Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please, Show steps Q4 Suppose you purchased a house 7 years ago and took out a mortgage for $400,000 with a 5.6% interest rate. The

Please, Show steps

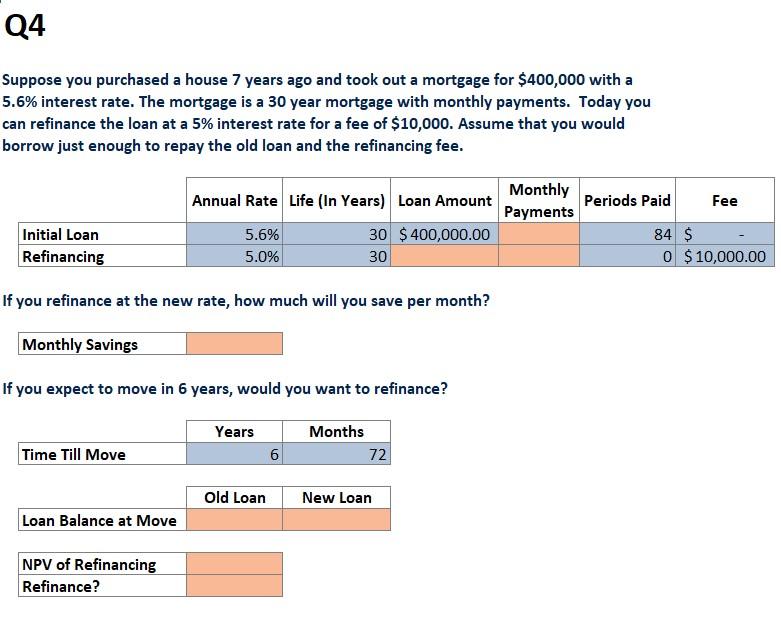

Q4 Suppose you purchased a house 7 years ago and took out a mortgage for $400,000 with a 5.6% interest rate. The mortgage is a 30 year mortgage with monthly payments. Today you can refinance the loan at a 5% interest rate for a fee of $10,000. Assume that you would borrow just enough to repay the old loan and the refinancing fee. Monthly Annual Rate Life (In Years) Loan Amount Periods Paid Fee Payments 5.6% 30 $400,000.00 84 $ 5.0% 30 o $10,000.00 Initial Loan Refinancing If you refinance at the new rate, how much will you save per month? Monthly Savings If you expect to move in 6 years, would you want to refinance? Years Months 72 Time Till Move 6 Old Loan New Loan Loan Balance at Move NPV of Refinancing RefinanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started