Answered step by step

Verified Expert Solution

Question

1 Approved Answer

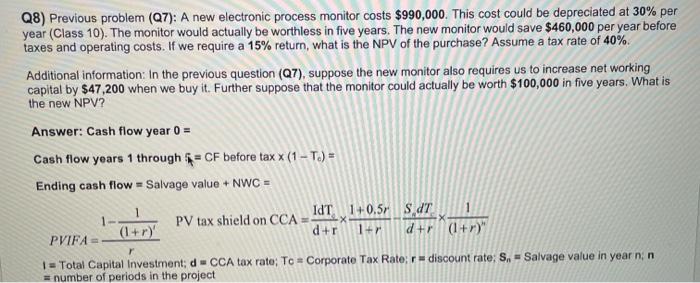

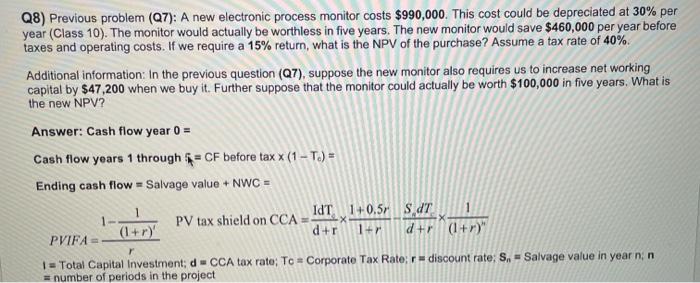

please show steps to solve along with formulas, no excel, thank you Q8) Previous problem (@7): A new electronic process monitor costs $990,000. This cost

please show steps to solve along with formulas, no excel, thank you

Q8) Previous problem (@7): A new electronic process monitor costs $990,000. This cost could be depreciated at 30% per year (Class 10). The monitor would actually be worthless in five years. The new monitor would save $460,000 per year before taxes and operating costs. If we require a 15% return, what is the NPV of the purchase? Assume a tax rate of 40%. Additional information: In the previous question (Q7), suppose the new monitor also requires us to increase net working capital by $47,200 when we buy it. Further suppose that the monitor could actually be worth $100,000 in five years. What is the new NPV? Answer: Cash flow year 0 = Cash flow years 1 through - CF before tax x (1 - T.) = Ending cash flow = Salvage value + NWC = IdT 1+0.57 S dr 1 PV tax shield on CCA (1+r) d+r 1+ d+r (1+r)" PVIFA 1 = Total Capital Investment; d - CCA tax rate; Tc - Corporate Tax Rate;r discount rate: S, =Salvage value in year n; n = number of periods in the project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started