Please show the steps and solutions. Thanks!!

I don't think there is extra information but see if its help from no. 3 or 2.

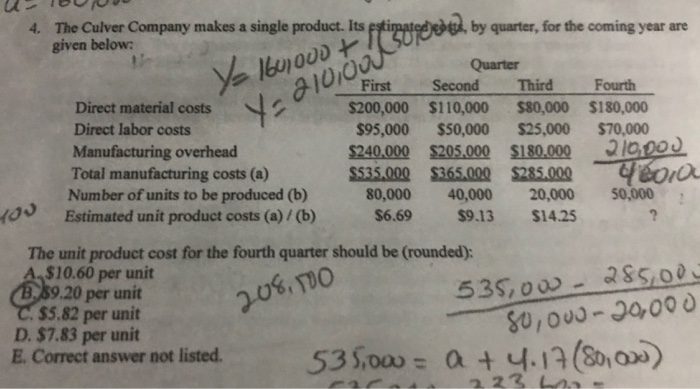

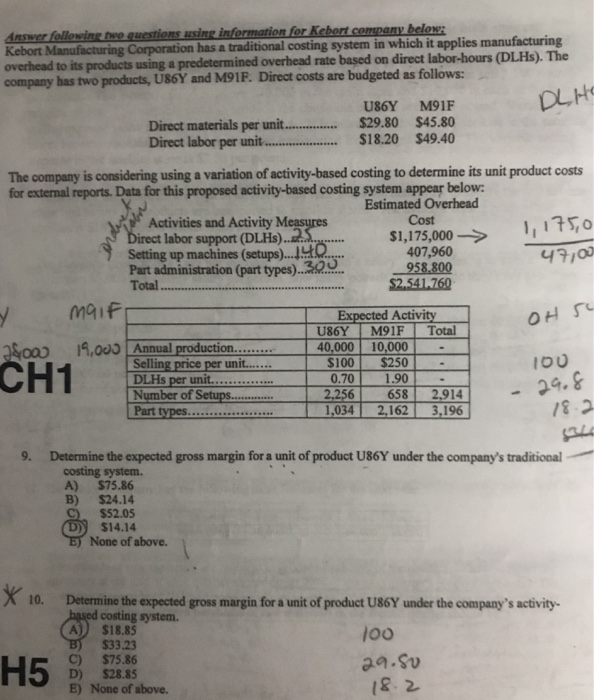

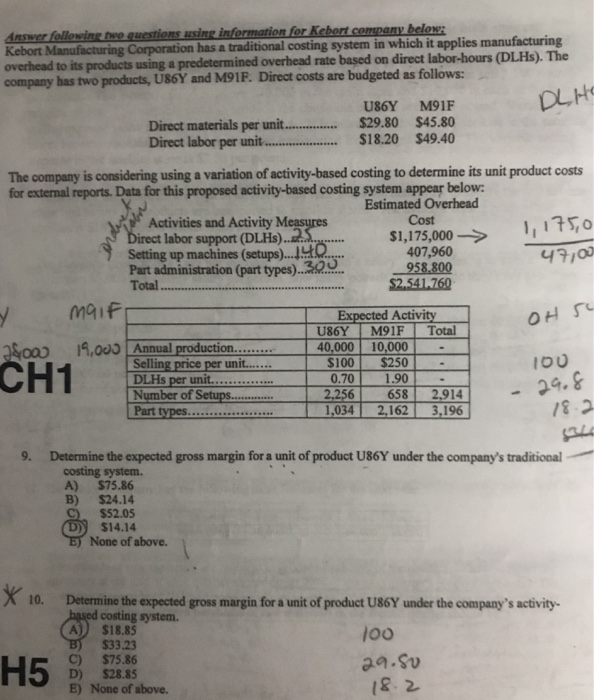

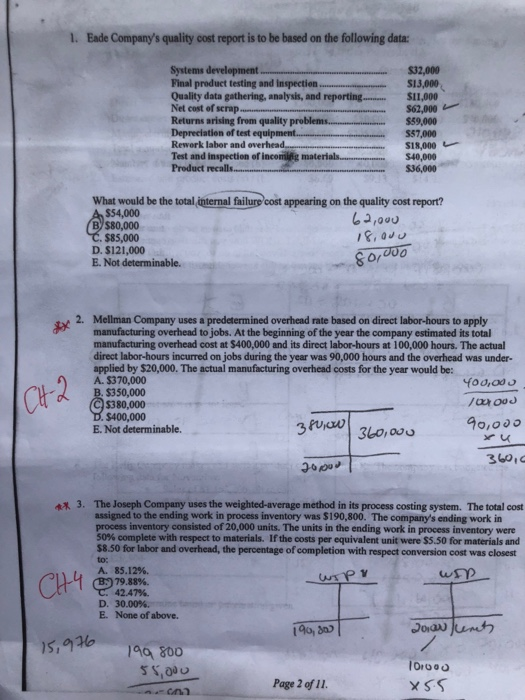

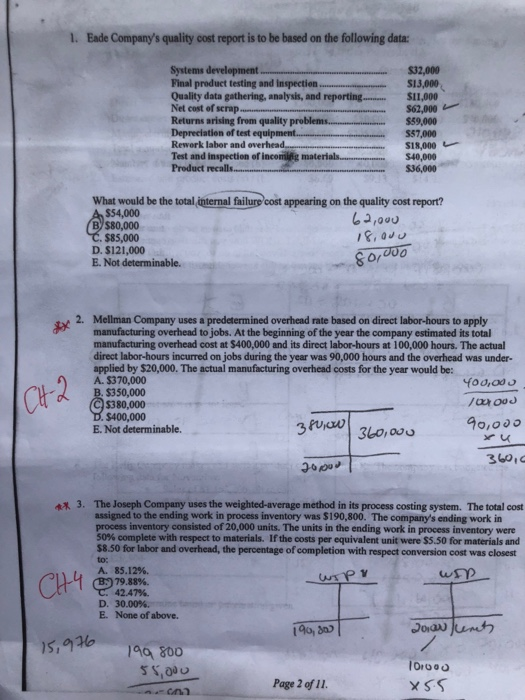

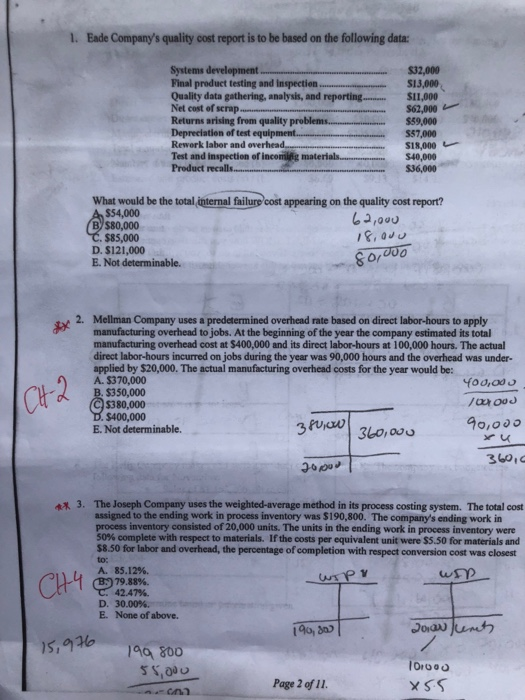

Yo luovo + seguridad 4. The Culver Company makes a single product. Its estin by quarter, for the coming year are given below: Quarter First Second Third Fourth Direct material costs $200,000 $110,000 $80,000 $180,000 Direct labor costs $95,000 $50,000 $25,000 $70,000 Manufacturing overhead $240,000 $205,000 $180,000 210 Dos Total manufacturing costs (a) $$35.000 $365,000 $285,000 Here Number of units to be produced (b) 80,000 40,000 20,000 50,000 Estimated unit product costs (a)/(b) $6.69 $9.13 $14.25 Ya 210,00 Yo The unit product cost for the fourth quarter should be (rounded): A $10.60 per unit B, 89.20 per unit C. $5.82 per unit D. $7.83 per unit E. Correct answer not listed. 223 L 206.10 535,00 - 285,00 80,000-30,000 535,000 = a + 4.17(80, 0) Answer following te cuestions using information for Kebert company below: Kebort Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHS). The company has two products, U86Y and M91F. Direct costs are budgeted as follows: DLHO Direct materials per unit. Direct labor per unit. U86Y M91F $29.80 $45.80 $18.20 $49.40 disin 1,175,0 47,00 The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below: Estimated Overhead Activities and Activity Measures Cost Direct labor support (DLHS)....... $1,175,000 -> Setting up machines (setups)...4... 407,960 Part administration (part types)..300 958.800 Total $2.541.760 maif Expected Activity U86Y M91F Total 2800 19.005 Annual production......... 40,000 10,000 Selling price per unit....... $100 $250 DLHs per unit.......... 0.70 1.90 Number of Setups.. 2.256 658 2.914 1,034 2,162 3,196 OH su CH1 29.8 Part types.. 18.2 Determine the expected gross margin for a unit of product U86Y under the company's traditional costing system. A) $75.86 B) $24.14 $52.05 $14.14 E) None of above. * 10. Determine the expected gross margin for a unit of product U86 under the company's activity- hased costing system A) $18.85 100 B) $33.23 C) $75.86 29. Sv D) $28.85 E) None of above. 18.2 H5 1. Eade Company's quality cost report is to be based on the following data: $32,000 S13,000 $11,000 $62,000 Systems development. Final product testing and inspection Quality data gathering, analysis, and reporting..... Nel cost of scrap Returns arising from quality problems.. Depreciation of test equipment Rework labor and overhead..... Test and inspection of incoming materials Product recalls........ $59,000 557,000 $18,000 L S40,000 $36,000 What would be the total internal failure cost appearing on the quality cost report? $54,000 62,000 B) $80,000 C. $85,000 18,000 D. S121,000 E. Not determinable 80,000 (CH2 2. Mellman Company uses a predetermined overhead rate based on direct labor-hours to apply manufacturing overhead to jobs. At the beginning of the year the company estimated its total manufacturing overhead cost at $400,000 and its direct labor-hours at 100,000 hours. The actual direct labor-hours incurred on jobs during the year was 90,000 hours and the overhead was under- applied by $20,000. The actual manufacturing overhead costs for the year would be: A. $370,000 You, od B. $350,000 C$380,000 10000 D. $400,000 E. Not determinable. 380,00 90,000 360,000 " 360,6 wip CHA ** 3. The Joseph Company uses the weighted average method in its process costing system. The total cost assigned to the ending work in process inventory was $190,800. The company's ending work in process inventory consisted of 20,000 units. The units in the ending work in process inventory were 50% complete with respect to materials. If the costs per equivalent unit were $5.50 for materials and $8.50 for labor and overhead, the percentage of completion with respect conversion cost was closest to: A. 85.12%. un B.9 79.88% C. 42.47% D. 30.00% E. None of above. Joru unch 199 800 55,000 101000 Page 2 of 11. x55 List 190, 303 15,976