Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show the calculations , Assumptions and Recommendation. Case 51 Refrigerator Magnets Company The Refrigerator Magnets Company (RMC) makes magnets. The magnets are sold in

Please show the calculations , Assumptions and Recommendation.

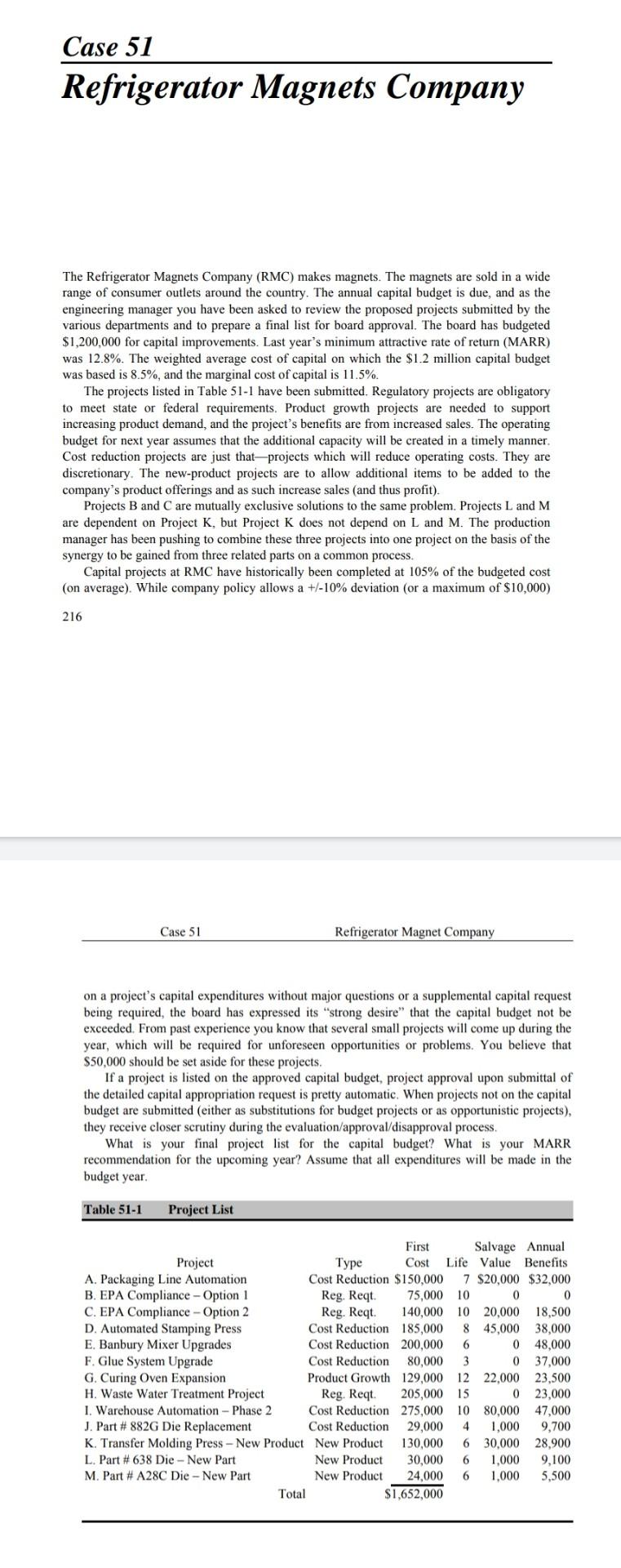

Case 51 Refrigerator Magnets Company The Refrigerator Magnets Company (RMC) makes magnets. The magnets are sold in a wide range of consumer outlets around the country. The annual capital budget is due, and as the engineering manager you have been asked to review the proposed projects submitted by the various departments and to prepare a final list for board approval. The board has budgeted $1,200,000 for capital improvements. Last year's minimum attractive rate of return (MARR) was 12.8%. The weighted average cost of capital on which the $1.2 million capital budget was based is 8.5%, and the marginal cost of capital is 11.5%. The projects listed in Table 51-1 have been submitted. Regulatory projects are obligatory to meet state or federal requirements. Product growth projects are needed to support increasing product demand, and the project's benefits are from increased sales. The operating budget for next year assumes that the additional capacity will be created in a timely manner. Cost reduction projects are just that-projects which will reduce operating costs. They are discretionary. The new-product projects are to allow additional items to be added to the company's product offerings and as such increase sales and thus profit). Projects B and C are mutually exclusive solutions to the same problem. Projects L and M are dependent on Project K, but Project K does not depend on L and M. The production manager has been pushing to combine these three projects into one project on the basis of the synergy to be gained from three related parts on a common process. Capital projects at RMC have historically been completed at 105% of the budgeted cost (on average). While company policy allows a +/-10% deviation (or a maximum of $10,000) 216 Case 51 Refrigerator Magnet Company on a project's capital expenditures without major questions or a supplemental capital request being required, the board has expressed its "strong desire" that the capital budget not be exceeded. From past experience you know that several small projects will come up during the year, which will be required for unforeseen opportunities or problems. You believe that $50,000 should be set aside for these projects. If a project is listed on the approved capital budget, project approval upon submittal of the detailed capital appropriation request is pretty automatic. When projects not on the capital budget are submitted (either as substitutions for budget projects or as opportunistic projects), they receive closer scrutiny during the evaluation/approval/disapproval process, What is your final project list for the capital budget? What is your MARR recommendation for the upcoming year? Assume that all expenditures will be made in the budget year. Table 51-1 Project List First Salvage Annual Project Type Cost Life Value Benefits A. Packaging Line Automation Cost Reduction $150,000 7 $20,000 $32,000 B. EPA Compliance - Option 1 Reg. Reqt 75,000 10 0 0 C. EPA Compliance - Option 2 Reg. Reqt 140,000 10 20,000 18,500 D. Automated Stamping Press Cost Reduction 185,000 8 45,000 38,000 E. Banbury Mixer Upgrades Cost Reduction 200,000 6 0 48,000 F. Glue System Upgrade Cost Reduction 80,000 3 0 37,000 G. Curing Oven Expansion Product Growth 129,000 12 22,000 23,500 H. Waste Water Treatment Project Reg. Reqt 205,000 15 0 23,000 1. Warehouse Automation - Phase 2 Cost Reduction 275,000 10 80,000 47,000 J. Part # 882G Die Replacement Cost Reduction 29,000 4 1,000 9,700 K. Transfer Molding Press - New Product New Product 130,000 6 30.000 28.900 L. Part # 638 Die - New Part New Product 30,000 6 1,000 9,100 M. Part # A28C Die - New Part New Product 24,000 6 1,000 5,500 Total $1,652,000 Case 51 Refrigerator Magnets Company The Refrigerator Magnets Company (RMC) makes magnets. The magnets are sold in a wide range of consumer outlets around the country. The annual capital budget is due, and as the engineering manager you have been asked to review the proposed projects submitted by the various departments and to prepare a final list for board approval. The board has budgeted $1,200,000 for capital improvements. Last year's minimum attractive rate of return (MARR) was 12.8%. The weighted average cost of capital on which the $1.2 million capital budget was based is 8.5%, and the marginal cost of capital is 11.5%. The projects listed in Table 51-1 have been submitted. Regulatory projects are obligatory to meet state or federal requirements. Product growth projects are needed to support increasing product demand, and the project's benefits are from increased sales. The operating budget for next year assumes that the additional capacity will be created in a timely manner. Cost reduction projects are just that-projects which will reduce operating costs. They are discretionary. The new-product projects are to allow additional items to be added to the company's product offerings and as such increase sales and thus profit). Projects B and C are mutually exclusive solutions to the same problem. Projects L and M are dependent on Project K, but Project K does not depend on L and M. The production manager has been pushing to combine these three projects into one project on the basis of the synergy to be gained from three related parts on a common process. Capital projects at RMC have historically been completed at 105% of the budgeted cost (on average). While company policy allows a +/-10% deviation (or a maximum of $10,000) 216 Case 51 Refrigerator Magnet Company on a project's capital expenditures without major questions or a supplemental capital request being required, the board has expressed its "strong desire" that the capital budget not be exceeded. From past experience you know that several small projects will come up during the year, which will be required for unforeseen opportunities or problems. You believe that $50,000 should be set aside for these projects. If a project is listed on the approved capital budget, project approval upon submittal of the detailed capital appropriation request is pretty automatic. When projects not on the capital budget are submitted (either as substitutions for budget projects or as opportunistic projects), they receive closer scrutiny during the evaluation/approval/disapproval process, What is your final project list for the capital budget? What is your MARR recommendation for the upcoming year? Assume that all expenditures will be made in the budget year. Table 51-1 Project List First Salvage Annual Project Type Cost Life Value Benefits A. Packaging Line Automation Cost Reduction $150,000 7 $20,000 $32,000 B. EPA Compliance - Option 1 Reg. Reqt 75,000 10 0 0 C. EPA Compliance - Option 2 Reg. Reqt 140,000 10 20,000 18,500 D. Automated Stamping Press Cost Reduction 185,000 8 45,000 38,000 E. Banbury Mixer Upgrades Cost Reduction 200,000 6 0 48,000 F. Glue System Upgrade Cost Reduction 80,000 3 0 37,000 G. Curing Oven Expansion Product Growth 129,000 12 22,000 23,500 H. Waste Water Treatment Project Reg. Reqt 205,000 15 0 23,000 1. Warehouse Automation - Phase 2 Cost Reduction 275,000 10 80,000 47,000 J. Part # 882G Die Replacement Cost Reduction 29,000 4 1,000 9,700 K. Transfer Molding Press - New Product New Product 130,000 6 30.000 28.900 L. Part # 638 Die - New Part New Product 30,000 6 1,000 9,100 M. Part # A28C Die - New Part New Product 24,000 6 1,000 5,500 Total $1,652,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started