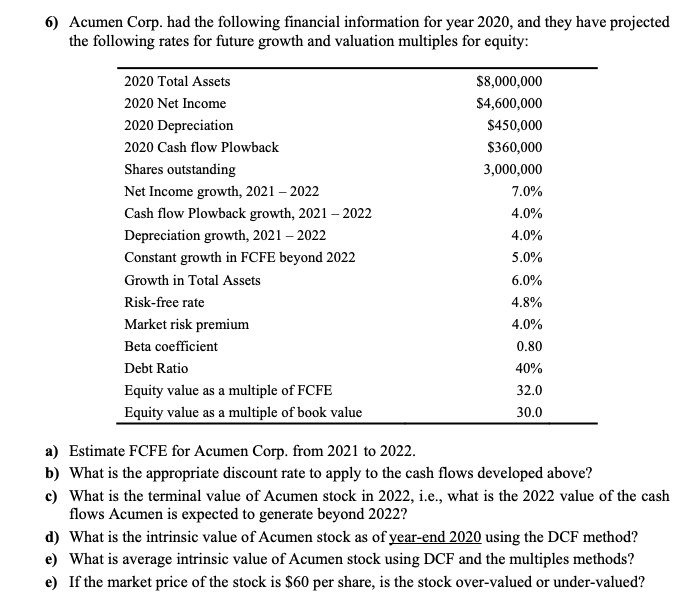

Please show steps 6) Acumen Corp. had the following financial information for year 2020, and they have projected the following rates for future growth and

Please show steps

6) Acumen Corp. had the following financial information for year 2020, and they have projected the following rates for future growth and valuation multiples for equity: 2020 Total Assets 2020 Net Income 2020 Depreciation 2020 Cash flow Plowback Shares outstanding Net Income growth, 2021 2022 Cash flow Plowback growth, 2021 - 2022 Depreciation growth, 2021 - 2022 Constant growth in FCFE beyond 2022 Growth in Total Assets Risk-free rate Market risk premium Beta coefficient Debt Ratio Equity value as a multiple of FCFE Equity value as a multiple of book value $8,000,000 $4,600,000 $450,000 $360,000 3,000,000 7.0% 4.0% 4.0% 5.0% 6.0% 4.8% 4.0% 0.80 40% 32.0 30.0 a) Estimate FCFE for Acumen Corp. from 2021 to 2022. b) What is the appropriate discount rate to apply to the cash flows developed above? c) What is the terminal value of Acumen stock in 2022, i.e., what is the 2022 value of the cash flows Acumen is expected to generate beyond 2022? d) What is the intrinsic value of Acumen stock as of year-end 2020 using the DCF method? e) What is average intrinsic value of Acumen stock using DCF and the multiples methods? e) If the market price of the stock is $60 per share, is the stock over-valued or under-valued? 6) Acumen Corp. had the following financial information for year 2020, and they have projected the following rates for future growth and valuation multiples for equity: 2020 Total Assets 2020 Net Income 2020 Depreciation 2020 Cash flow Plowback Shares outstanding Net Income growth, 2021 2022 Cash flow Plowback growth, 2021 - 2022 Depreciation growth, 2021 - 2022 Constant growth in FCFE beyond 2022 Growth in Total Assets Risk-free rate Market risk premium Beta coefficient Debt Ratio Equity value as a multiple of FCFE Equity value as a multiple of book value $8,000,000 $4,600,000 $450,000 $360,000 3,000,000 7.0% 4.0% 4.0% 5.0% 6.0% 4.8% 4.0% 0.80 40% 32.0 30.0 a) Estimate FCFE for Acumen Corp. from 2021 to 2022. b) What is the appropriate discount rate to apply to the cash flows developed above? c) What is the terminal value of Acumen stock in 2022, i.e., what is the 2022 value of the cash flows Acumen is expected to generate beyond 2022? d) What is the intrinsic value of Acumen stock as of year-end 2020 using the DCF method? e) What is average intrinsic value of Acumen stock using DCF and the multiples methods? e) If the market price of the stock is $60 per share, is the stock over-valued or under-valuedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started