Answered step by step

Verified Expert Solution

Question

1 Approved Answer

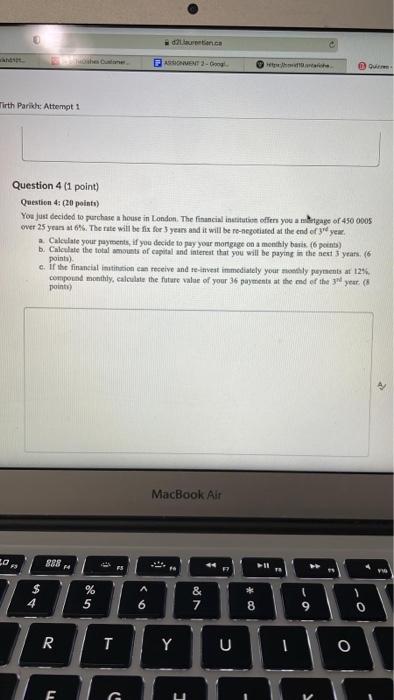

please show the work note as well dr.ca ASSONNENT - Google with Qui Tirth Pariche Attempt 1 Question 4 (1 point) Question 4: (20 points)

please show the work note as well

dr.ca ASSONNENT - Google with Qui Tirth Pariche Attempt 1 Question 4 (1 point) Question 4: (20 points) You just decided to purchase a house in London. The financial institute offers you a mortgage of 450 0005 over 25 years at 6%. The rate will be fix for 3 years and it will be re-negotiated at the end of yea a. Calculate your payments, if you decide to pay your mortgage on a monthly basik (6 points) b. Calculate the total amounts of capital and interest that you will be paying in the next 3 years (6 points) c. If the financial institution can receive and re-invest immediately your why payments 125 compound monthly, calculate the future value of your 36 payments at the end of the 3 years points) - MacBook Air 20 888 d, 3 * $ 4 % 5 & 7 6 8 9 0 R T Y U o TE G C > dr.ca ASSONNENT - Google with Qui Tirth Pariche Attempt 1 Question 4 (1 point) Question 4: (20 points) You just decided to purchase a house in London. The financial institute offers you a mortgage of 450 0005 over 25 years at 6%. The rate will be fix for 3 years and it will be re-negotiated at the end of yea a. Calculate your payments, if you decide to pay your mortgage on a monthly basik (6 points) b. Calculate the total amounts of capital and interest that you will be paying in the next 3 years (6 points) c. If the financial institution can receive and re-invest immediately your why payments 125 compound monthly, calculate the future value of your 36 payments at the end of the 3 years points) - MacBook Air 20 888 d, 3 * $ 4 % 5 & 7 6 8 9 0 R T Y U o TE G C > Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started