Answered step by step

Verified Expert Solution

Question

1 Approved Answer

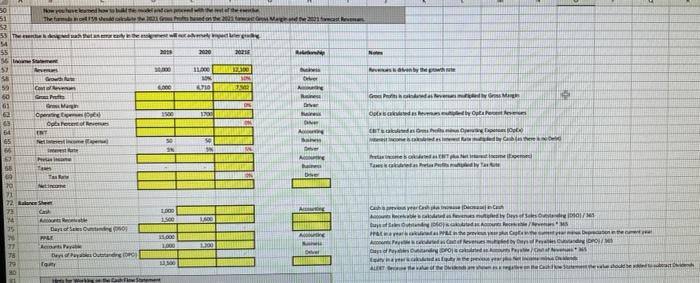

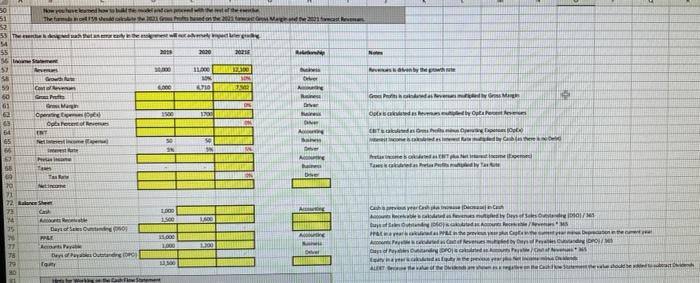

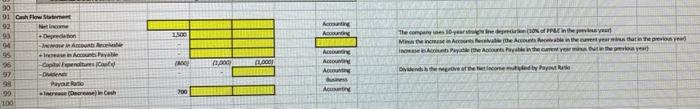

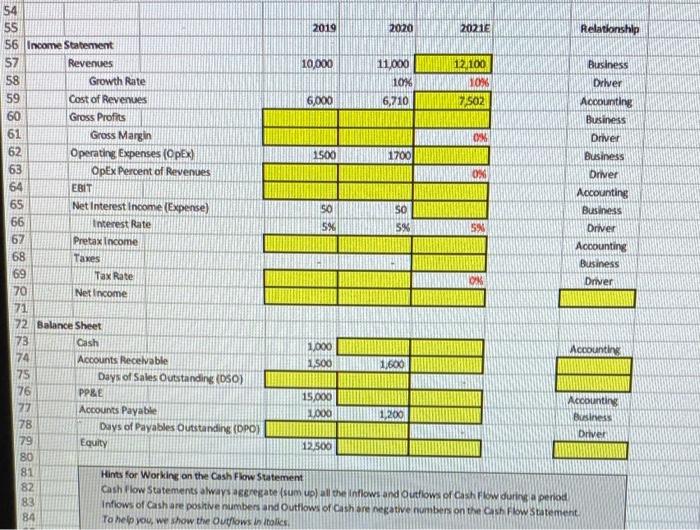

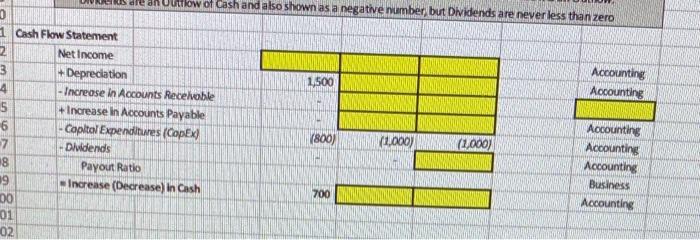

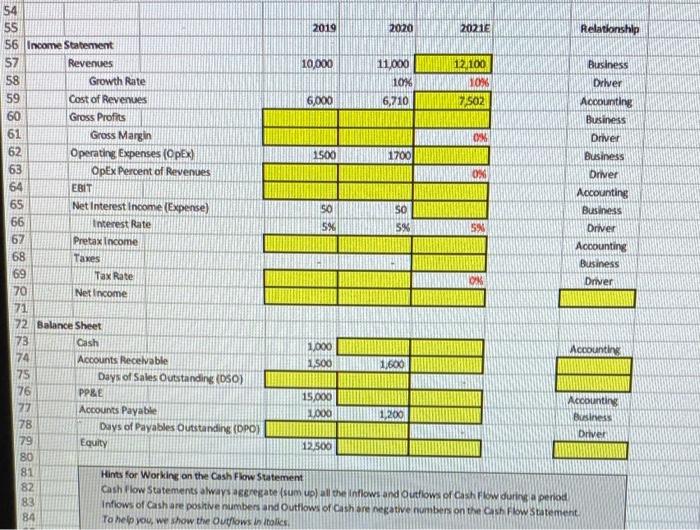

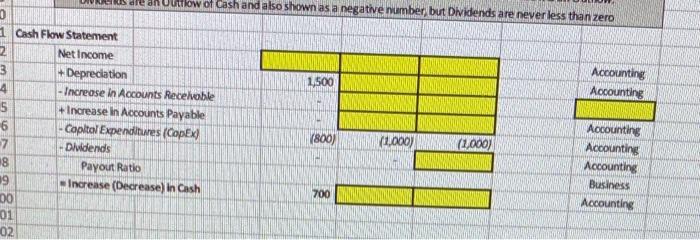

Please show the excel formulas & values used to calculate the yellow boxes. Thank you more clear photos if the ones above can't be read

Please show the excel formulas & values used to calculate the yellow boxes. Thank you

more clear photos if the ones above can't be read

50 How The fa -Marna 53 The het 144 14 55 2000 2018 11. Month S 5 LIN Brod Com UNE 55 60 63 EN Goes Plato WARE 1700 Odote 69 Manh Opening Quecer HT Felice 19 A ca SA A med 57 55 ht Tess De OL ce 71 72 ore Chow 1.000 1.00 1.400 14 15 po wool . low 11.00 The content wewe 1100 loop V. 75 79 Per Barong Tony nede MORE O 1,500 AG The companies are on the year MAA In het TOWY that the previous w year 91 Glow 92 re 93 Deprecation Am 95 + 36 -Capture 97 -D 98 PR 99 merch 100 1.000 1.000 AN AL Am Decoratie 700 A 54 55 2019 2020 20215 Relationship 56 Income Statement 57 Revenues 10,000 11.000 12 100 Business 58 Growth Rate 10% 1096 Driver 59 Cost of Revenues 6,000 6,710 7502 Accounting 60 Gross Profits Business 61 Gross Margin OM Driver 62 Operating Expenses (Opex) 1500 1700 Business 63 OpEx Percent of Revenues Driver 64 EBIT Accounting 65 Net Interest income (Expense) 50 SO Business 66 Interest Rate 5% 5% Driver 67 Pretax income Accounting 68 Taxes Business 69 Tax Rate 0% Driver 70 Net Income 71 72 Balance Sheet 73 Cash 1,000 Accounting 74 Accounts Receivable 1,500 1,600 Days of Sales Outstanding (050) 76 PPRE 15.000 Accounting Accounts Payable 1000 1,200 Business 78 Days of Payables Outstanding (OPO) Driver 79 Equity 12500 80 Hints for Working on the Cash Flow Statement 82 Cash Flow Statements always ergate (sum up) all the inflows and outflows of cash flow during a period 83 Inflows of Cash are positive numbers and Outflows of cash are negative numbers on the cash flow Statement 84 To help you, we show the Outflows in italics 75 81 ale anulow of cash and also shown as a negative number, but Dividends are never less than zero 1,500 Accounting Accounting 1 Cash Flow Statement 2 Net Income 3 +Depreciation Increase in Accounts Receivable 5 +Increase in Accounts Payable 6 Capitol Expenditures (copex) 7 Dividends 8 Payout Ratio 19 - Increase (Decrease) in Cash 00 01 02 (800) (1.000) (1.000) Accounting Accounting Accounting Business Accounting 700 50 How The fa -Marna 53 The het 144 14 55 2000 2018 11. Month S 5 LIN Brod Com UNE 55 60 63 EN Goes Plato WARE 1700 Odote 69 Manh Opening Quecer HT Felice 19 A ca SA A med 57 55 ht Tess De OL ce 71 72 ore Chow 1.000 1.00 1.400 14 15 po wool . low 11.00 The content wewe 1100 loop V. 75 79 Per Barong Tony nede MORE O 1,500 AG The companies are on the year MAA In het TOWY that the previous w year 91 Glow 92 re 93 Deprecation Am 95 + 36 -Capture 97 -D 98 PR 99 merch 100 1.000 1.000 AN AL Am Decoratie 700 A 54 55 2019 2020 20215 Relationship 56 Income Statement 57 Revenues 10,000 11.000 12 100 Business 58 Growth Rate 10% 1096 Driver 59 Cost of Revenues 6,000 6,710 7502 Accounting 60 Gross Profits Business 61 Gross Margin OM Driver 62 Operating Expenses (Opex) 1500 1700 Business 63 OpEx Percent of Revenues Driver 64 EBIT Accounting 65 Net Interest income (Expense) 50 SO Business 66 Interest Rate 5% 5% Driver 67 Pretax income Accounting 68 Taxes Business 69 Tax Rate 0% Driver 70 Net Income 71 72 Balance Sheet 73 Cash 1,000 Accounting 74 Accounts Receivable 1,500 1,600 Days of Sales Outstanding (050) 76 PPRE 15.000 Accounting Accounts Payable 1000 1,200 Business 78 Days of Payables Outstanding (OPO) Driver 79 Equity 12500 80 Hints for Working on the Cash Flow Statement 82 Cash Flow Statements always ergate (sum up) all the inflows and outflows of cash flow during a period 83 Inflows of Cash are positive numbers and Outflows of cash are negative numbers on the cash flow Statement 84 To help you, we show the Outflows in italics 75 81 ale anulow of cash and also shown as a negative number, but Dividends are never less than zero 1,500 Accounting Accounting 1 Cash Flow Statement 2 Net Income 3 +Depreciation Increase in Accounts Receivable 5 +Increase in Accounts Payable 6 Capitol Expenditures (copex) 7 Dividends 8 Payout Ratio 19 - Increase (Decrease) in Cash 00 01 02 (800) (1.000) (1.000) Accounting Accounting Accounting Business Accounting 700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started