Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show steps to solve in Excel. 1. What are the business cases for each of the two projects, Match My Doll Clothing (MMDC) and

Please show steps to solve in Excel.

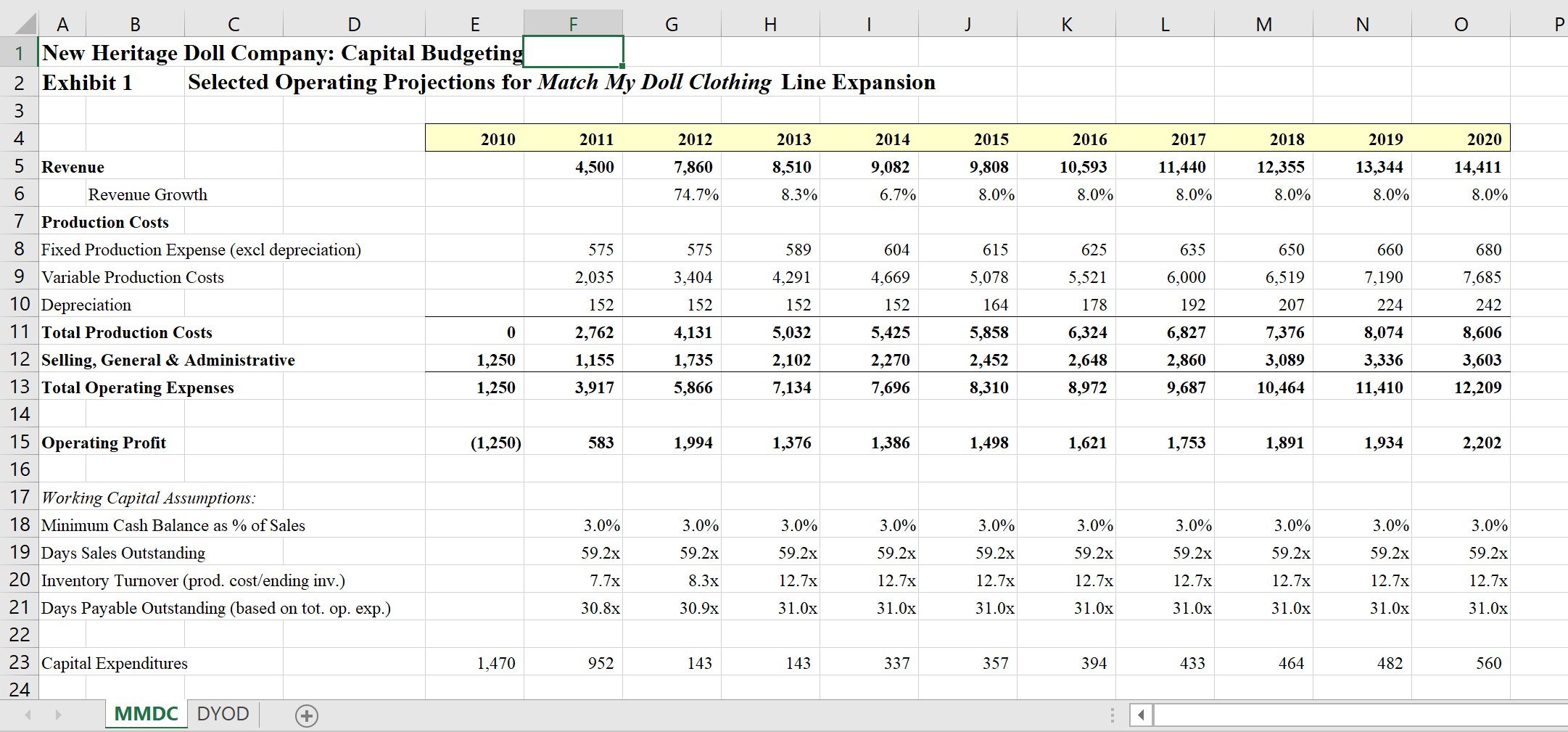

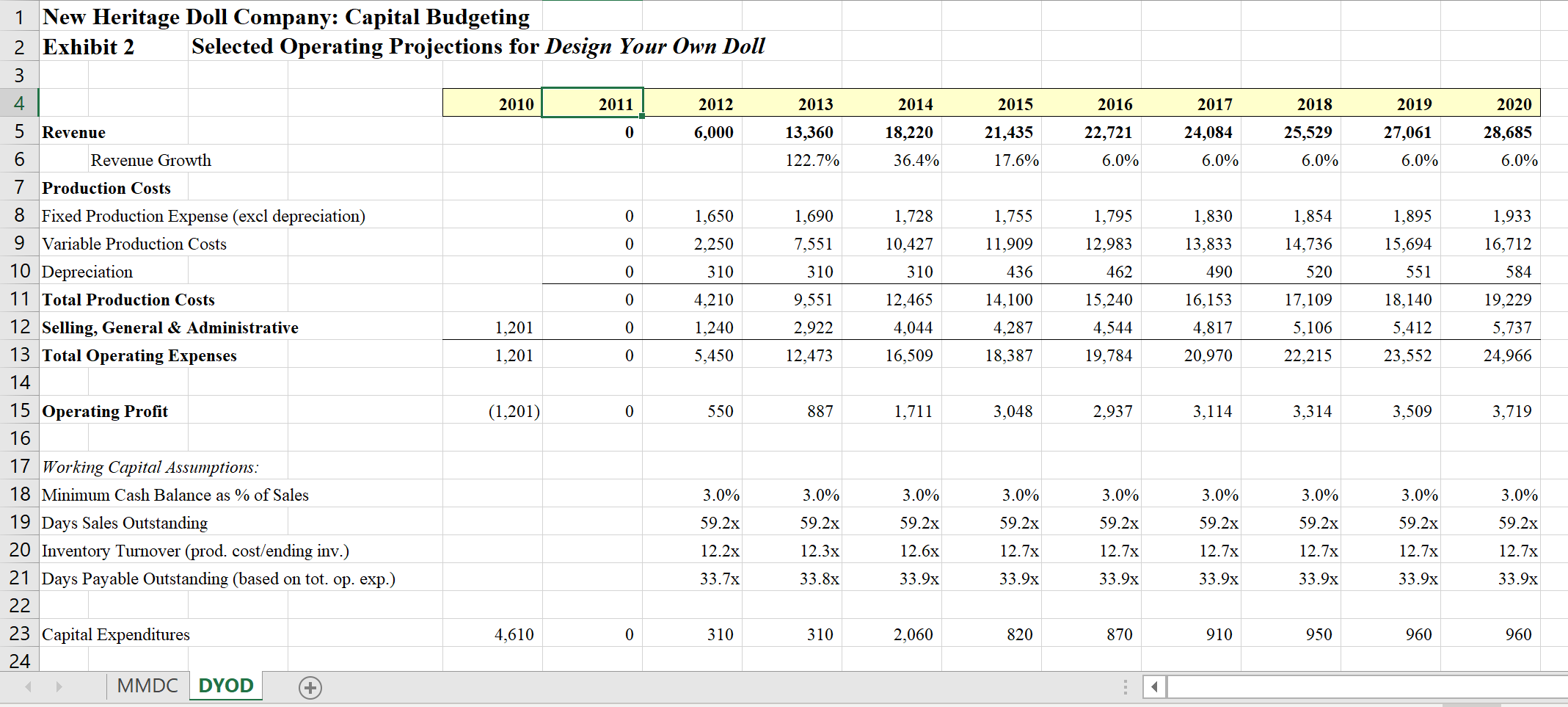

1. What are the business cases for each of the two projects, Match My Doll Clothing (MMDC) and Design Your Own Doll (DYOD). Which case is more compelling from a qualitative point of view? bullet points are fine to answer this. 2. Find the NPV and IRR of both projects in the Excel sheet provided. K. L M. N o A B D E F G H 1 New Heritage Doll Company: Capital Budgeting 2 Exhibit 1 Selected Operating Projections for Match My Doll Clothing Line Expansion 3 Nm 4 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 5 Revenue 4,500 7,860 8,510 9,808 11,440 12,355 13,344 14,411 9,082 6.7% 10,593 8.0% 6 Revenue Growth 74.7% 8.3% 8.0% 8.0% 8.0% 8.0% 8.0% 575 575 589 604 615 625 635 650 660 680 2,035 3,404 4,291 4,669 5,078 5,521 6,000 6,519 7,190 7,685 152 152 152 152 164 178 192 207 224 242 0 2,762 4,131 5,032 6,324 6,827 7,376 8,606 5,858 2,452 8,074 3,336 1,250 1,155 5,425 2,270 7,696 1,735 2,860 3,089 2,102 7,134 3,603 2,648 8,972 1,250 3,917 5,866 8,310 9,687 10,464 11,410 12,209 (1,250) 583 1,994 1,376 1,386 1,498 1,621 1,753 1,891 1,934 2,202 7 Production Costs 8 Fixed Production Expense (excl depreciation) 9 Variable Production Costs 10 Depreciation 11 Total Production Costs 12 Selling, General & Administrative 13 Total Operating Expenses 14 15 Operating Profit 16 17 Working Capital Assumptions: 18 Minimum Cash Balance as % of Sales 19 Days Sales Outstanding 20 Inventory Turnover (prod. cost/ending inv.) 21 Days Payable Outstanding (based on tot. op. exp.) 22 23 Capital Expenditures 24 MMDC DYOD 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x 7.7x 8.3x 12.7x 12.7x 12.7x 12.7x 12.7x 12.7x 12.7x 12.7x 30.8x 30.9x 31.0x 31.0x 31.0x 31.0x 31.0x 31.0x 31.0x 31.0x 1,470 952 143 143 337 357 394 433 464 482 560 1 New Heritage Doll Company: Capital Budgeting 2 Exhibit 2 Selected Operating Projections for Design Your Own Doll 3 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 5 Revenue 0 6,000 13,360 18,220 21,435 22,721 24,084 25,529 27,061 28,685 No Revenue Growth 122.7% 36.4% 17.6% 6.0% 6.0% 6.0% 6.0% 6.0% 0 1,728 1,755 1,795 1,830 1,854 1,933 1,650 2.250 1,690 7,551 1,895 15,694 0 11,909 12.983 13,833 14,736 16,712 10,427 310 0 310 310 436 462 490 520 551 584 0 9,551 19,229 1,201 4,210 1,240 5,450 0 12,465 4,044 16,509 2.922 14,100 4,287 18,387 17,109 5,106 15,240 4,544 19,784 16,153 4,817 20,970 18,140 5,412 23,552 5,737 1,201 0 12,473 22,215 24,966 (1,201) 0 550 887 1,711 3,048 2,937 3,114 3,314 3,509 3,719 7 Production Costs 8 Fixed Production Expense (excl depreciation) 9 Variable Production Costs 10 Depreciation 11 Total Production Costs 12 Selling, General & Administrative 13 Total Operating Expenses 14 15 Operating Profit 16 17 Working Capital Assumptions: 18 Minimum Cash Balance as % of Sales 19 Days Sales Outstanding 20 Inventory Turnover (prod. cost/ending inv.) 21 Days Payable Outstanding (based on tot. op. exp.) 22 23 Capital Expenditures 24 MMDC DYOD 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x 12.2x 12.3x 12.6x 12.7x 12.7x 12.7x 12.7x 12.7x 12.7x 33.7x 33.8x 33.9x 33.9x 33.9x 33.9x 33.9x 33.9x 33.9x 4,610 0 310 310 2,060 820 870 910 950 960 960 1. What are the business cases for each of the two projects, Match My Doll Clothing (MMDC) and Design Your Own Doll (DYOD). Which case is more compelling from a qualitative point of view? bullet points are fine to answer this. 2. Find the NPV and IRR of both projects in the Excel sheet provided. K. L M. N o A B D E F G H 1 New Heritage Doll Company: Capital Budgeting 2 Exhibit 1 Selected Operating Projections for Match My Doll Clothing Line Expansion 3 Nm 4 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 5 Revenue 4,500 7,860 8,510 9,808 11,440 12,355 13,344 14,411 9,082 6.7% 10,593 8.0% 6 Revenue Growth 74.7% 8.3% 8.0% 8.0% 8.0% 8.0% 8.0% 575 575 589 604 615 625 635 650 660 680 2,035 3,404 4,291 4,669 5,078 5,521 6,000 6,519 7,190 7,685 152 152 152 152 164 178 192 207 224 242 0 2,762 4,131 5,032 6,324 6,827 7,376 8,606 5,858 2,452 8,074 3,336 1,250 1,155 5,425 2,270 7,696 1,735 2,860 3,089 2,102 7,134 3,603 2,648 8,972 1,250 3,917 5,866 8,310 9,687 10,464 11,410 12,209 (1,250) 583 1,994 1,376 1,386 1,498 1,621 1,753 1,891 1,934 2,202 7 Production Costs 8 Fixed Production Expense (excl depreciation) 9 Variable Production Costs 10 Depreciation 11 Total Production Costs 12 Selling, General & Administrative 13 Total Operating Expenses 14 15 Operating Profit 16 17 Working Capital Assumptions: 18 Minimum Cash Balance as % of Sales 19 Days Sales Outstanding 20 Inventory Turnover (prod. cost/ending inv.) 21 Days Payable Outstanding (based on tot. op. exp.) 22 23 Capital Expenditures 24 MMDC DYOD 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x 7.7x 8.3x 12.7x 12.7x 12.7x 12.7x 12.7x 12.7x 12.7x 12.7x 30.8x 30.9x 31.0x 31.0x 31.0x 31.0x 31.0x 31.0x 31.0x 31.0x 1,470 952 143 143 337 357 394 433 464 482 560 1 New Heritage Doll Company: Capital Budgeting 2 Exhibit 2 Selected Operating Projections for Design Your Own Doll 3 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 5 Revenue 0 6,000 13,360 18,220 21,435 22,721 24,084 25,529 27,061 28,685 No Revenue Growth 122.7% 36.4% 17.6% 6.0% 6.0% 6.0% 6.0% 6.0% 0 1,728 1,755 1,795 1,830 1,854 1,933 1,650 2.250 1,690 7,551 1,895 15,694 0 11,909 12.983 13,833 14,736 16,712 10,427 310 0 310 310 436 462 490 520 551 584 0 9,551 19,229 1,201 4,210 1,240 5,450 0 12,465 4,044 16,509 2.922 14,100 4,287 18,387 17,109 5,106 15,240 4,544 19,784 16,153 4,817 20,970 18,140 5,412 23,552 5,737 1,201 0 12,473 22,215 24,966 (1,201) 0 550 887 1,711 3,048 2,937 3,114 3,314 3,509 3,719 7 Production Costs 8 Fixed Production Expense (excl depreciation) 9 Variable Production Costs 10 Depreciation 11 Total Production Costs 12 Selling, General & Administrative 13 Total Operating Expenses 14 15 Operating Profit 16 17 Working Capital Assumptions: 18 Minimum Cash Balance as % of Sales 19 Days Sales Outstanding 20 Inventory Turnover (prod. cost/ending inv.) 21 Days Payable Outstanding (based on tot. op. exp.) 22 23 Capital Expenditures 24 MMDC DYOD 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 3.0% 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x 59.2x 12.2x 12.3x 12.6x 12.7x 12.7x 12.7x 12.7x 12.7x 12.7x 33.7x 33.8x 33.9x 33.9x 33.9x 33.9x 33.9x 33.9x 33.9x 4,610 0 310 310 2,060 820 870 910 950 960 960Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started