Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show the step. Thank you Nutrien Enterprise is the world's leading producer of potash. It produces and sells potash, nitrogen and phosphate products nitrogen

Please show the step. Thank you

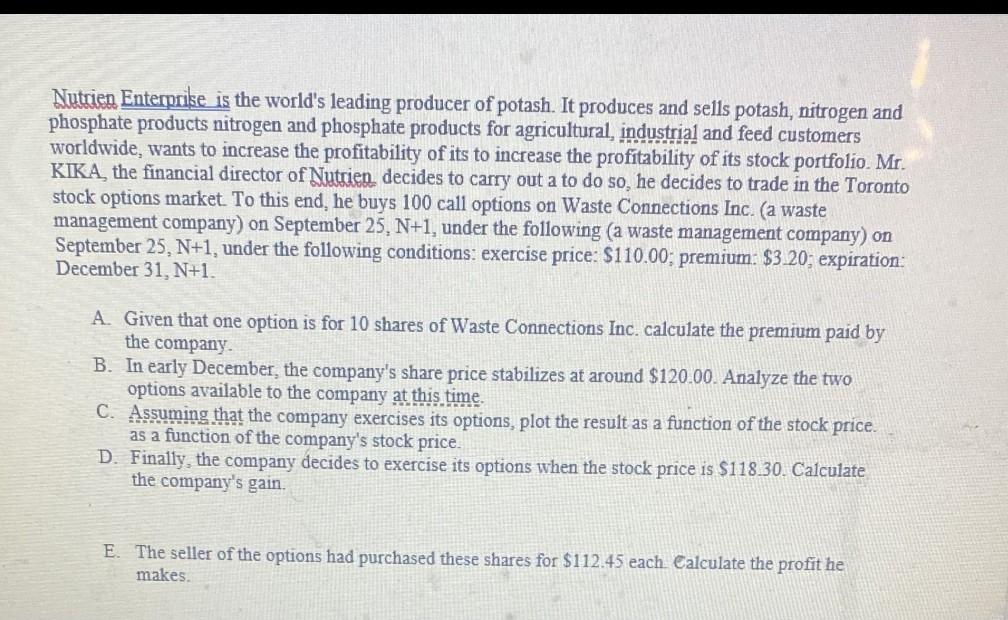

Nutrien Enterprise is the world's leading producer of potash. It produces and sells potash, nitrogen and phosphate products nitrogen and phosphate products for agricultural, industrial and feed customers worldwide, wants to increase the profitability of its to increase the profitability of its stock portfolio. Mr. KIKA, the financial director of Nutrien decides to carry out a to do so, he decides to trade in the Toronto stock options market. To this end, he buys 100 call options on Waste Connections Inc. (a waste management company) on September 25, N+1, under the following a waste management company) on September 25, N+1, under the following conditions: exercise price: $110.00; premium: $3.20; expiration: December 31, N+1. A. Given that one option is for 10 shares of Waste Connections Inc. calculate the premium paid by the company. B. In early December, the company's share price stabilizes at around $120.00. Analyze the two options available to the company at this time. C. Assuming that the company exercises its options, plot the result as a function of the stock price. as a function of the company's stock price. D. Finally, the company decides to exercise its options when the stock price is $118.30. Calculate the company's gain E. The seller of the options had purchased these shares for $112.45 each Calculate the profit he makes Nutrien Enterprise is the world's leading producer of potash. It produces and sells potash, nitrogen and phosphate products nitrogen and phosphate products for agricultural, industrial and feed customers worldwide, wants to increase the profitability of its to increase the profitability of its stock portfolio. Mr. KIKA, the financial director of Nutrien decides to carry out a to do so, he decides to trade in the Toronto stock options market. To this end, he buys 100 call options on Waste Connections Inc. (a waste management company) on September 25, N+1, under the following a waste management company) on September 25, N+1, under the following conditions: exercise price: $110.00; premium: $3.20; expiration: December 31, N+1. A. Given that one option is for 10 shares of Waste Connections Inc. calculate the premium paid by the company. B. In early December, the company's share price stabilizes at around $120.00. Analyze the two options available to the company at this time. C. Assuming that the company exercises its options, plot the result as a function of the stock price. as a function of the company's stock price. D. Finally, the company decides to exercise its options when the stock price is $118.30. Calculate the company's gain E. The seller of the options had purchased these shares for $112.45 each Calculate the profit he makesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started