Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show the exact steps on a financial calculator... Philip Dawson is working with his financial planner to estimate the amount of savings required to

please show the exact steps on a financial calculator...

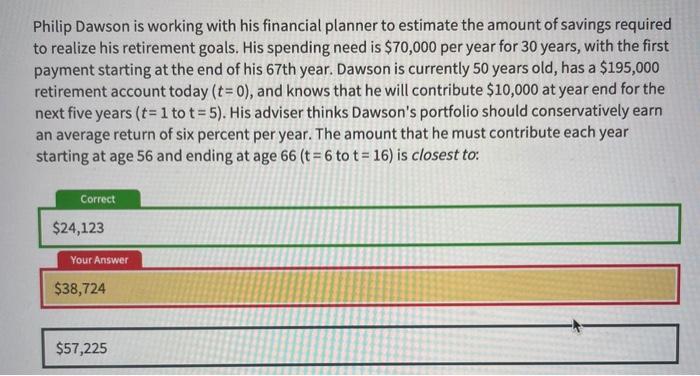

Philip Dawson is working with his financial planner to estimate the amount of savings required to realize his retirement goals. His spending need is $70,000 per year for 30 years, with the first payment starting at the end of his 67 th year. Dawson is currently 50 years old, has a $195,000 retirement account today (t=0), and knows that he will contribute $10,000 at year end for the next five years ( t=1 to t=5 ). His adviser thinks Dawson's portfolio should conservatively earn an average return of six percent per year. The amount that he must contribute each year starting at age 56 and ending at age 66(t=6 to t=16) is closest to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started