Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show the break down for this problem and the answer. Thank you! Required information The Foundational 15 (Static) [LO13-1, LO13-2] [The following information applies

please show the break down for this problem and the answer. Thank you!

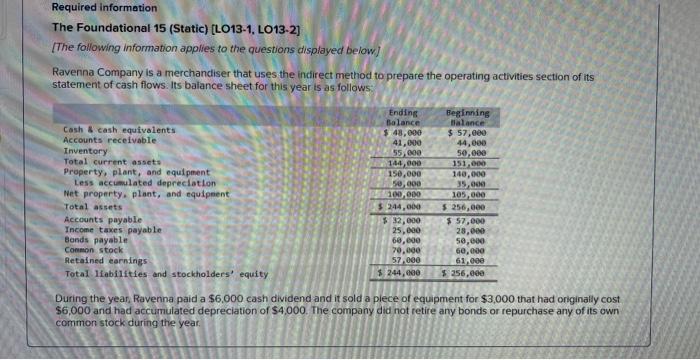

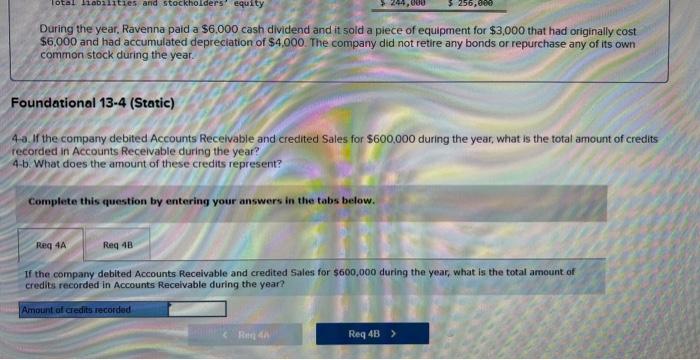

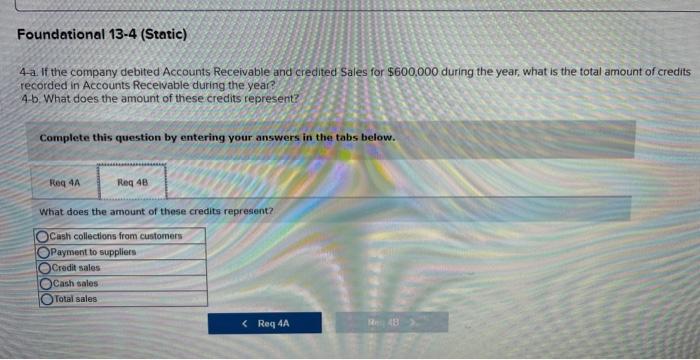

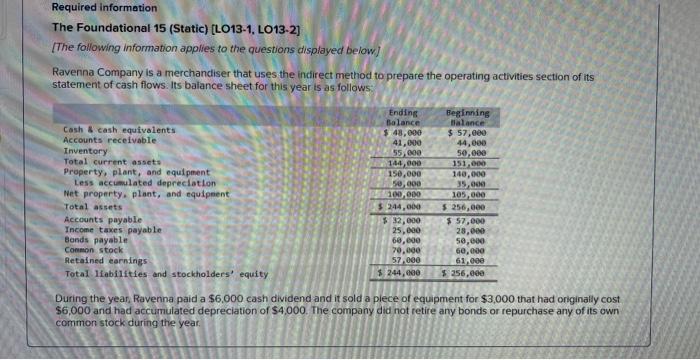

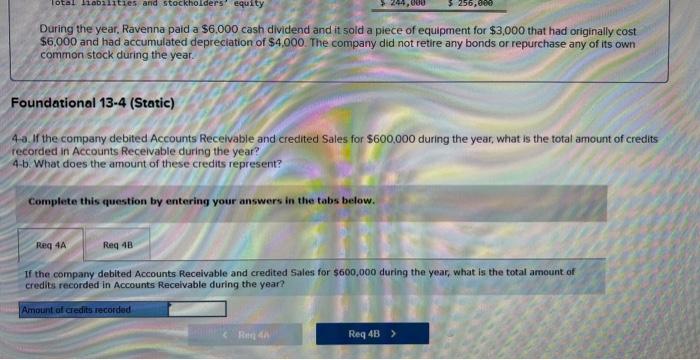

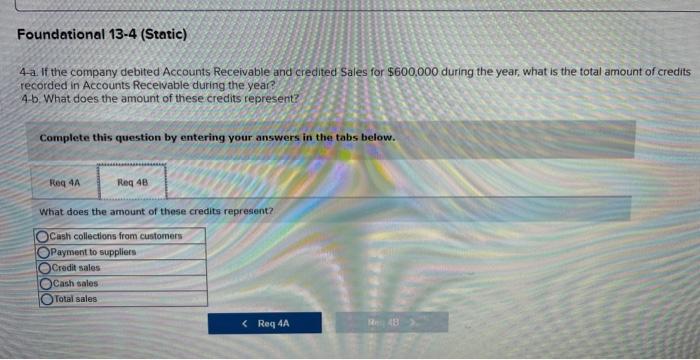

Required information The Foundational 15 (Static) [LO13-1, LO13-2] [The following information applies to the questions displayed below] Ravenina Company is a merchandiser that uses the indirect method to prepare the operating activities section of its statement of cash flows. Its balance sheet for this year is as follows: During the year, Ravenna paid a $6,000 cash dividend and it sold a plece of equipment for $3,000 that had originally cost $6,000 and had accumulated depreciation of $4,000. The company did not retite any bonds or repurchase any of its own common stock during the year. During the year, Ravenna paid a $6,000 cash dividend and it sold a piece of equipment for $3,000 that had originally cost $6.000 and had accumulated depreciation of $4,000. The company did not retire any bonds or repurchase any of its own common stock during the year. Foundational 13-4 (Static) 4. If the company debited Accounts Recelvable and credited Sales for $600,000 during the year, what is the total amount of credits recorded in Accounts Receivable during the year? 4.b. What does the amount of these credits represent? Complete this question by entering your answers in the tabs below. If the company debited Accounts Receivable and credited Sales for $600,000 during the year, what is the total amount of credits recorded in Accounts Recelvable during the year? 4-a. If the company debited Accounts Receivable and credited Sales for $600.000 during the year, what is the total amount of credits recorded in Accounts Recelvable during the year? 4b. What does the amount of these credits represent? Complete this question by entering your answers in the tabs below. What does the amount of these credits represent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started