please show steps

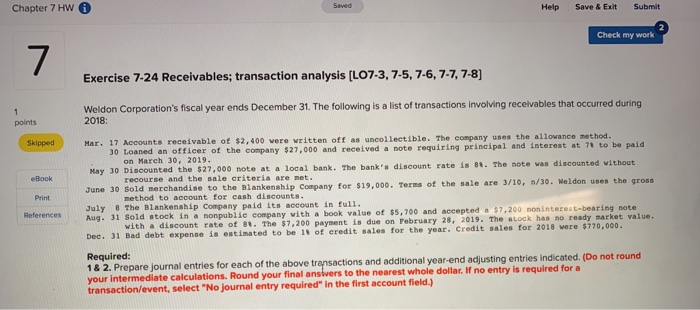

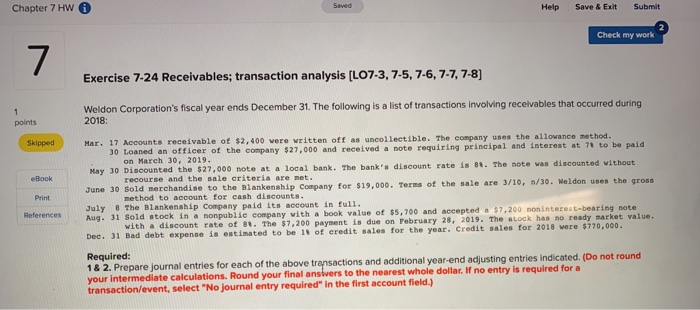

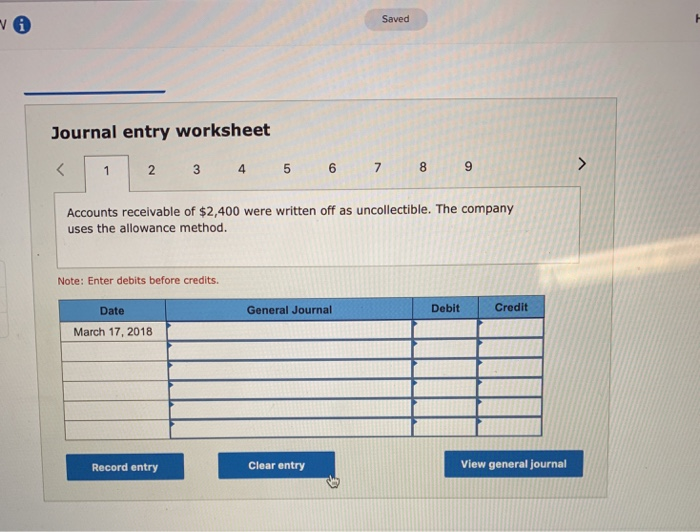

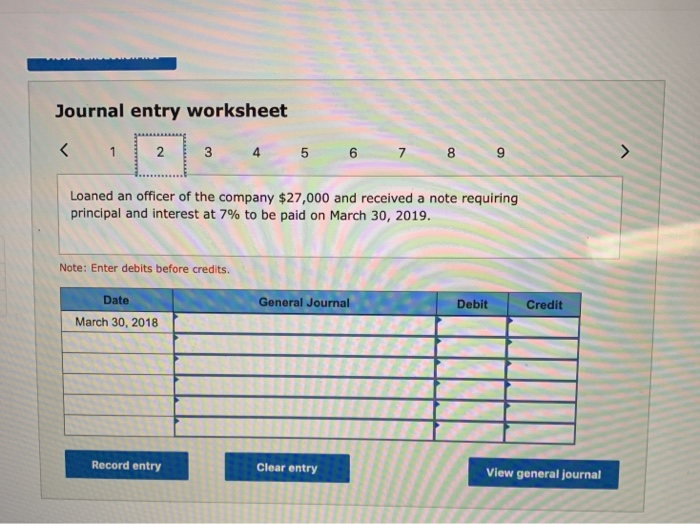

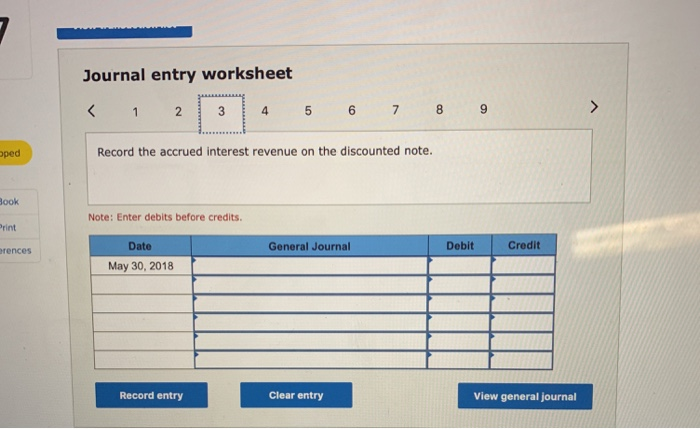

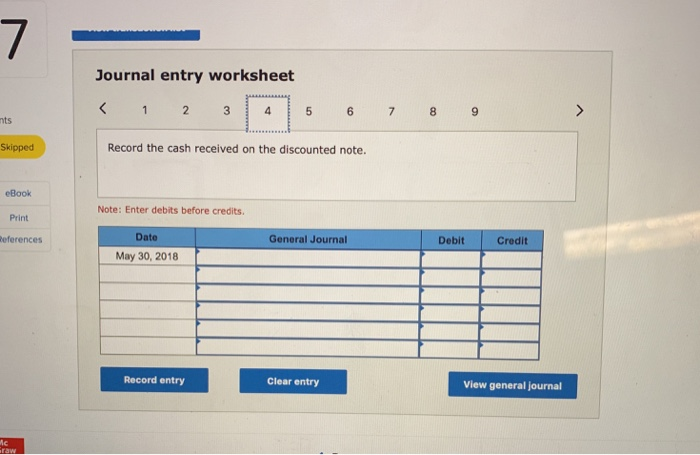

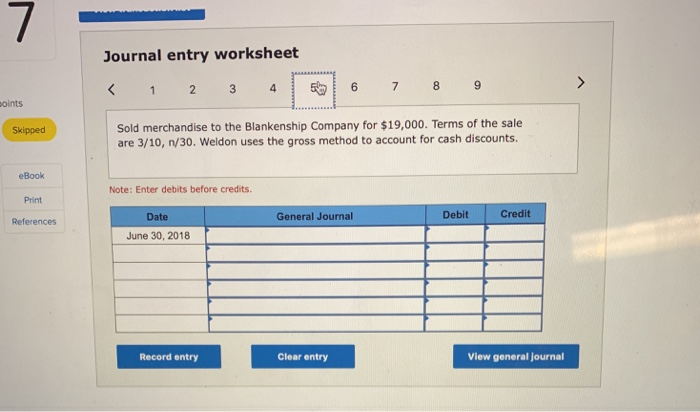

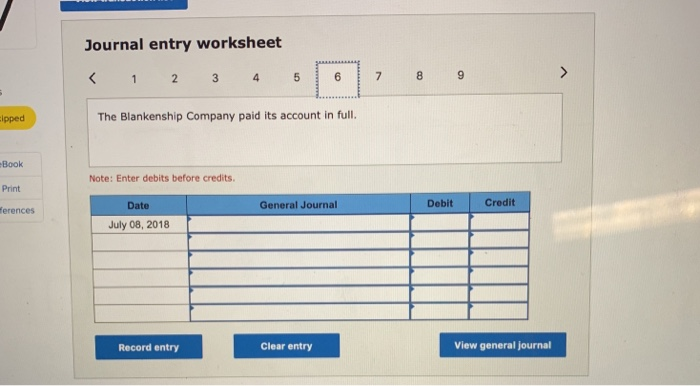

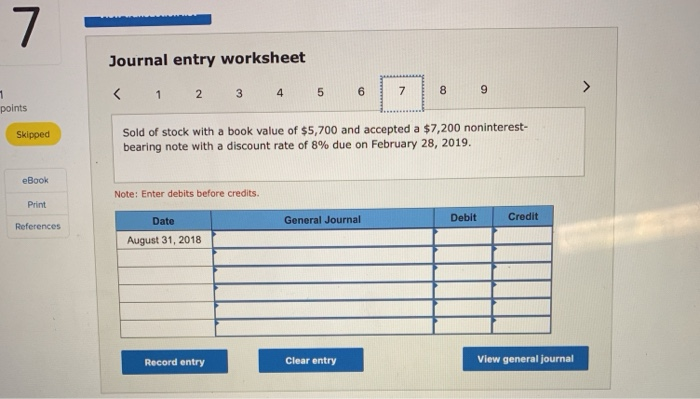

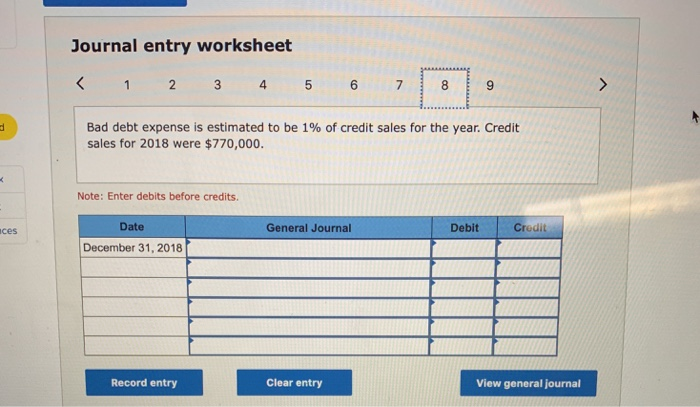

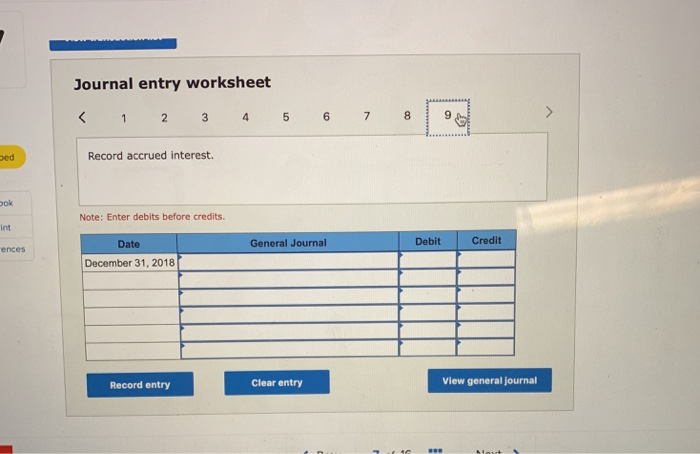

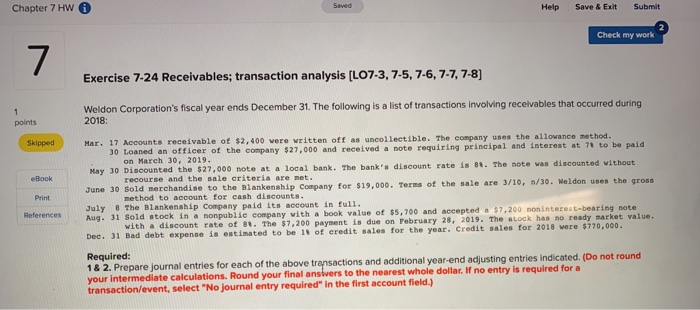

Chapter 7 Hw Help Save &Exit Submit Check my work 7 Exercise 7-24 Receivables; transaction analysis [L07-3, 7-5,7-6, 7-7, 7-8] Weldon Corporation's fiscal year ends December 31. The following is a list of transactions involving receivables that occurred during 2018 Mar. 17 Accounts receivable of $2,400 vere written off as uncollectible. The company uses the allowance May 30 Discounted the $27,000 note at a local bank. The bank's discount rate is 8. The note vas d July 8 The Blankenship Company paid its account in full points Skipped 30 Loaned an officer of the company $27,000 and received a note requiring principal and interest at 7t to be paid on March 30, 2019 eBook Print References d merchandise to the Blankenship Company for $19,000. Terms of the sale are 3/10, n/. Weldon uses the gross nethod to account for cash discounts. recourse and the sale criteria are net Sold stock in a nonpublie com with a discount rate of 8%. The S7.200 payment is due on rebruary 2, Aug. 31 pany vith a book value of $5,700 and accepted a $7,200 noninterest-bearing note y 28, 2019. The sLock has no ready market value. 018 were $770,000 se is estimated to be 1% of credit sales for the year. Credit sales for 2 Required: 1& 2. Prepare journal entries for each of the above transactions and additional year-end adjusting your intermediate calculations. Round your final answers to the ne transaction/event, select "No journal entry required" in the first account field.) entries indicated. (Do not round arest whole dollar. If no entry is required for a Saved Journal entry worksheet Accounts receivable of $2,400 were written off as uncollectible. The company uses the allowance method Note: Enter debits before credits. Date General Journal Debit Credit March 17, 2018 Record entry Clear entry View general journal Journal entry worksheet Loaned an officer of the company $27,000 and received a note requiring principal and interest at 7% to be paid on March 30, 2019. Note: Enter debits before credits. Date General Journal Debit Credit March 30, 2018 Record entry Clear entry View general journal Journal entry worksheet ped Record the accrued interest revenue on the discounted note. ook Note: Enter debits before credits rint Date General Journal Debit Credit rences May 30, 2018 Record entry Clear entry View general journal Journal entry worksheet oints Sold merchandise to the Blankenship Company for $19,000. Terms of the sale are 3/10, n/30. Weldon uses the gross method to account for cash discounts Skipped eBook Print References Note: Enter debits before credits. Date General Journal Debit Credit June 30, 2018 Record entry Clear entry View general journal Journal entry worksheet The Blankenship Company paid its account in full. ipped Book Note: Enter debits before credits. Print Date General Journal Debit Credit erences July 08, 2018 Record entry Clear entry View general journal 7 Journal entry worksheet points Sold of stock with a book value of $5,700 and accepted a $7,200 noninterest- bearing note with a discount rate of 8% due on February 28, 2019. Skipped eBook Print References Note: Enter debits before credits. Date General Journal Debit Credit August 31, 2018 Record entry Clear entry View general journal Journal entry worksheet 2 4 Bad debt expense is estimated to be 1% of credit sales for the year. Credit sales for 2018 were $770,000. Note: Enter debits before credits Date General Journal Debit ces December 31, 2018 Record entry Clear entry View general journal Journal entry worksheet ped Record accrued interest. ook Note: Enter debits before credits int Date General Journal Debit Credit ences December 31, 2018 Record entry Clear entry View general journal