Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show the workings for part (c) 1. The following three stocks are listed in the US stock market. The risk-free rate is 0.0170 and

Please show the workings for part (c)

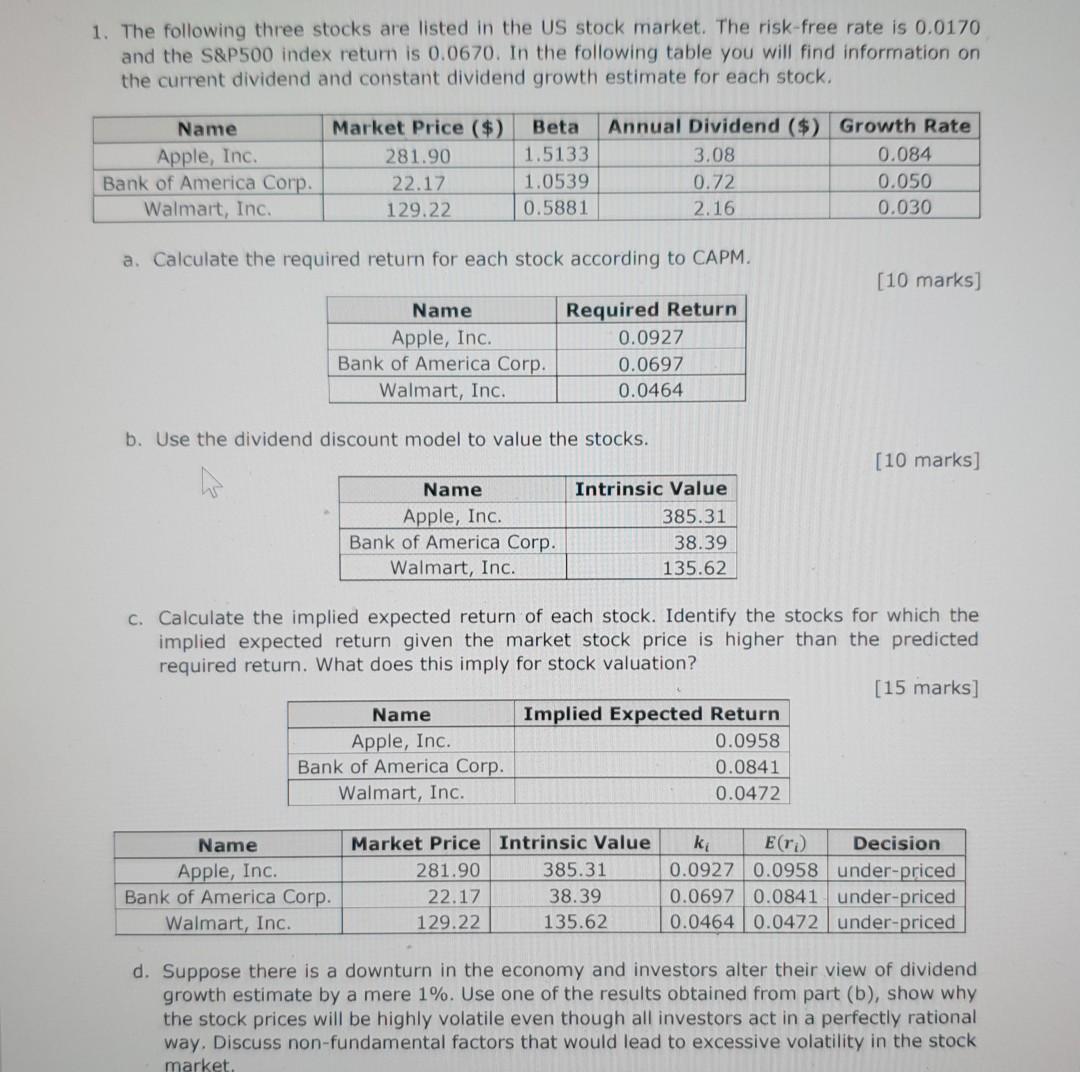

1. The following three stocks are listed in the US stock market. The risk-free rate is 0.0170 and the S&P500 index return is 0.0670. In the following table you will find information on the current dividend and constant dividend growth estimate for each stock. Name Apple, Inc. Bank of America Corp. Walmart, Inc. Market Price ($) 281.90 22.17 129.22 Beta 1.5133 1.0539 0.5881 Annual Dividend ($) Growth Rate 3.08 0.084 0.72 0.050 2.16 0.030 a. Calculate the required return for each stock according to CAPM. [10 marks] Name Apple, Inc. Bank of America Corp. Walmart, Inc. Required Return 0.0927 0.0697 0.0464 b. Use the dividend discount model to value the stocks. [10 marks] Name Apple, Inc. Bank of America Corp. Walmart, Inc. Intrinsic Value 385.31 38.39 135.62 c. Calculate the implied expected return of each stock. Identify the stocks for which the implied expected return given the market stock price is higher than the predicted required return. What does this imply for stock valuation? [15 marks] Name Implied Expected Return Apple, Inc. 0.0958 Bank of America Corp. 0.0841 Walmart, Inc. 0.0472 Name Apple, Inc. Bank of America Corp. Walmart, Inc. Market Price Intrinsic Value 281.90 385.31 22.17 38.39 129.22 135.62 ki Er) Decision 0.0927 0.0958 under-priced 0.0697 0.0841 under-priced 0.0464 0.0472 under-priced d. Suppose there is a downturn in the economy and investors alter their view of dividend growth estimate by a mere 1%. Use one of the results obtained from part (b), show why the stock prices will be highly volatile even though all investors act in a perfectly rational way. Discuss non-fundamental factors that would lead to excessive volatility in the stock marketStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started