please show the entire question and working process included the formula. no excel generated. thank you

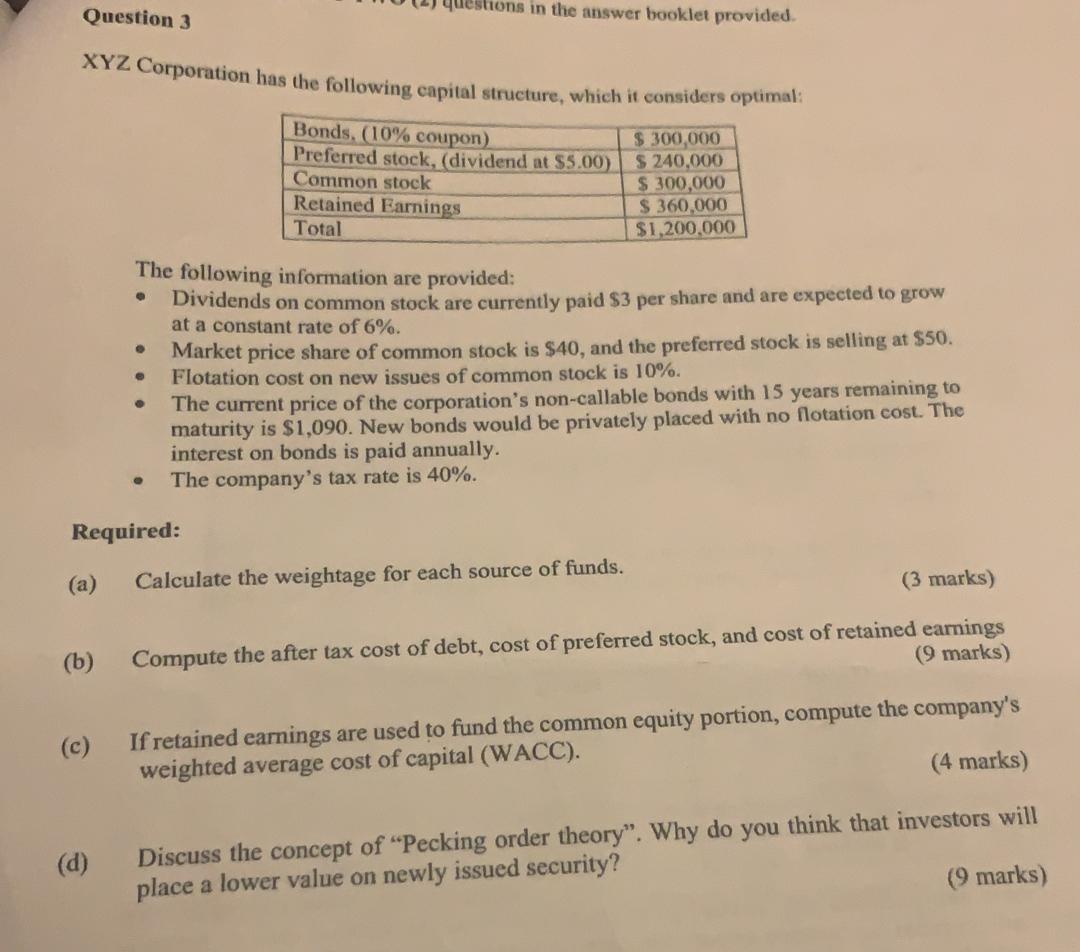

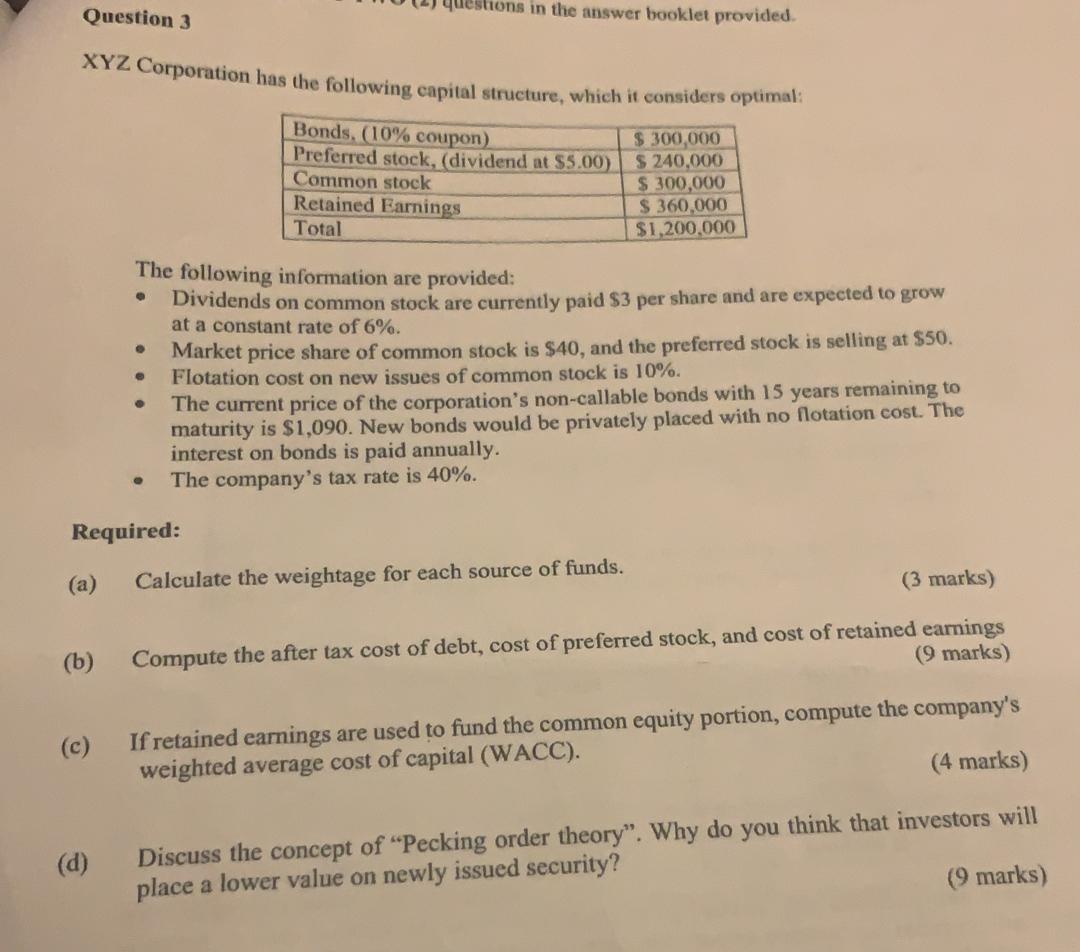

Question 3 questions in the answer booklet provided. XYZ Corporation has the following capital structure, which it considers optimal: Bonds. (10% coupon) Preferred stock, (dividend at $5.00) Common stock Retained Earnings Total $ 300,000 $ 240,000 $ 300,000 S 360,000 $1,200.000 The following information are provided: Dividends on common stock are currently paid $3 per share and are expected to grow at a constant rate of 6%. Market price share of common stock is $40, and the preferred stock is selling at $50. Flotation cost on new issues of common stock is 10%. The current price of the corporation's non-callable bonds with 15 years remaining to maturity is $1,090. New bonds would be privately placed with no flotation cost. The interest on bonds is paid annually. The company's tax rate is 40%. Required: (a) Calculate the weightage for each source of funds. (3 marks) (b) Compute the after tax cost of debt, cost of preferred stock, and cost of retained earnings (9 marks) If retained earnings are used to fund the common equity portion, compute the company's weighted average cost of capital (WACC). (4 marks) (d) Discuss the concept of "Pecking order theory". Why do you think that investors will place a lower value on newly issued security? (9 marks) Question 3 questions in the answer booklet provided. XYZ Corporation has the following capital structure, which it considers optimal: Bonds. (10% coupon) Preferred stock, (dividend at $5.00) Common stock Retained Earnings Total $ 300,000 $ 240,000 $ 300,000 S 360,000 $1,200.000 The following information are provided: Dividends on common stock are currently paid $3 per share and are expected to grow at a constant rate of 6%. Market price share of common stock is $40, and the preferred stock is selling at $50. Flotation cost on new issues of common stock is 10%. The current price of the corporation's non-callable bonds with 15 years remaining to maturity is $1,090. New bonds would be privately placed with no flotation cost. The interest on bonds is paid annually. The company's tax rate is 40%. Required: (a) Calculate the weightage for each source of funds. (3 marks) (b) Compute the after tax cost of debt, cost of preferred stock, and cost of retained earnings (9 marks) If retained earnings are used to fund the common equity portion, compute the company's weighted average cost of capital (WACC). (4 marks) (d) Discuss the concept of "Pecking order theory". Why do you think that investors will place a lower value on newly issued security? (9 marks)