Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show the entire question and working process included the formula. no excel generated.Thank you. Question 1 Assuming LWC Enterprise is analysing the best investment

please show the entire question and working process included the formula. no excel generated.Thank you.

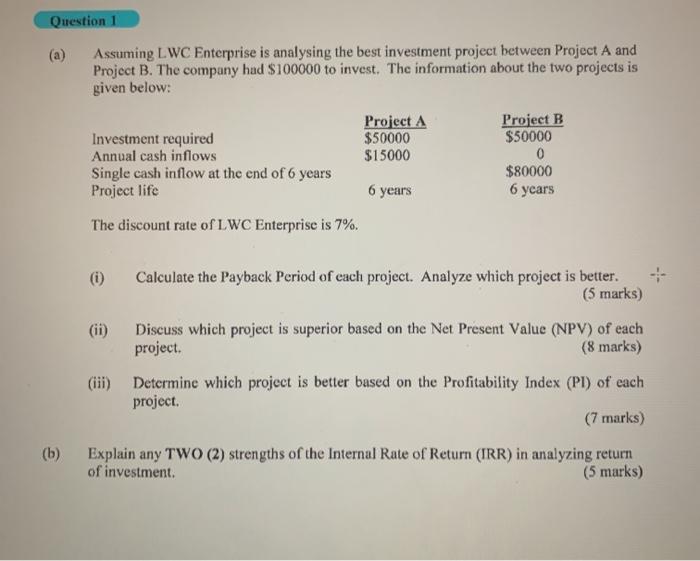

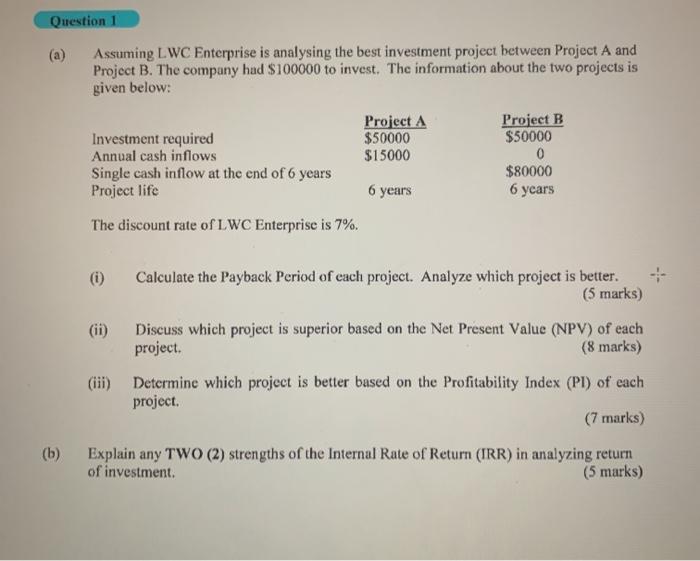

Question 1 Assuming LWC Enterprise is analysing the best investment project between Project A and Project B. The company had $100000 to invest. The information about the two projects is given below: Project A Investment required $50000 Annual cash inflows $15000 Single cash inflow at the end of 6 years Project life 6 years The discount rate of LWC Enterprise is 7%. Project B $50000 0 $80000 6 years (1) Calculate the Payback period of each project. Analyze which project is better. (5 marks) (ii) Discuss which project is superior based on the Net Present Value (NPV) of each project (8 marks) (iii) Determine which project is better based on the Profitability Index (PI) of each project (7 marks) (b) Explain any TWO (2) strengths of the Internal Rate of Return (IRR) in analyzing return of investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started