Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show the calculation in details please show calculation in detail Gueition? a) Rend reteiue leceved in odronce cratunhtig to tuests. c) Defrecisicn if Trecwing

please show the calculation in details

please show calculation in detail

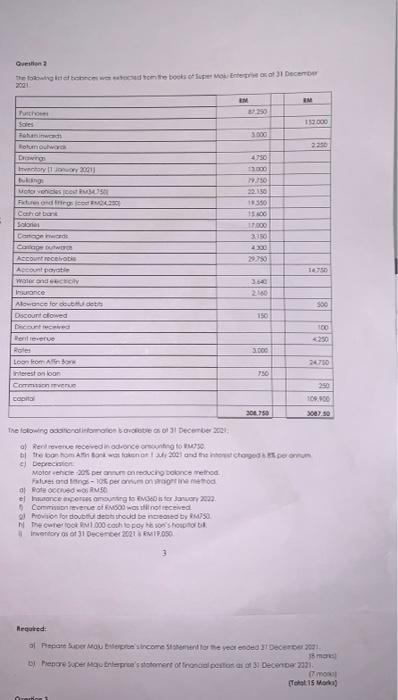

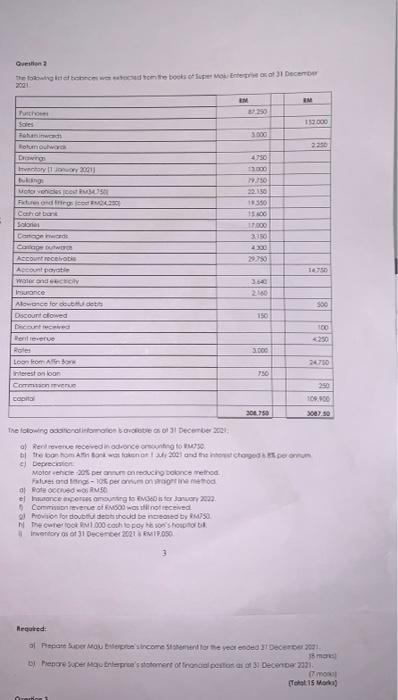

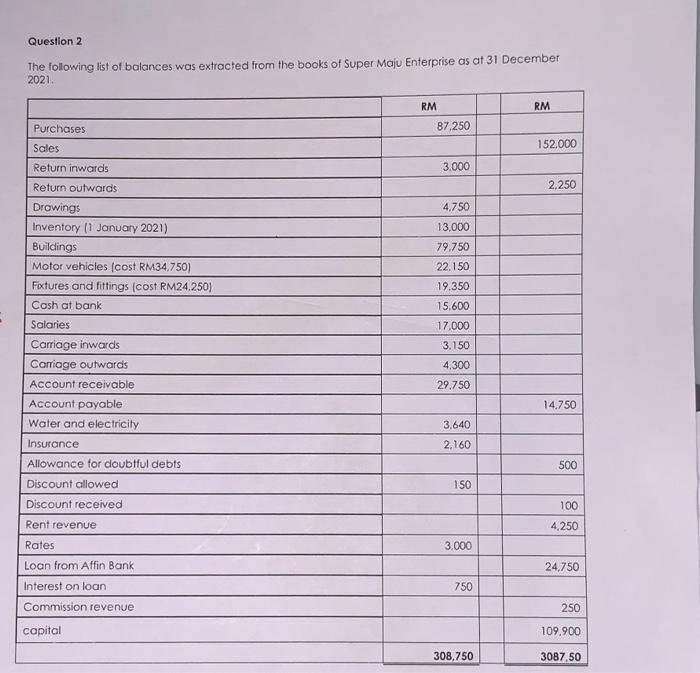

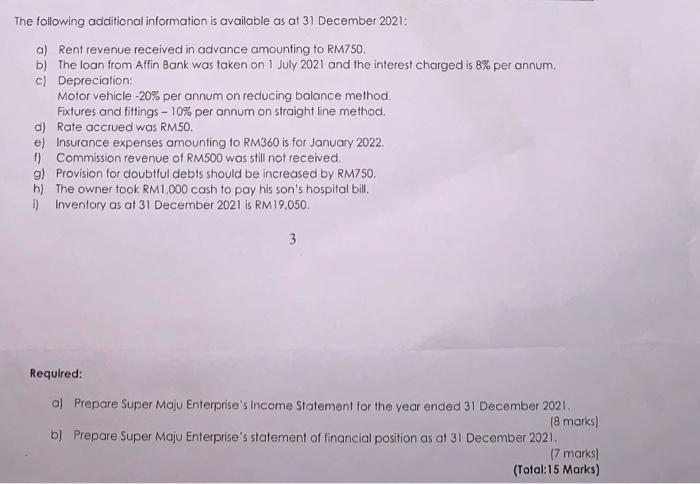

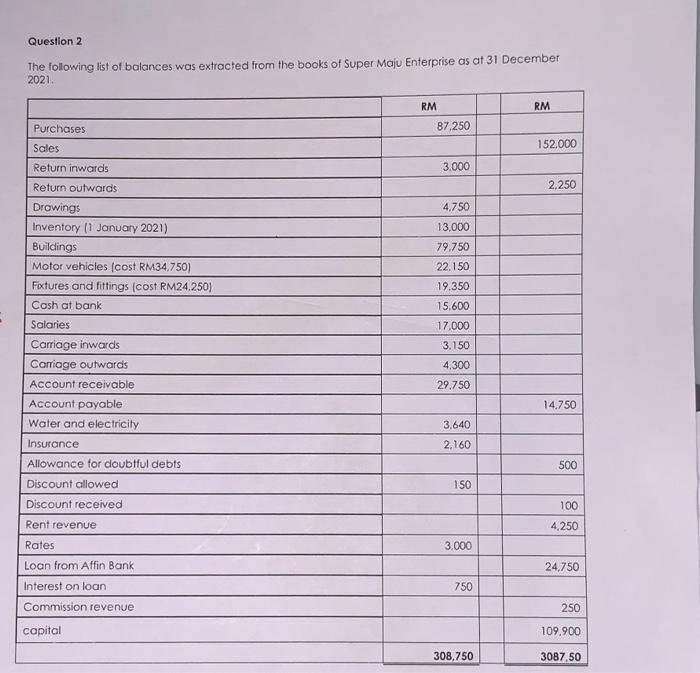

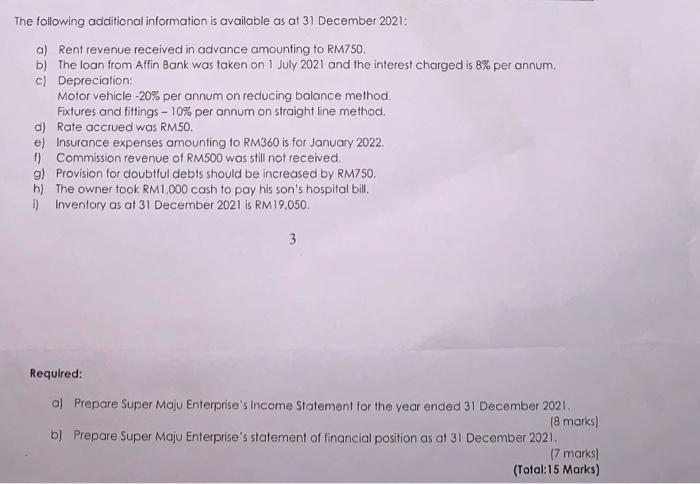

Gueition? a) Rend reteiue leceved in odronce cratunhtig to tuests. c) Defrecisicn if Trecwing foct-2wa 1000 cothlo pay tho son's frosolat bal. 3) Arqutied: The following list of balances was extracted from the books of Super Maju Enterprise as at 31 December 2021. The following additional information is available as at 31 December 2021: a) Rent revenue received in advance amounting to RM750. b) The loan from Affin Bank was taken on 1 July 2021 and the interest charged is 8% per annum. c) Depreciation: Motor vehicle 20% per annum on reducing balance method. Fixtures and fittings 10% per annum on straight ine method. d) Rate accrued was RM50. e) Insurance expenses amounting to RM360 is for January 2022. f) Commission revenue of RM500 was still not received. g) Provision for doubtful debts should be increased by RM750. h) The owner took RM1.000 cash to pay his son's hospital bill. i) Inventory as at 31 December 2021 is RM19.050. 3 Required: a) Prepare Super Maju Enterprise's Income Statement for the year ended 31 December 2021 . (8 marks) b) Prepare Super Maju Enterprise's statement of financial position as at 31 December 2021. (7 marks) (Total:15 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started