Answered step by step

Verified Expert Solution

Question

1 Approved Answer

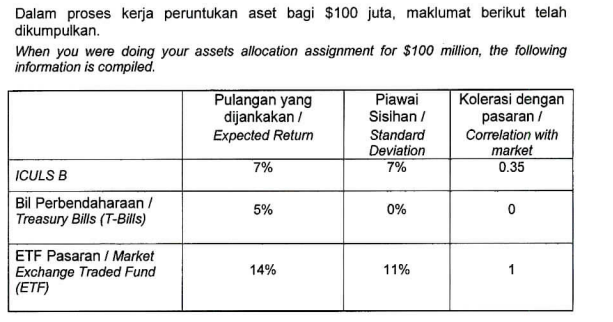

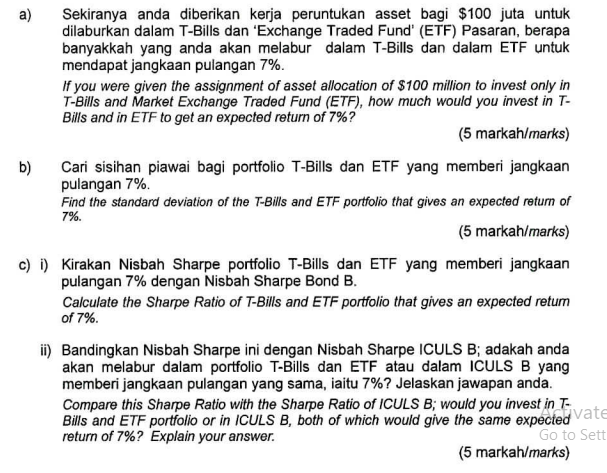

please show the calculations together with the formulas. thank you Dalam proses kerja peruntukan aset bagi $100 juta, maklumat berikut telah dikumpulkan When you were

please show the calculations together with the formulas. thank you

Dalam proses kerja peruntukan aset bagi $100 juta, maklumat berikut telah dikumpulkan When you were doing your assets allocation assignment for $100 million, the following information is compiled. Pulangan yang Piawai Kolerasi dengan dijankakan/ Sisihan / pasaran / Expected Return Standard Correlation with Deviation market ICULS B 7% 7% 0.35 Bil Perbendaharaan / 5% 0% 0 Treasury Bills (T-Bills) ETF Pasaran / Market Exchange Traded Fund (ETF) 14% 11% 7% a) Sekiranya anda diberikan kerja peruntukan asset bagi $100 juta untuk dilaburkan dalam T-Bills dan 'Exchange Traded Fund' (ETF) Pasaran, berapa banyakkah yang anda akan melabur dalam T-Bills dan dalam ETF untuk mendapat jangkaan pulangan 7%. If you were given the assignment of asset allocation of $100 million to invest only in T-Bills and Market Exchange Traded Fund (ETF), how much would you invest in T- Bills and in ETF to get an expected return of 7%? (5 markah/marks) b) Cari sisihan piawai bagi portfolio T-Bills dan ETF yang memberi jangkaan pulangan 7% Find the standard deviation of the T-Bills and ETF portfolio that gives an expected return of (5 markah/marks) c) i) Kirakan Nisbah Sharpe portfolio T-Bills dan ETF yang memberi jangkaan pulangan 7% dengan Nisbah Sharpe Bond B. Calculate the Sharpe Ratio of T-Bills and ETF portfolio that gives an expected retum of 7%. ii) Bandingkan Nisbah Sharpe ini dengan Nisbah Sharpe ICULS B; adakah anda akan melabur dalam portfolio T-Bills dan ETF atau dalam ICULS B yang memberi jangkaan pulangan yang sama, iaitu 7%? Jelaskan jawapan anda. Compare this Sharpe Ratio with the Sharpe Ratio of ICULS B; would you invest i return of 7%? Explain your answer. Go to Sett (5 markah/marks) Dalam proses kerja peruntukan aset bagi $100 juta, maklumat berikut telah dikumpulkan When you were doing your assets allocation assignment for $100 million, the following information is compiled. Pulangan yang Piawai Kolerasi dengan dijankakan/ Sisihan / pasaran / Expected Return Standard Correlation with Deviation market ICULS B 7% 7% 0.35 Bil Perbendaharaan / 5% 0% 0 Treasury Bills (T-Bills) ETF Pasaran / Market Exchange Traded Fund (ETF) 14% 11% 7% a) Sekiranya anda diberikan kerja peruntukan asset bagi $100 juta untuk dilaburkan dalam T-Bills dan 'Exchange Traded Fund' (ETF) Pasaran, berapa banyakkah yang anda akan melabur dalam T-Bills dan dalam ETF untuk mendapat jangkaan pulangan 7%. If you were given the assignment of asset allocation of $100 million to invest only in T-Bills and Market Exchange Traded Fund (ETF), how much would you invest in T- Bills and in ETF to get an expected return of 7%? (5 markah/marks) b) Cari sisihan piawai bagi portfolio T-Bills dan ETF yang memberi jangkaan pulangan 7% Find the standard deviation of the T-Bills and ETF portfolio that gives an expected return of (5 markah/marks) c) i) Kirakan Nisbah Sharpe portfolio T-Bills dan ETF yang memberi jangkaan pulangan 7% dengan Nisbah Sharpe Bond B. Calculate the Sharpe Ratio of T-Bills and ETF portfolio that gives an expected retum of 7%. ii) Bandingkan Nisbah Sharpe ini dengan Nisbah Sharpe ICULS B; adakah anda akan melabur dalam portfolio T-Bills dan ETF atau dalam ICULS B yang memberi jangkaan pulangan yang sama, iaitu 7%? Jelaskan jawapan anda. Compare this Sharpe Ratio with the Sharpe Ratio of ICULS B; would you invest i return of 7%? Explain your answer. Go to Sett (5 markah/marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started