Answered step by step

Verified Expert Solution

Question

1 Approved Answer

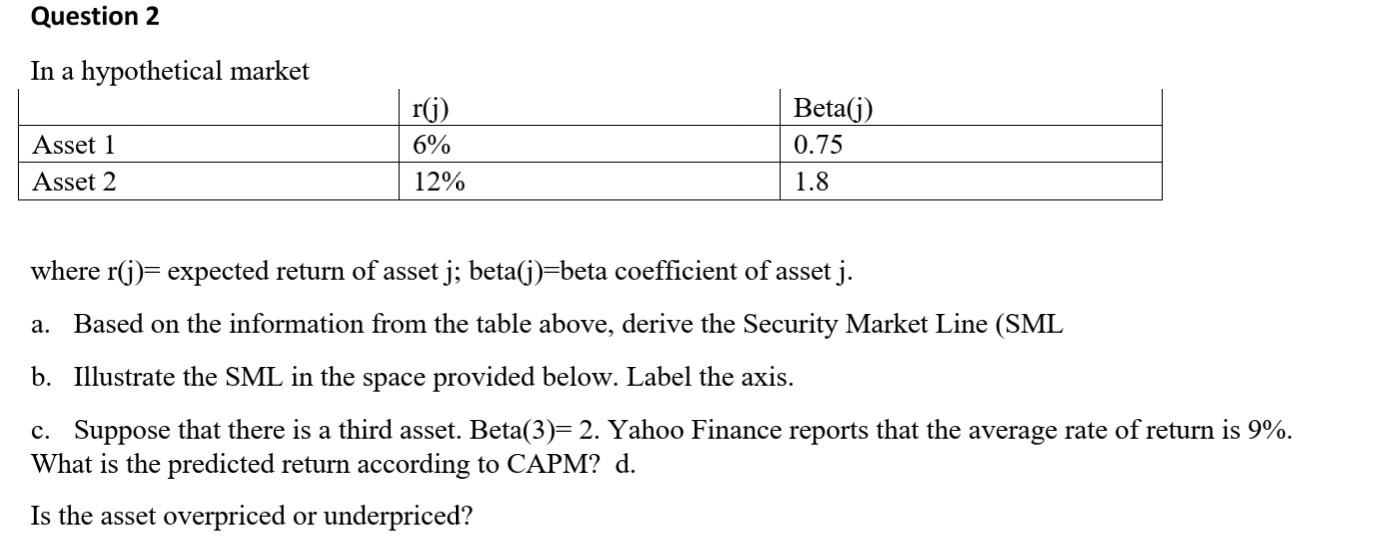

Please show steps and formula. Question 2 In a hypothetical market r(i) 6% Asset 1 Asset 2 Beta(j) 0.75 1.8 12% where r(j)= expected return

Please show steps and formula.

Question 2 In a hypothetical market r(i) 6% Asset 1 Asset 2 Beta(j) 0.75 1.8 12% where r(j)= expected return of asset j; beta(j)=beta coefficient of asset j. a. Based on the information from the table above, derive the Security Market Line (SML b. Illustrate the SML in the space provided below. Label the axis. c. Suppose that there is a third asset. Beta(3)= 2. Yahoo Finance reports that the average rate of return is 9%. a What is the predicted return according to CAPM? d. Is the asset overpriced or underpricedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started