Answered step by step

Verified Expert Solution

Question

1 Approved Answer

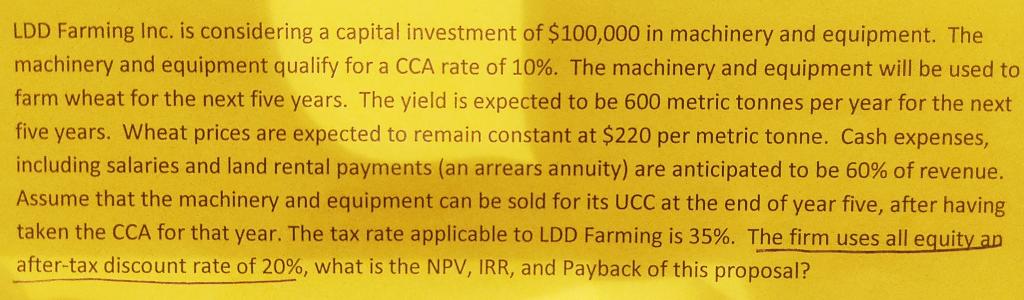

Please show the calculations in excel screenshots with formulas. LDD Farming Inc. is considering a capital investment of $100,000 in machinery and equipment. The machinery

Please show the calculations in excel screenshots with formulas.

LDD Farming Inc. is considering a capital investment of $100,000 in machinery and equipment. The machinery and equipment qualify for a CCA rate of 10%. The machinery and equipment will be used to farm wheat for the next five years. The yield is expected to be 600 metric tonnes per year for the next five years. Wheat prices are expected to remain constant at $220 per metric tonne. Cash expenses, including salaries and land rental payments (an arrears annuity) are anticipated to be 60% of revenue. Assume that the machinery and equipment can be sold for its UCC at the end of year five, after having taken the CCA for that year. The tax rate applicable to LDD Farming is 35%. The firm uses all equity an after-tax discount rate of 20%, what is the NPV, IRR, and Payback of this proposalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started