Answered step by step

Verified Expert Solution

Question

1 Approved Answer

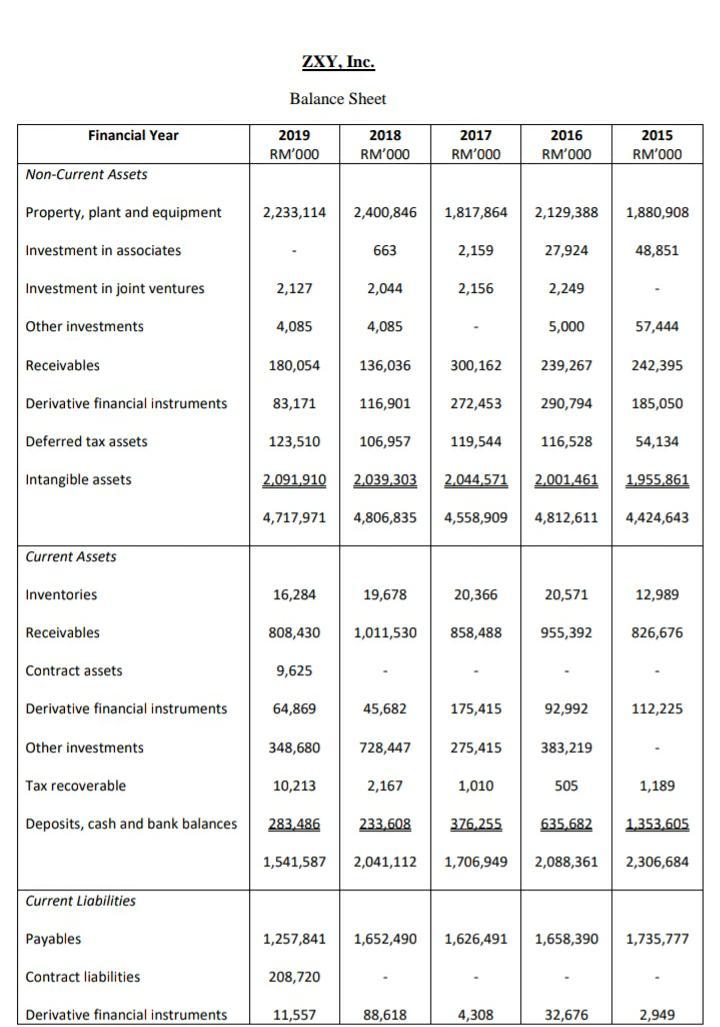

Please show the calculations with formulas (in excel) ZXY, Inc. Balance Sheet Financial Year 2017 2019 RM'000 2018 RM'000 2016 RM'000 2015 RM'000 RM'000 Non-Current

Please show the calculations with formulas (in excel)

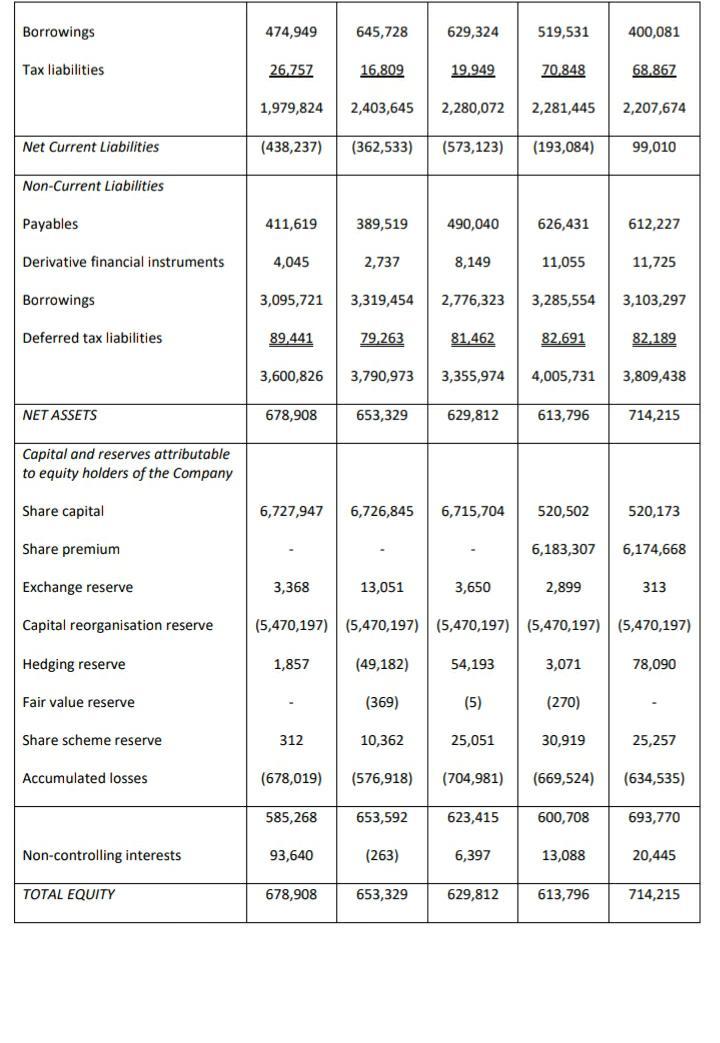

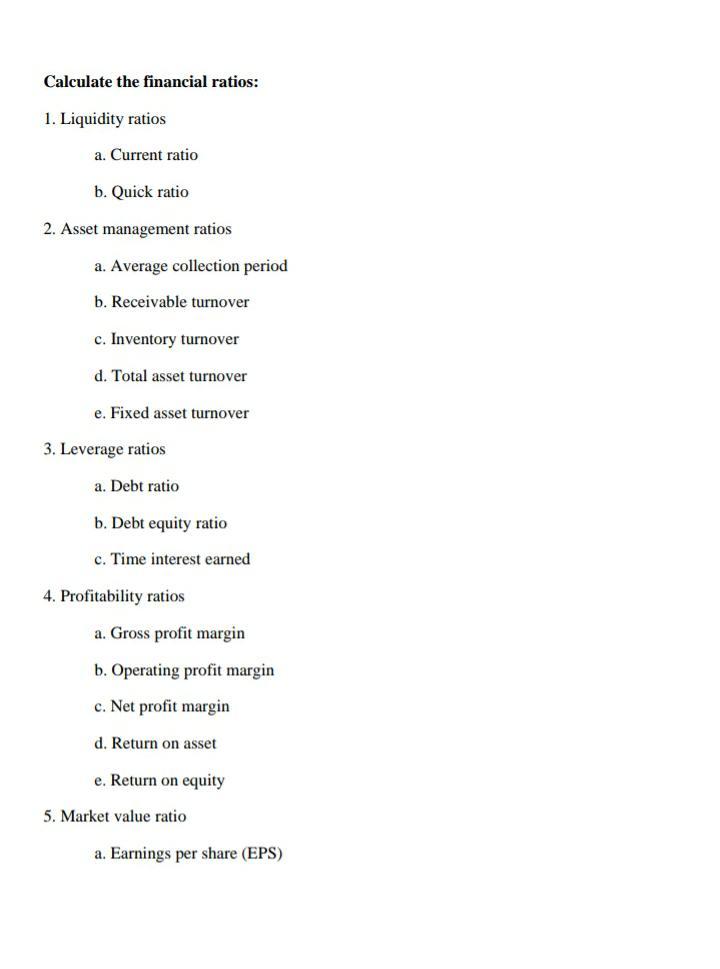

ZXY, Inc. Balance Sheet Financial Year 2017 2019 RM'000 2018 RM'000 2016 RM'000 2015 RM'000 RM'000 Non-Current Assets Property, plant and equipment 2,233,114 2,400,846 1,817,864 2,129,388 1,880,908 Investment in associates 663 2,159 27,924 48,851 Investment in joint ventures 2,127 2,044 2,156 2,249 Other investments 4,085 4,085 5,000 57,444 Receivables 180,054 136,036 300,162 239,267 242,395 Derivative financial instruments 83,171 116,901 272,453 290,794 185,050 Deferred tax assets 123,510 106,957 119,544 116,528 54,134 Intangible assets 2.091.910 2.039,303 2.044,571 2.001.461 1.955.861 4,717,971 4,806,835 4,558,909 4,812,611 4,424,643 Current Assets Inventories 16,284 19,678 20,366 20,571 12,989 Receivables 808,430 1,011,530 858,488 955,392 826,676 Contract assets 9,625 Derivative financial instruments 64,869 45,682 175,415 92,992 112,225 Other investments 348,680 728,447 275,415 383,219 Tax recoverable 10,213 2,167 1,010 505 1,189 Deposits, cash and bank balances 283.486 233,608 376.255 635.682 1.353.605 1,541,587 2,041,112 1,706,949 2,088,361 2,306,684 Current Liabilities Payables 1,257,841 1,652,490 1,626,491 1,658,390 1,735,777 Contract liabilities 208,720 Derivative financial instruments 11,557 88,618 88,618 4,308 32,676 2,949 Borrowings 474,949 645,728 629,324 519,531 400,081 Tax liabilities 26.757 16.809 19.949 70.848 68,867 1,979,824 2,403,645 2,280,072 2,281,445 2,207,674 Net Current Liabilities (438,237) (362,533) (573,123) (193,084) 99,010 Non-Current Liabilities Payables 411,619 389,519 490,040 626,431 612,227 Derivative financial instruments 4,045 2,737 8,149 11,055 11,725 Borrowings 3,095,721 3,319,454 2,776,323 3,285,554 3,103,297 Deferred tax liabilities 89.441 79.263 81,462 82.691 82.189 3,600,826 3,790,973 3,355,974 4,005,731 3,809,438 NET ASSETS 678,908 653,329 629,812 613,796 714,215 Capital and reserves attributable to equity holders of the Company Share capital 6,727,947 6,726,845 6,715,704 520,502 520,173 Share premium 6,183,307 6,174,668 Exchange reserve 3,368 13,051 3,650 2,899 313 313 Capital reorganisation reserve (5,470,197) (5,470,197) (5,470,197) (5,470,197) (5,470,197) Hedging reserve 1,857 (49,182) 54,193 3,071 78,090 Fair value reserve (369) (5) (270) Share scheme reserve 312 10,362 25,051 30,919 25,257 Accumulated losses (678,019) (576,918) (704,981) (669,524) (634,535) 585,268 653,592 623,415 600,708 693,770 Non-controlling interests 93,640 (263) 6,397 13,088 20,445 TOTAL EQUITY 678,908 653,329 629,812 613,796 714,215 Calculate the financial ratios: 1. Liquidity ratios a. Current ratio b. Quick ratio 2. Asset management ratios a. Average collection period b. Receivable turnover c. Inventory turnover d. Total asset turnover e. Fixed asset turnover 3. Leverage ratios a. Debt ratio b. Debt equity ratio c. Time interest earned 4. Profitability ratios a. Gross profit margin b. Operating profit margin c. Net profit margin d. Return on asset e. Return on equity 5. Market value ratio a. Earnings per share (EPS)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started