please show the steps for the answers for a, b, and c.

please show steps for answers a, b, and c.

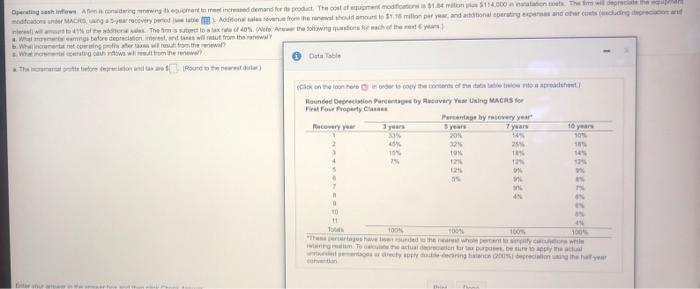

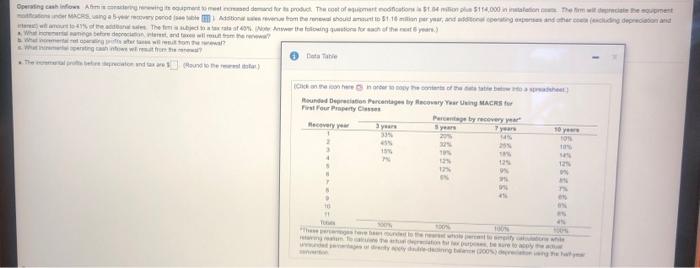

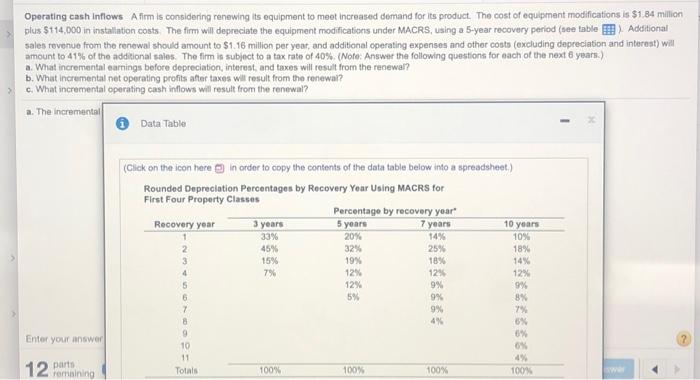

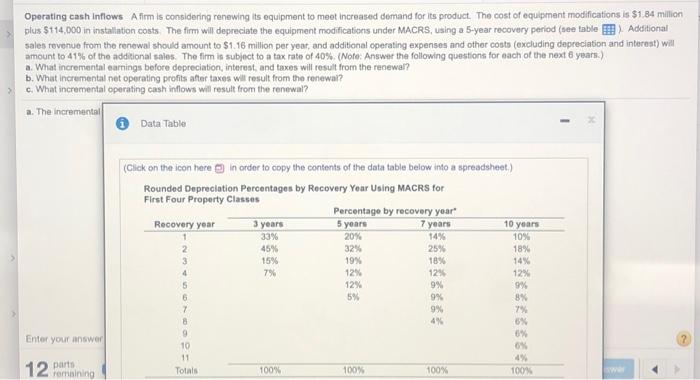

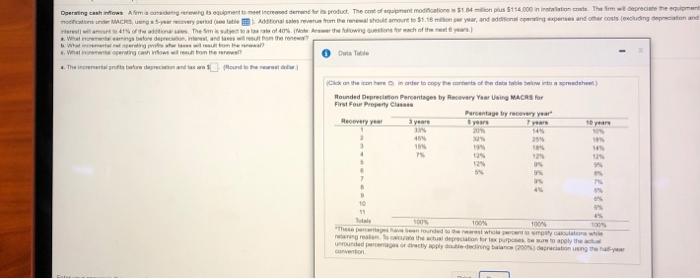

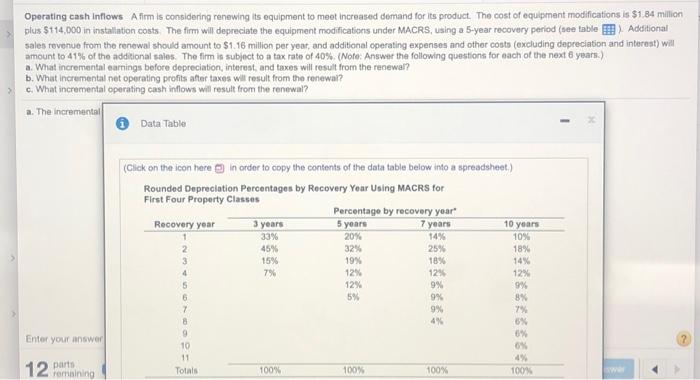

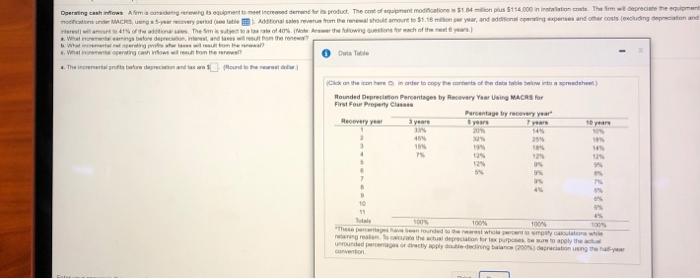

Derating cash in Almaany wonder product. The con modalion 15114.000 milionate Themelore the more Control motto $1.18 mya, andando ingen and with them to rely on what there We starts with wwwwww Out Tool There is no Click on the interes of the dish) Founded Deton Percentages by every Yaar Using MACRS for First Four Property Percentage by recovery year? Revery year 1 year 24 1 NO The words who are we the way around young andeng canon Operating sanhi congwing and demand for the product. The cost of medico non$14.000 nro Them wideo medios MAC grovery from the mount 1 milion per and only and cond These 405 Wote www the following for free was forces wit from the wall Where there? Date the round) con other wordt Founded Depression Pentages by Rucavery Your Uning MACRS Pretour Property wie by every year ecovery Syers Tyears 10 years 201 10 20 tox 12 IN 10 11 1 TON 100 100 The way we To be the dengan be Opening how to reproduct the cost of motion 5114.000 in the west MACRS aby prostorom the houd51 16 de depreciation and with the entirafya We will What Writing with Data Table the dunder Cech unded in arcentages by Yar Un MAGRS Four Property Percentage by recovery ar Hecovery 3 years years 335 10 M ON 2 17 125 12 12 0 Operating cash Inflows A firm is considering renewing is equipment to meet increased demand for its product. The cost of equipment modifications in 51.84 million plus $114,000 in installation costs. The firm will depreciate the equipment modifications under MACRS, using a 5-year recovery period (see table Additional sales revenue from the renewal should amount to $1.16 million per yeat, and additional operating expenses and other costs (excluding depreciation and interest) will amount to 41% of the additional sales. The firm is subject to a tax rate of 40% (Note: Answer the following questions for each of the next 6 years.) a. What incremental earnings before depreciation, interest, and taxes will result from the renewal? b. What incremental net operating profits after taxes will result from the renewal? c. What incremental operating cash inflows will result from the renewa!? a. The Incremental Data Table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 10 years 33% 20% 14% 10% 45% 32% 25% 18% 3 15% 19% 18% 14% 79 12% 12% 12% 12% 9% 9% 6 5% 9% 8% 7 9% 7% 4% 6% 9 0% 10 0 4 Totais 100% 100% 100% 100% 4 5 8 Enter your answer 11 12 parts Pemaining A

please show the steps for the answers for a, b, and c.

please show the steps for the answers for a, b, and c.