Answered step by step

Verified Expert Solution

Question

1 Approved Answer

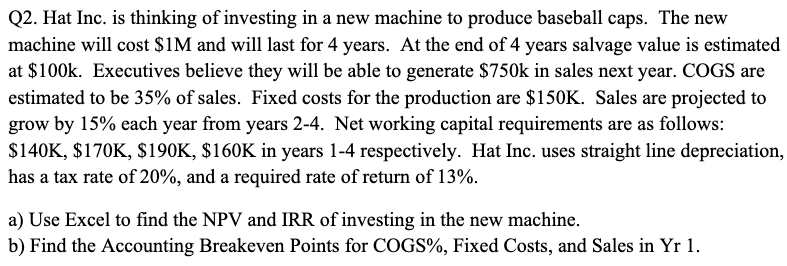

**PLEASE SHOW THE EXCEL FUNCTIONS AND FORMULAS YOU USED** Q2. Hat Inc. is thinking of investing in a new machine to produce baseball caps. The

**PLEASE SHOW THE EXCEL FUNCTIONS AND FORMULAS YOU USED**

Q2. Hat Inc. is thinking of investing in a new machine to produce baseball caps. The new machine will cost $1M and will last for 4 years. At the end of 4 years salvage value is estimated at $100k. Executives believe they will be able to generate $750k in sales next year. COGS are estimated to be 35% of sales. Fixed costs for the production are $150K. Sales are projected to grow by 15% each year from years 2-4. Net working capital requirements are as follows: $140K, $170K, $190K, $160K in years 1-4 respectively. Hat Inc. uses straight line depreciation, has a tax rate of 20%, and a required rate of return of 13%. a) Use Excel to find the NPV and IRR of investing in the new machine. b) Find the Accounting Breakeven Points for COGS%, Fixed Costs, and Sales in Yr 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started