Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show steps. Thank you. The Little Feat Manufacturing Company produces a product that is sold as an input to most golf cart manufacturers. Little

Please show steps. Thank you.

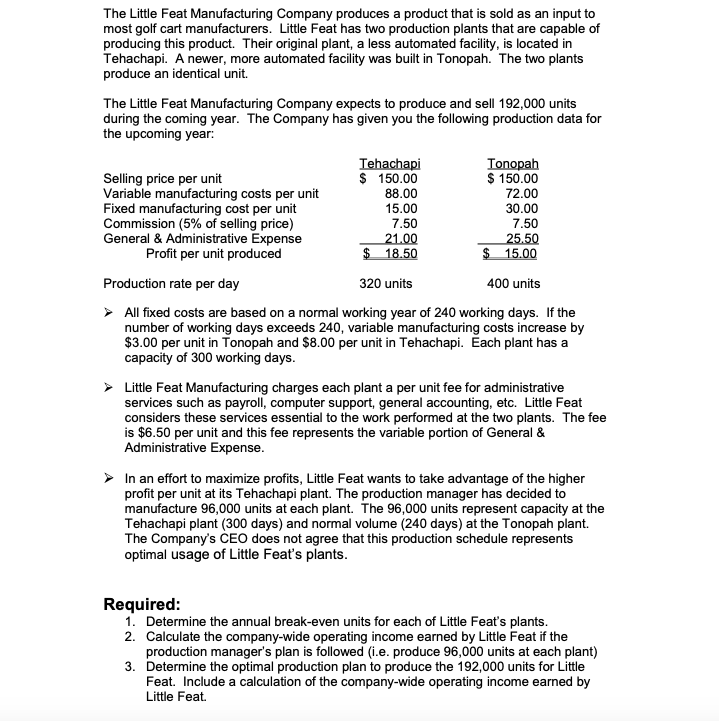

The Little Feat Manufacturing Company produces a product that is sold as an input to most golf cart manufacturers. Little Feat has two production plants that are capable of producing this product. Their original plant, a less automated facility, is located in Tehachapi. A newer, more automated facility was built in Tonopah. The two plants produce an identical unit. The Little Feat Manufacturing Company expects to produce and sell 192,000 units during the coming year. The Company has given you the following production data for the upcoming year: Tehachapi Tonopah Selling price per unit $ 150.00 $ 150.00 Variable manufacturing costs per unit 88.00 72.00 Fixed manufacturing cost per unit 15.00 30.00 Commission (5% of selling price) 7.50 7.50 General & Administrative Expense 21.00 25.50 Profit per unit produced $ 18.50 $ 15.00 Production rate per day 320 units 400 units All fixed costs are based on a normal working year of 240 working days. If the number of working days exceeds 240, variable manufacturing costs increase by $3.00 per unit in Tonopah and $8.00 per unit in Tehachapi. Each plant has a capacity of 300 working days. Little Feat Manufacturing charges each plant a per unit fee for administrative services such as payroll, computer support, general accounting, etc. Little Feat considers these services essential to the work performed at the two plants. The fee is $6.50 per unit and this fee represents the variable portion of General & Administrative Expense. In an effort to maximize profits, Little Feat wants to take advantage of the higher profit per unit at its Tehachapi plant. The production manager has decided to manufacture 96,000 units at each plant. The 96,000 units represent capacity at the Tehachapi plant (300 days) and normal volume (240 days) at the Tonopah plant. The Company's CEO does not agree that this production schedule represents optimal usage of Little Feat's plants. Required: 1. Determine the annual break-even units for each of Little Feat's plants. 2. Calculate the company-wide operating income earned by Little Feat if the production manager's plan is followed (i.e. produce 96,000 units at each plant) 3. Determine the optimal production plan to produce the 192,000 units for Little Feat. Include a calculation of the company-wide operating income earned by Little FeatStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started