Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show the calculation in excel. Thankyou! 1. You have purchased equipment to manufacture biochar from waste sugar cane for $550,000. It is to be

Please show the calculation in excel. Thankyou!

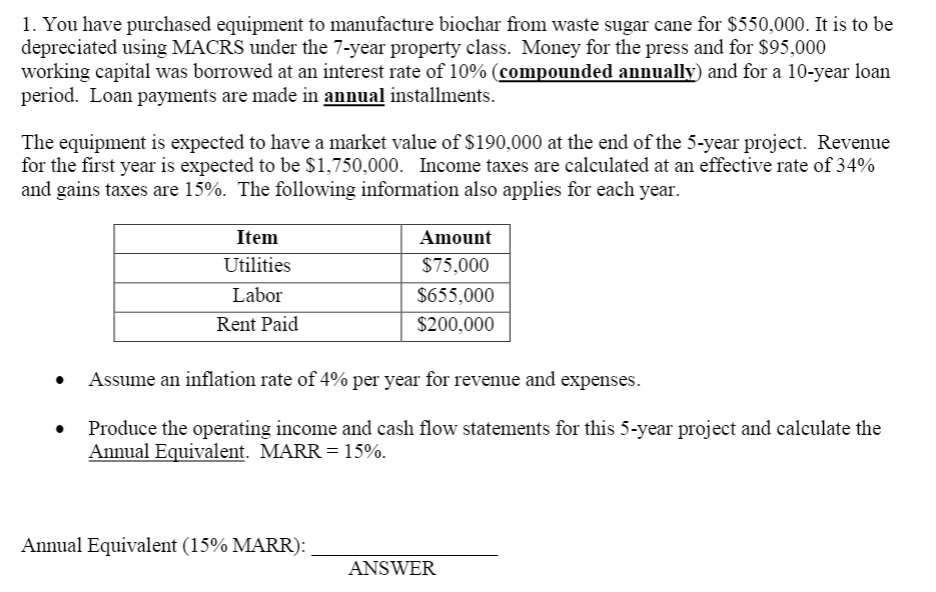

1. You have purchased equipment to manufacture biochar from waste sugar cane for $550,000. It is to be depreciated using MACRS under the 7-year property class. Money for the press and for $95,000 working capital was borrowed at an interest rate of 10% (compounded annually) and for a 10-year loan period. Loan payments are made in annual installments. The equipment is expected to have a market value of $190,000 at the end of the 5-year project. Revenue for the first year is expected to be $1,750,000. Income taxes are calculated at an effective rate of 34% and gains taxes are 15%. The following information also applies for each year. Item Utilities Labor Rent Paid Amount $75,000 $655,000 $200,000 Assume an inflation rate of 4% per year for revenue and expenses. Produce the operating income and cash flow statements for this 5-year project and calculate the Annual Equivalent. MARR = 15%. Annual Equivalent (15% MARR)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started