Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show the formulas thank you Chapter 6 Evaluating the Fina: Steps To Success: Level 2 FM pe technology being used at TheZone. The cost

please show the formulas thank you

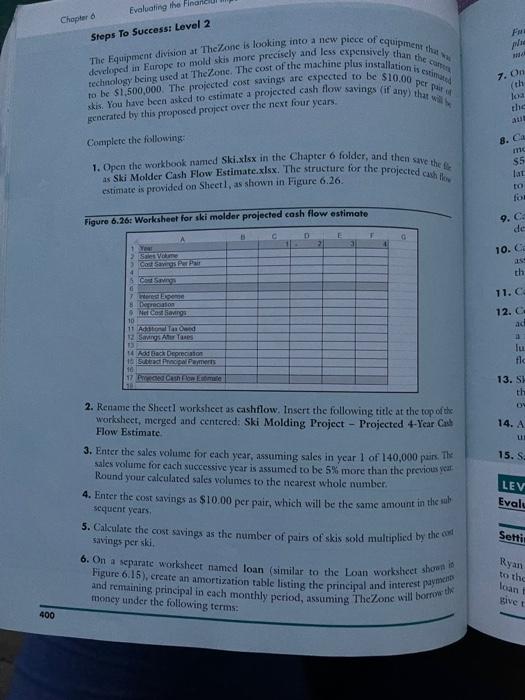

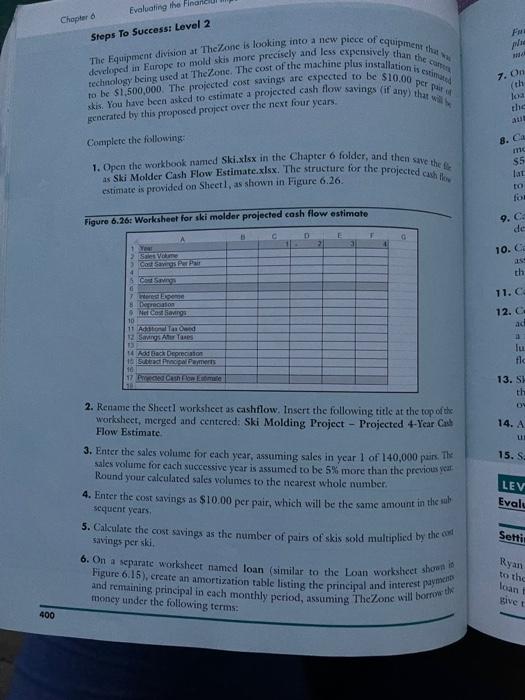

Chapter 6 Evaluating the Fina: Steps To Success: Level 2 FM pe technology being used at TheZone. The cost of the machine plus installation is est developed in Europe to mold dis more precisely and less expensively than the The Equipment division at The Zone is looking into a new picce of equipment that skis. You have been asked to estimate a projected cash flow savings (if any) that wil to be $1,500,000. The projected cost savings are expected to be $10.00 per 7. On (th loa the generated by this proposed project over the next four years Complete the following: 8. C me S5 1. Open the workbook named Ski.xlsx in the Chapter 6 folder, and then save the as Ski Molder Cash Flow Estimate.xlsx. The structure for the projected cashion estimate is provided on Sheetl, as shown in Figure 6.26. to Figure 6.26: Worksheet for ski molder projected cash flow estimate 9. C. de A C E T 2 a Year Ses ve 10. C th CAS 11. 7 wespe Darcon Mercogs 12. C ad 11 Added 12 Savings Ares lu fic 14A Back Depreciation Immers 10 17 free CSI Lume 13. Si th 6 14. A ul 15. SE 2. Rename the Sheetl worksheet as cashflow. Insert the following title at the top of the worksheet, merged and centered: Ski Molding Project - Projected 4-Year Cast Flow Estimate 3. Enter the sales volume for each year, assuming sales in year 1 of 140,000 pairs. The sales volume for each successive year is assumed to be 5% more than the previous year Round your calculated sales volumes to the nearest whole number. 4. Enter the cost savings as $10.00 per pair, which will be the same amount in the wall sequent years 5. Calculate the cost savings as the number of pairs of skis sold multiplied by the con savingsperski 6. On a separate worksheet named loan (similar to the Loan worksheet shown Figure 6.15), create an amortization table listing the principal and interest payme and remaining principal in each monthly period, assuming The one will borrowth money under the following terms: LEV Evalu Setti: Ryan to the loan givet 400 6 Evaluating the Financial Impact of loons and Investments Chapter 6 Fwding will lv arged for the entire cost of this throw (the cast of the machine plus installatiow) at 5.25 Intro campowder monthly paid out in full imagal wendy falls w witry 7. On the cashflow worksheet, calculate the cumulative interest expense for year 1 (the interest portion of the loan payments for the corresponding year). Assume the loan will start at the beginning of year 1 (January), and all payments will be made at the end of cach period. Write your formela so that it can be copied across the row to automatically calculate these values for years 2 through B. Calculate the depreciation for this equipment using the straight line depreciation method. The equipment is assumed to have an 8 vear life with a salvage value of 350,000 at the end of that period. For cost, use the cost of the machine plus instal lation. Set up a separate worksheet named depreciation to store these values (similar to the depreciation worksheet shown in Figure 6,19), and use sumed ranges in your formula 9. Calculate the net cost savings--the cost savings less the interest expense and depreciation 10. Calculate the additional tax that would be owed (based on the net cost savings assuming that TheZone is taxed at a 35% rate. Use a global named range to store this value 11. Calculate the savings after taxes 12. Complete the worksheet, adding back in the depreciation that was deducted and adding in the cumulative principal payments for the corresponding year, to arrive at a final projected cash flow estimate for each of the four years. Use the correct abso lute and relative cell referencing so that your formulas will work for each of the cash Level: flow years. 13. Skipping several rows under the data, include a sentence summarizing whether or not the cost of this machine will be recovered based on the Projected Cash Flow Estimate wwer the four years. Highlight your analysis in a light blue color 14. Add titles on cach worksheet, and format them to make them easy to read and understand 15. Save and close the Ski Molder Cash Flow Estimate.xlsx workbook et - Post LEVEL 3 Evaluating the Financial Viability of Alternative Project Options Setting Up a Worksheet to Analyze Profitability Ryan has now estimated the cash flow for the manufacture of the TZEdge shoe according to the terms of the option 1 loan, which requires $1,000,000 in capital funded through a loan from Ctr Bank at 8 interest compounded quarterly. This cash flow spreadsheet will give the company an excellent idea of what funds will be needed when, and at what time 401 Chapter 6 Evaluating the Fina: Steps To Success: Level 2 FM pe technology being used at TheZone. The cost of the machine plus installation is est developed in Europe to mold dis more precisely and less expensively than the The Equipment division at The Zone is looking into a new picce of equipment that skis. You have been asked to estimate a projected cash flow savings (if any) that wil to be $1,500,000. The projected cost savings are expected to be $10.00 per 7. On (th loa the generated by this proposed project over the next four years Complete the following: 8. C me S5 1. Open the workbook named Ski.xlsx in the Chapter 6 folder, and then save the as Ski Molder Cash Flow Estimate.xlsx. The structure for the projected cashion estimate is provided on Sheetl, as shown in Figure 6.26. to Figure 6.26: Worksheet for ski molder projected cash flow estimate 9. C. de A C E T 2 a Year Ses ve 10. C th CAS 11. 7 wespe Darcon Mercogs 12. C ad 11 Added 12 Savings Ares lu fic 14A Back Depreciation Immers 10 17 free CSI Lume 13. Si th 6 14. A ul 15. SE 2. Rename the Sheetl worksheet as cashflow. Insert the following title at the top of the worksheet, merged and centered: Ski Molding Project - Projected 4-Year Cast Flow Estimate 3. Enter the sales volume for each year, assuming sales in year 1 of 140,000 pairs. The sales volume for each successive year is assumed to be 5% more than the previous year Round your calculated sales volumes to the nearest whole number. 4. Enter the cost savings as $10.00 per pair, which will be the same amount in the wall sequent years 5. Calculate the cost savings as the number of pairs of skis sold multiplied by the con savingsperski 6. On a separate worksheet named loan (similar to the Loan worksheet shown Figure 6.15), create an amortization table listing the principal and interest payme and remaining principal in each monthly period, assuming The one will borrowth money under the following terms: LEV Evalu Setti: Ryan to the loan givet 400 6 Evaluating the Financial Impact of loons and Investments Chapter 6 Fwding will lv arged for the entire cost of this throw (the cast of the machine plus installatiow) at 5.25 Intro campowder monthly paid out in full imagal wendy falls w witry 7. On the cashflow worksheet, calculate the cumulative interest expense for year 1 (the interest portion of the loan payments for the corresponding year). Assume the loan will start at the beginning of year 1 (January), and all payments will be made at the end of cach period. Write your formela so that it can be copied across the row to automatically calculate these values for years 2 through B. Calculate the depreciation for this equipment using the straight line depreciation method. The equipment is assumed to have an 8 vear life with a salvage value of 350,000 at the end of that period. For cost, use the cost of the machine plus instal lation. Set up a separate worksheet named depreciation to store these values (similar to the depreciation worksheet shown in Figure 6,19), and use sumed ranges in your formula 9. Calculate the net cost savings--the cost savings less the interest expense and depreciation 10. Calculate the additional tax that would be owed (based on the net cost savings assuming that TheZone is taxed at a 35% rate. Use a global named range to store this value 11. Calculate the savings after taxes 12. Complete the worksheet, adding back in the depreciation that was deducted and adding in the cumulative principal payments for the corresponding year, to arrive at a final projected cash flow estimate for each of the four years. Use the correct abso lute and relative cell referencing so that your formulas will work for each of the cash Level: flow years. 13. Skipping several rows under the data, include a sentence summarizing whether or not the cost of this machine will be recovered based on the Projected Cash Flow Estimate wwer the four years. Highlight your analysis in a light blue color 14. Add titles on cach worksheet, and format them to make them easy to read and understand 15. Save and close the Ski Molder Cash Flow Estimate.xlsx workbook et - Post LEVEL 3 Evaluating the Financial Viability of Alternative Project Options Setting Up a Worksheet to Analyze Profitability Ryan has now estimated the cash flow for the manufacture of the TZEdge shoe according to the terms of the option 1 loan, which requires $1,000,000 in capital funded through a loan from Ctr Bank at 8 interest compounded quarterly. This cash flow spreadsheet will give the company an excellent idea of what funds will be needed when, and at what time 401

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started