Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show with formulas used, thanks Suppose an all-equity company has 700,000 shares outstanding and the price per share is currently $30. The EBIT is

please show with formulas used, thanks

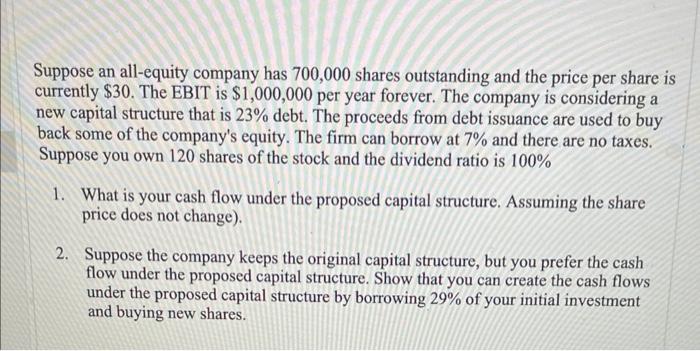

Suppose an all-equity company has 700,000 shares outstanding and the price per share is currently $30. The EBIT is $1,000,000 per year forever. The company is considering a new capital structure that is 23% debt. The proceeds from debt issuance are used to buy back some of the company's equity. The firm can borrow at 7% and there are no taxes. Suppose you own 120 shares of the stock and the dividend ratio is 100% 1. What is your cash flow under the proposed capital structure. Assuming the share price does not change). 2. Suppose the company keeps the original capital structure, but you prefer the cash flow under the proposed capital structure. Show that you can create the cash flows under the proposed capital structure by borrowing 29% of your initial investment and buying new shares

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started