Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show the steps, thank you! The following are simplified consolidated balance sheets for the chartered banking system and the Bank of Canada. Do not

Please show the steps, thank you!

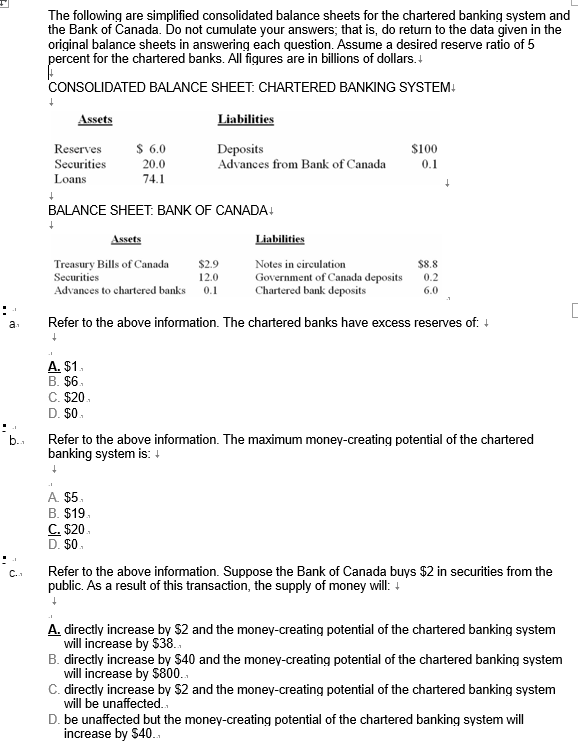

The following are simplified consolidated balance sheets for the chartered banking system and the Bank of Canada. Do not cumulate your answers, that is, do return to the data given in the original balance sheets in answering each question. Assume a desired reserve ratio of 5 percent for the chartered banks. All figures are in billions of dollars. CONSOLIDATED BALANCE SHEET: CHARTERED BANKING SYSTEM Liabilities Assets S 6,0 Reserves Deposits Advances from Bank of Canada $100 Securities 20.0 0.1 Loans 74.1 BALANCE SHEET: BANK OF CANADA Assets Liabilities Treasury Bills of Canada $2,9 Notes in circulation $8.8 Securities 12.0 Government of Canada deposits Chartered bank deposits 0.2 Advances to chartered banks 0.1 6.0 Refer to the above information. The chartered banks have exces s reserves of: A. $1 B. $6 C. $20 D. $0 Refer to the above information. The maximum money-creating potential of the chartered banking system is: A $5 B. $19 C. $20 D. $0 Refer to the above information. Suppose the Bank of Canada buys $2 in securities from the public. As a result of this transaction, the supply of money will: A. directly increase by $2 and the money-creating potential of the chartered banking system will increase by $38. B. directly increase by $40 and the money-creating potential of the chartered banking system will increase by $800.. C. directly increase by $2 and the money-creating potential of the chartered banking system will be unaffected. D. be unaffected but the money-creating potential of the chartered banking system will increase by $40Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started