Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show the calculations too While preparing financial stements for April 2020. Croissant Company discovered the following errors made in April 2020. (a) The purchase

Please show the calculations too

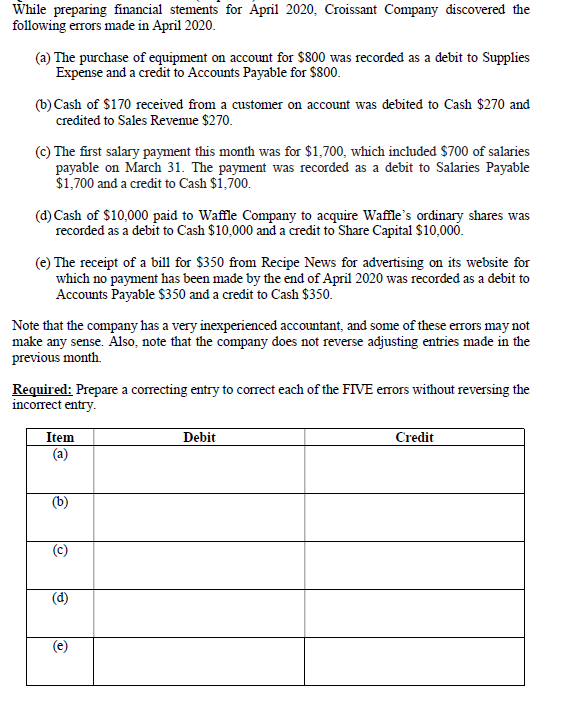

While preparing financial stements for April 2020. Croissant Company discovered the following errors made in April 2020. (a) The purchase of equipment on account for $800 was recorded as a debit to Supplies Expense and a credit to Accounts Payable for $800. (6) Cash of $170 received from a customer on account was debited to Cash $270 and credited to Sales Revenue $270. (c) The first salary payment this month was for $1,700, which included $700 of salaries payable on March 31. The payment was recorded as a debit to Salaries Payable $1,700 and a credit to Cash $1,700. (d) Cash of $10,000 paid to Waffle Company to acquire Waffle's ordinary shares was recorded as a debit to Cash $10,000 and a credit to Share Capital $10,000. (e) The receipt of a bill for $350 from Recipe News for advertising on its website for which no payment has been made by the end of April 2020 was recorded as a debit to Accounts Payable $350 and a credit to Cash $350. Note that the company has a very inexperienced accountant, and some of these errors may not make any sense. Also, note that the company does not reverse adjusting entries made in the previous month Required: Prepare a correcting entry to correct each of the FIVE errors without reversing the incorrect entry Debit Credit Item (a) (b) (c) (d) e)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started