Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show steps using finance calculator. Thank you A company is planning to move to a larger office and is trying to decide if the

Please show steps using finance calculator. Thank you

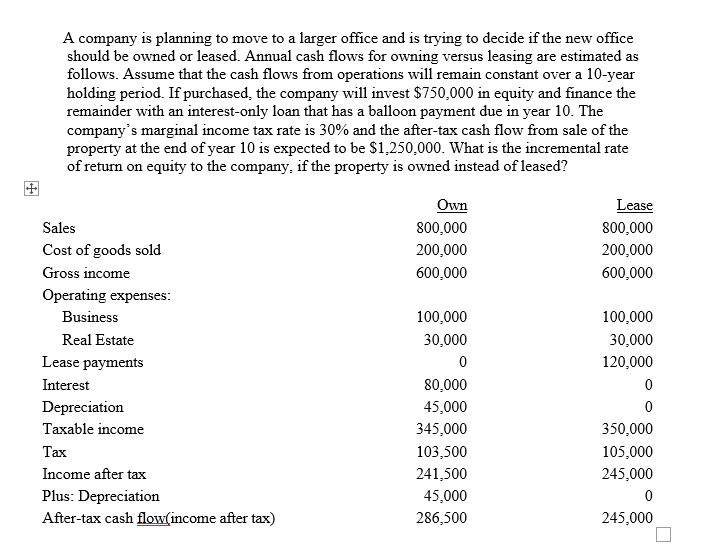

A company is planning to move to a larger office and is trying to decide if the new office should be owned or leased. Annual cash flows for owning versus leasing are estimated as follows. Assume that the cash flows from operations will remain constant over a 10-year holding period. If purchased, the company will invest $750,000 in equity and finance the remainder with an interest-only loan that has a balloon payment due in year 10 . The company's marginal income tax rate is 30% and the after-tax cash flow from sale of the property at the end of year 10 is expected to be $1,250,000. What is the incremental rate of return on equity to the company, if the property is owned instead of leasedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started