Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show steps on how to solve these questions 23. Assume that Investment X and Investment Y are expected to generate the following cash flows

Please show steps on how to solve these questions

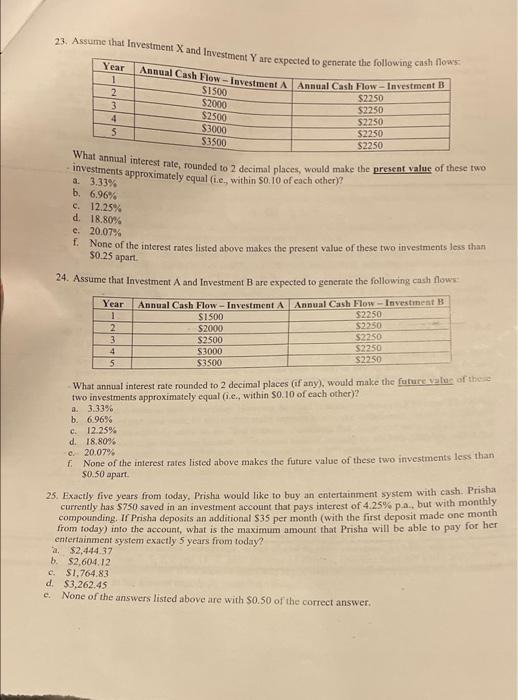

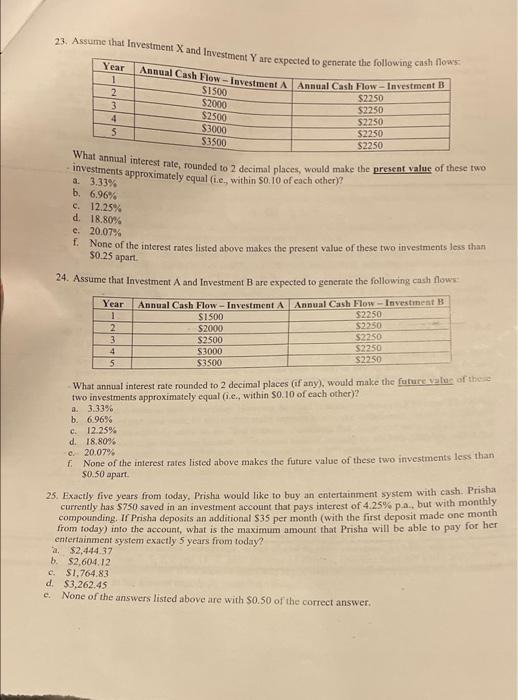

23. Assume that Investment X and Investment Y are expected to generate the following cash flows Year Annual Cash Flow - Investment A 1 S1500 2 S2000 3 $2.500 4 $3000 5 $3500 Annual Cash Flow - Investment B $2250 $2250 $2250 $2250 S2250 What annual interest rate, rounded to 2 decimal places, would make the present value of these two investments approximately equal (.e., within 50, 10 of cach other)? a 3.33% b. 6.96% c. 12.25% d. 18.80% c. 20.07% 1. None of the interest rates listed above makes the present value of these two investments less than 50.25 apart a. b G. 24. Assume that Investment A and Investment Bare expected to generate the following cash flows Year Annual Cash Flow - Investment A Annual Cash Flow - Investment B 1 S1500 $2250 2 S2000 S2250 3 $2250 $2500 4 S3000 S2250 5 S3500 $2250 What annual interest rate rounded to 2 decimal places (if any), would make the future value of the two investments approximately equal (.e., within 50.10 of cach other)? 3.33% 6.96% 12.25% d. 18.80% c. 20.07% f None of the interest rates listed above makes the future value of these two investments less than S0.50 apart 25. Exactly five years from today. Prisha would like to buy an entertainment system with cash. Prisha currently has $750 saved in an investment account that pays interest of 4.25% p.a., but with monthly compounding. Ir Prisha deposits an additional S35 per month (with the first deposit made one month from today) into the account, what is the maximum amount that Prisho will be able to pay for her entertainment system exactly 5 years from today? a. $2,444,37 b. $2.604.12 c. S1.764.83 d. $3,262.45 None of the answers listed above are with $0.50 of the correct answer. e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started