Answered step by step

Verified Expert Solution

Question

1 Approved Answer

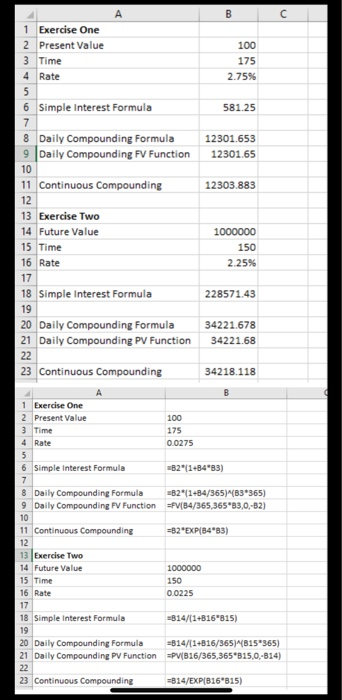

Please show the answer and the formula. The second picture is an example of what would help me the best. Thank you :) O Search

Please show the answer and the formula. The second picture is an example of what would help me the best. Thank you :)

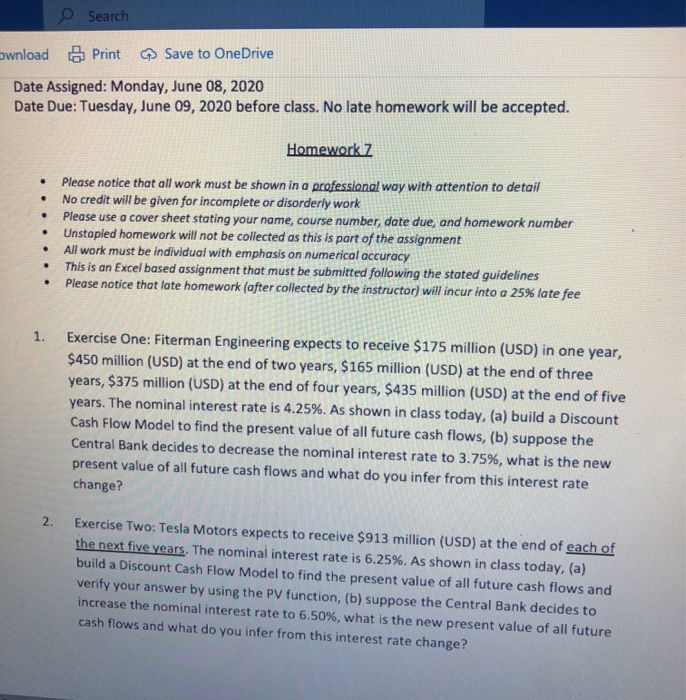

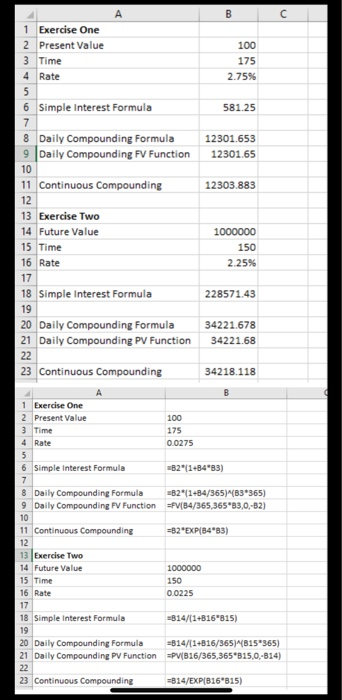

O Search wnload Print Save to OneDrive Date Assigned: Monday, June 08, 2020 Date Due: Tuesday, June 09, 2020 before class. No late homework will be accepted. Homework 7 . . . Please notice that all work must be shown in a professional way with attention to detail No credit will be given for incomplete or disorderly work Please use a cover sheet stating your name, course number, date due, and homework number Unstapled homework will not be collected as this is part of the assignment All work must be individual with emphasis on numerical accuracy This is an Excel based assignment that must be submitted following the stated guidelines Please notice that late homework (after collected by the instructor) will incur into a 25% late fee . . 1. Exercise One: Fiterman Engineering expects to receive $175 million (USD) in one year, $450 million (USD) at the end of two years, $165 million (USD) at the end of three years, $375 million (USD) at the end of four years, $435 million (USD) at the end of five years. The nominal interest rate is 4.25%. As shown in class today, (a) build a Discount Cash Flow Model to find the present value of all future cash flows, (b) suppose the Central Bank decides to decrease the nominal interest rate to 3.75%, what is the new present value of all future cash flows and what do you infer from this interest rate change? 2. Exercise Two: Tesla Motors expects to receive $913 million (USD) at the end of each of the next five years. The nominal interest rate is 6.25%. As shown in class today, (a) build a Discount Cash Flow Model to find the present value of all future cash flows and verify your answer by using the PV function, (b) suppose the Central Bank decides to increase the nominal interest rate to 6.50%, what is the new present value of all future cash flows and what do you infer from this interest rate change? B 100 175 2.75% 581.25 12301.653 12301.65 12303.883 1 Exercise One 2 Present Value 3 Time 4 Rate 5 6 Simple Interest Formula 7 8 Daily Compounding Formula 9 Daily Compounding FV Function 10 11 Continuous Compounding 12 13 Exercise Two 14 Future Value 15 Time 16 Rate 17 18 Simple Interest Formula 19 20 Daily Compounding Formula 21 Daily Compounding PV Function 22 23 Continuous Compounding 1000000 150 2.25% 228571.43 34221.678 34221.68 34218.118 1 Exercise One 2 Present Value 3 Time 4 Rate 100 175 0.0275 6 Simple Interest Formula =B2*(1+8483) 8 Daily Compounding Formula =B2*(1+B4/365)*(3*365) 9 Daily Compounding FV Function SFV[84/365,365*83,0,-82) 10 11 Continuous Compounding =B2*EXP(84*83) 12 13 Exercise Two 14 Future Value 1000000 15 Time 150 16 Rate 0.0225 17 18 Simple Interest Formula =B14/(1+B16"815) 19 20 Daily Compounding Formula =B14/(1+B16/365)(15*365) 21 Daily Compounding PV Function =PV1816/365,365*815,0,-814) 22 23 Continuous Compounding =814/EXP(816*815)

O Search wnload Print Save to OneDrive Date Assigned: Monday, June 08, 2020 Date Due: Tuesday, June 09, 2020 before class. No late homework will be accepted. Homework 7 . . . Please notice that all work must be shown in a professional way with attention to detail No credit will be given for incomplete or disorderly work Please use a cover sheet stating your name, course number, date due, and homework number Unstapled homework will not be collected as this is part of the assignment All work must be individual with emphasis on numerical accuracy This is an Excel based assignment that must be submitted following the stated guidelines Please notice that late homework (after collected by the instructor) will incur into a 25% late fee . . 1. Exercise One: Fiterman Engineering expects to receive $175 million (USD) in one year, $450 million (USD) at the end of two years, $165 million (USD) at the end of three years, $375 million (USD) at the end of four years, $435 million (USD) at the end of five years. The nominal interest rate is 4.25%. As shown in class today, (a) build a Discount Cash Flow Model to find the present value of all future cash flows, (b) suppose the Central Bank decides to decrease the nominal interest rate to 3.75%, what is the new present value of all future cash flows and what do you infer from this interest rate change? 2. Exercise Two: Tesla Motors expects to receive $913 million (USD) at the end of each of the next five years. The nominal interest rate is 6.25%. As shown in class today, (a) build a Discount Cash Flow Model to find the present value of all future cash flows and verify your answer by using the PV function, (b) suppose the Central Bank decides to increase the nominal interest rate to 6.50%, what is the new present value of all future cash flows and what do you infer from this interest rate change? B 100 175 2.75% 581.25 12301.653 12301.65 12303.883 1 Exercise One 2 Present Value 3 Time 4 Rate 5 6 Simple Interest Formula 7 8 Daily Compounding Formula 9 Daily Compounding FV Function 10 11 Continuous Compounding 12 13 Exercise Two 14 Future Value 15 Time 16 Rate 17 18 Simple Interest Formula 19 20 Daily Compounding Formula 21 Daily Compounding PV Function 22 23 Continuous Compounding 1000000 150 2.25% 228571.43 34221.678 34221.68 34218.118 1 Exercise One 2 Present Value 3 Time 4 Rate 100 175 0.0275 6 Simple Interest Formula =B2*(1+8483) 8 Daily Compounding Formula =B2*(1+B4/365)*(3*365) 9 Daily Compounding FV Function SFV[84/365,365*83,0,-82) 10 11 Continuous Compounding =B2*EXP(84*83) 12 13 Exercise Two 14 Future Value 1000000 15 Time 150 16 Rate 0.0225 17 18 Simple Interest Formula =B14/(1+B16"815) 19 20 Daily Compounding Formula =B14/(1+B16/365)(15*365) 21 Daily Compounding PV Function =PV1816/365,365*815,0,-814) 22 23 Continuous Compounding =814/EXP(816*815)

Please show the answer and the formula.

The second picture is an example of what would help me the best. Thank you :)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started