please show the workinh process included formula. thank you.

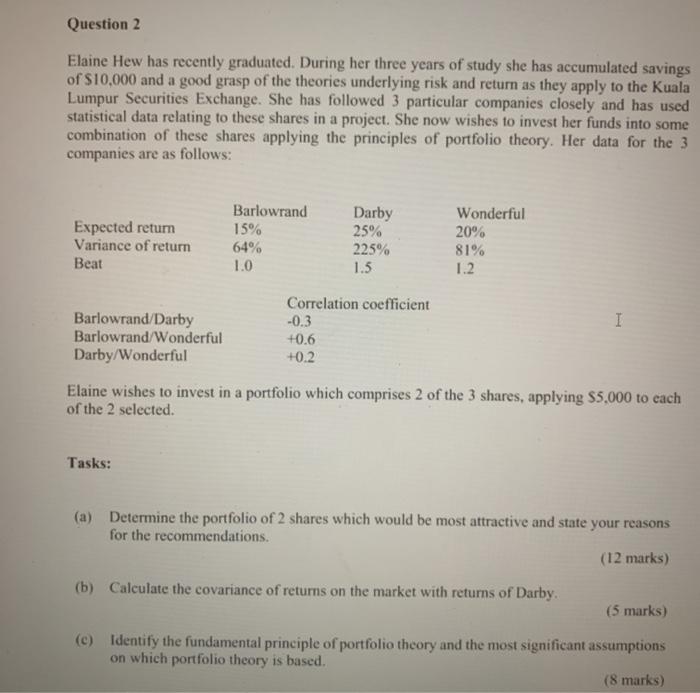

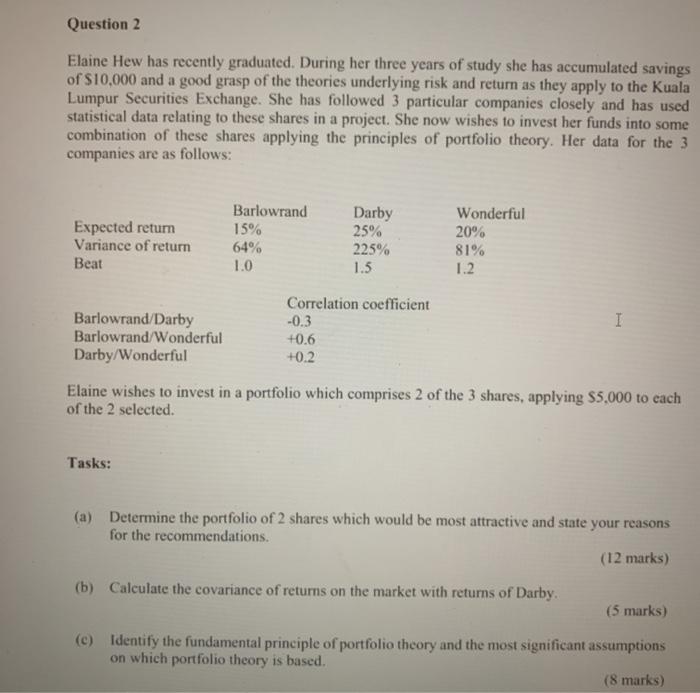

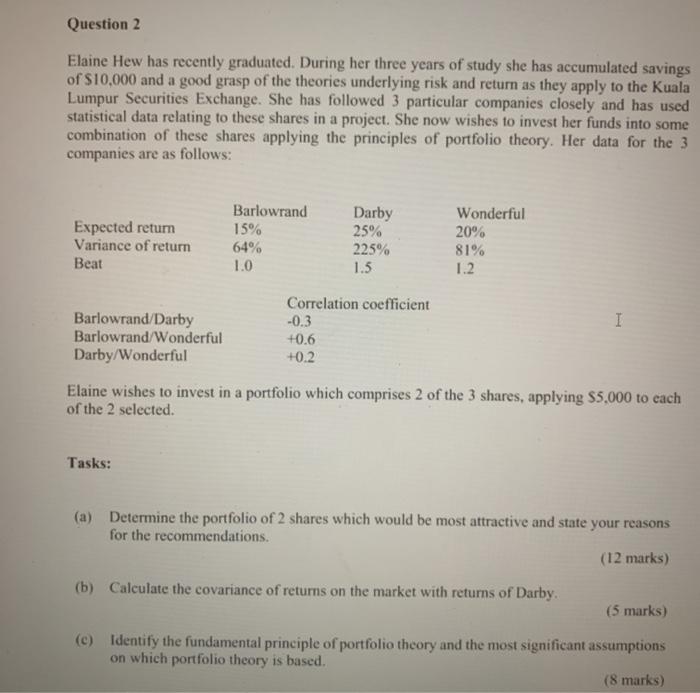

Question 2 Elaine Hew has recently graduated. During her three years of study she has accumulated savings of $10,000 and a good grasp of the theories underlying risk and return as they apply to the Kuala Lumpur Securities Exchange. She has followed 3 particular companies closely and has used statistical data relating to these shares in a project. She now wishes to invest her funds into some combination of these shares applying the principles of portfolio theory. Her data for the 3 companies are as follows: Expected return Variance of return Beat Barlowrand 15% 64% 1.0 Darby 25% 225% 1.5 Wonderful 20% 81% 1.2 I Barlowrand/Darby Barlowrand/Wonderful Darby/Wonderful Correlation coefficient -0.3 +0.6 +0.2 Elaine wishes to invest in a portfolio which comprises 2 of the 3 shares, applying $5,000 to each of the 2 selected. Tasks: (a) Determine the portfolio of 2 shares which would be most attractive and state your reasons for the recommendations. (12 marks) (b) Calculate the covariance of returns on the market with returns of Darby (5 marks) (c) Identify the fundamental principle of portfolio theory and the most significant assumptions on which portfolio theory is based. (8 marks) Question 2 Elaine Hew has recently graduated. During her three years of study she has accumulated savings of $10,000 and a good grasp of the theories underlying risk and return as they apply to the Kuala Lumpur Securities Exchange. She has followed 3 particular companies closely and has used statistical data relating to these shares in a project. She now wishes to invest her funds into some combination of these shares applying the principles of portfolio theory. Her data for the 3 companies are as follows: Expected return Variance of return Beat Barlowrand 15% 64% 1.0 Darby 25% 225% 1.5 Wonderful 20% 81% 1.2 I Barlowrand/Darby Barlowrand/Wonderful Darby/Wonderful Correlation coefficient -0.3 +0.6 +0.2 Elaine wishes to invest in a portfolio which comprises 2 of the 3 shares, applying $5,000 to each of the 2 selected. Tasks: (a) Determine the portfolio of 2 shares which would be most attractive and state your reasons for the recommendations. (12 marks) (b) Calculate the covariance of returns on the market with returns of Darby (5 marks) (c) Identify the fundamental principle of portfolio theory and the most significant assumptions on which portfolio theory is based. (8 marks)