please show steps

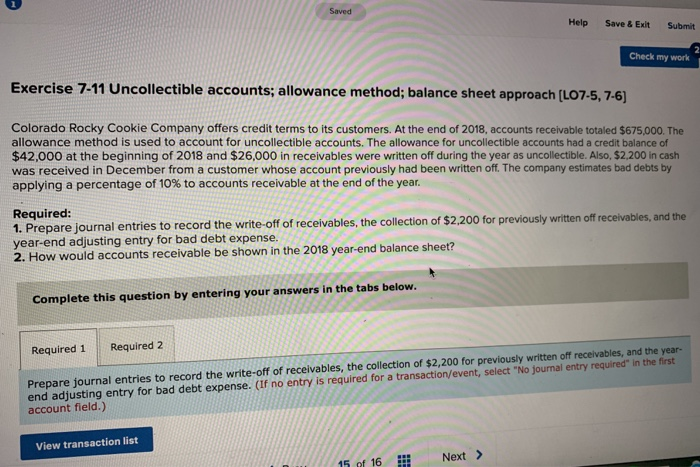

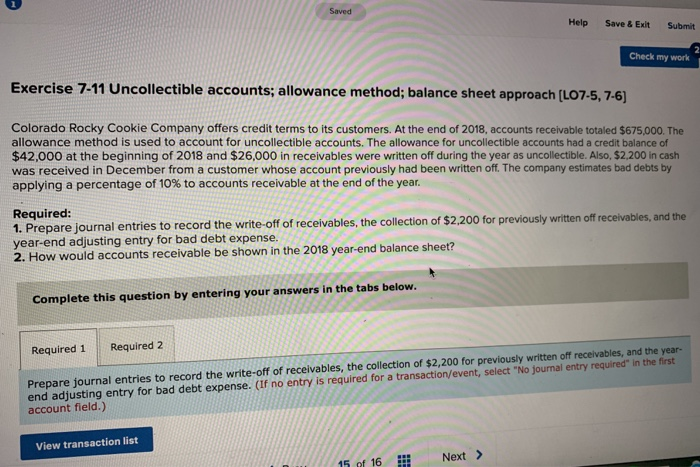

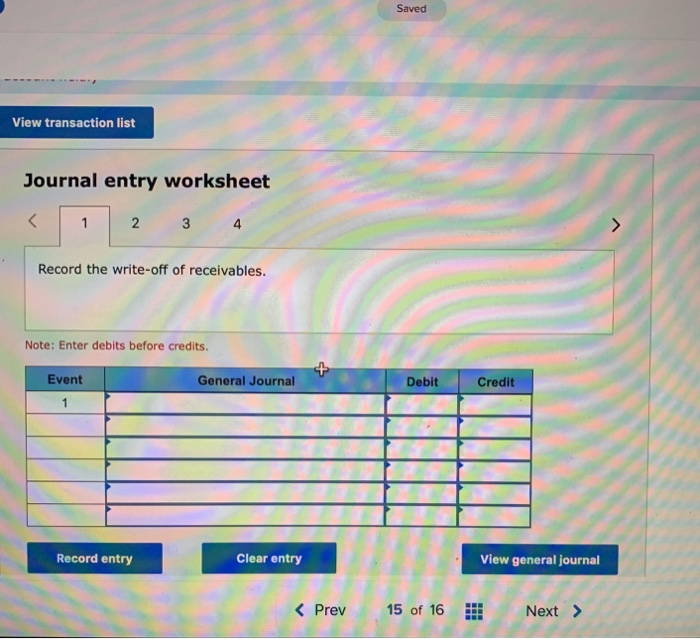

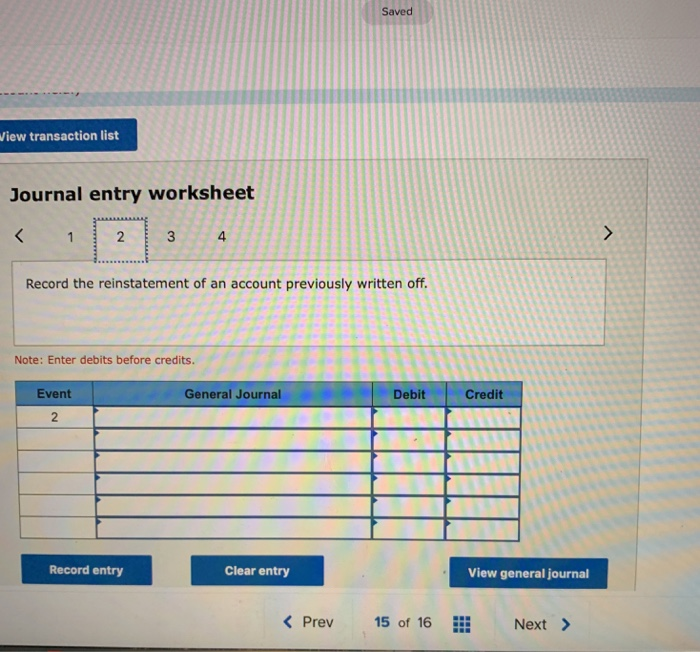

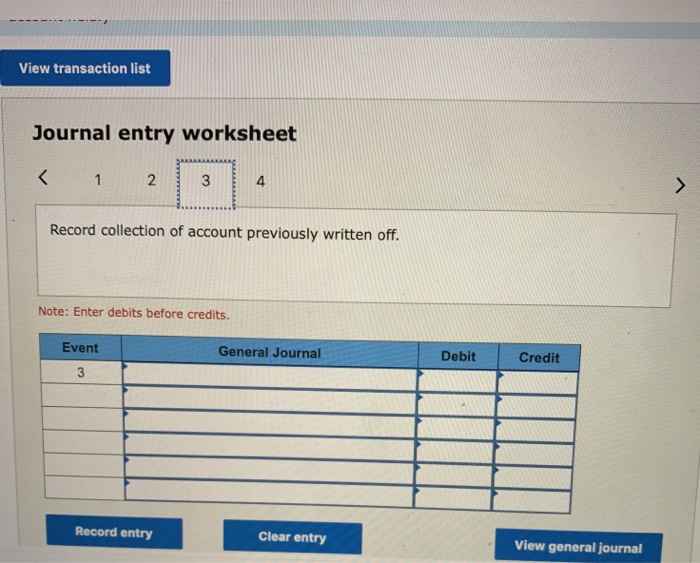

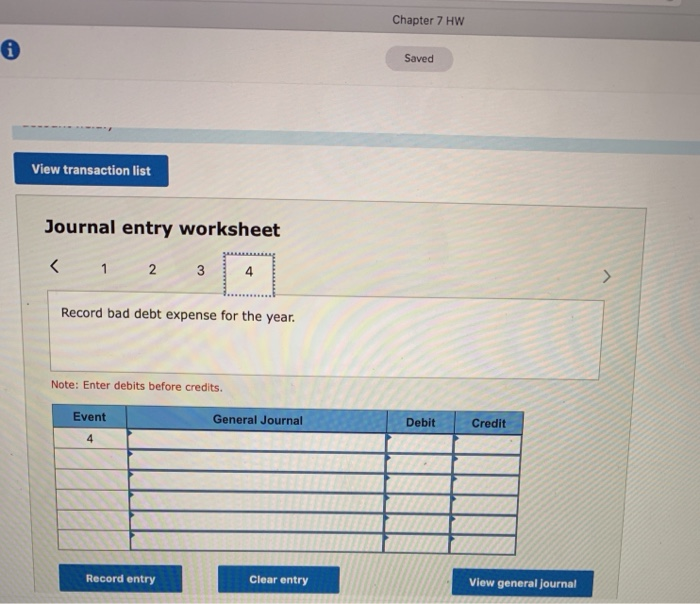

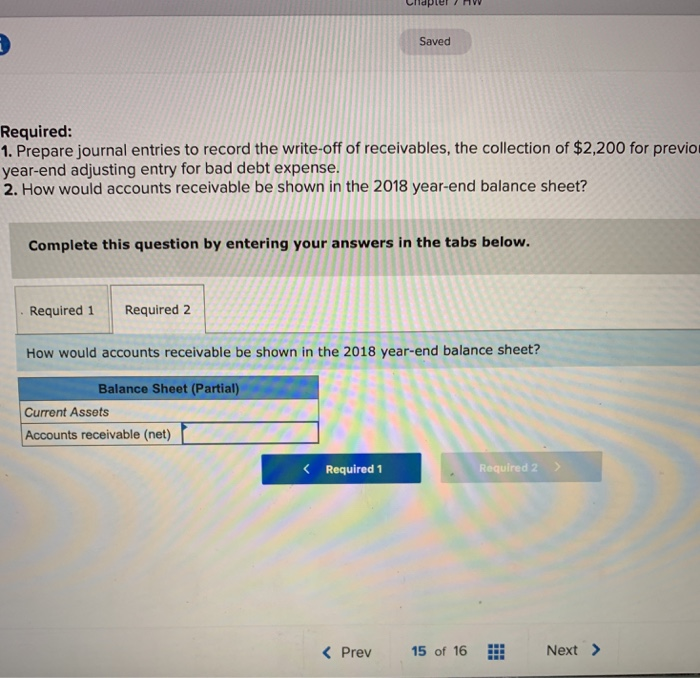

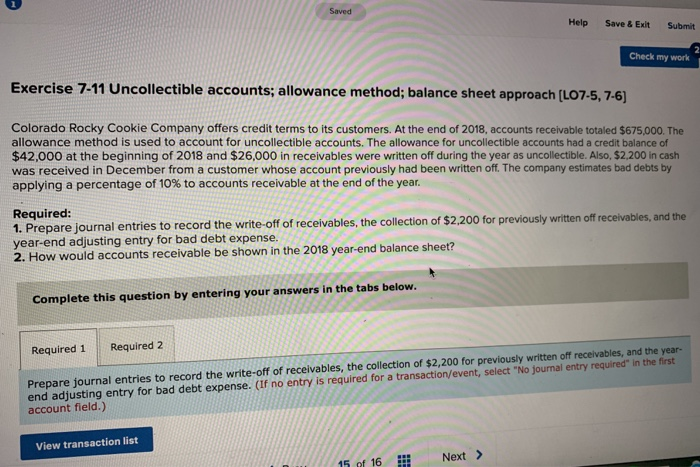

Saved Help Save & ExitSubmit Check my work Exercise 7-11 Uncollectible accounts; allowance method; balance sheet approach [LO7-5, 7-6) Colorado Rocky Cookie Company offers credit terms to its customers. At the end of 2018, accounts receivable totaled $675,000. The allowance method is used to account for uncollectible accounts. The allowance for uncollectible accounts had a credit balance of $42,000 at the beginning of 2018 and $26,000 in receivables were written off during the year as uncollectible. Also, $2,200 in cash was received in December from a customer whose account previously had been written off. The company estimates bad debts by applying a percentage of 10% to accounts receivable at the end of the year. Required: 1. Prepare journal entries to record the write-off of receivables, the collection of $2,200 for previously wirtten off receivables, and the year-end adjusting entry for bad debt expense. 2. How would accounts receivable be shown in the 2018 year-end balance sheet? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare journal entries to record the write-off of receivables, the collection of $2,200 for previously written off receivables, and the year- (If no entry is required for a transaction/event, select "No journal entry required in the first end adjusting entry for bad debt expense. ( account field.) View transaction list Next > 15 of 16 Saved View transaction list Journal entry worksheet 4 Record the write-off of receivables. Note: Enter debits before credits. Event General Journal Debit Credit Record entry Clear entry View general journa Prev 15 of 16 Next Next > Saved View transaction list Journal entry worksheet 3 4 Record the reinstatement of an account previously written off Note: Enter debits before credits. Event General Journal Debit Credit 2 Record entry Clear entry View general journal Prev 15 of 16 Next oNext View transaction list Journal entry worksheet 4 Record collection of account previously written off Note: Enter debits before credits. Event General Journal Debit Credit Record entry Clear entry View general journal Chapter 7 Hw 0 Saved View transaction list Journal entry worksheet 4 Record bad debt expense for the year. Note: Enter debits before credits. Event General Journal Debit Credit 4 Record entry Clear entry View general journal CHapter7 HW Saved Required: 1. Prepare journal entries to record the write-off of receivables, the collection of $2,200 for previo year-end adjusting entry for bad debt expense. 2. How would accounts receivable be shown in the 2018 year-end balance sheet? Complete this question by entering your answers in the tabs below. Required 1 Required 2 How would accounts receivable be shown in the 2018 year-end balance sheet? Balance Sheet (Partial) Current Assets Accounts receivable (net) Required 1 Required 2 K Prev15 of 16 Next