Please show work.

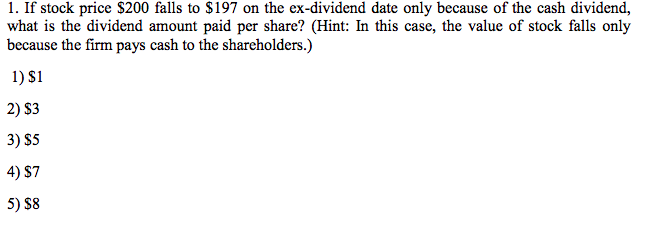

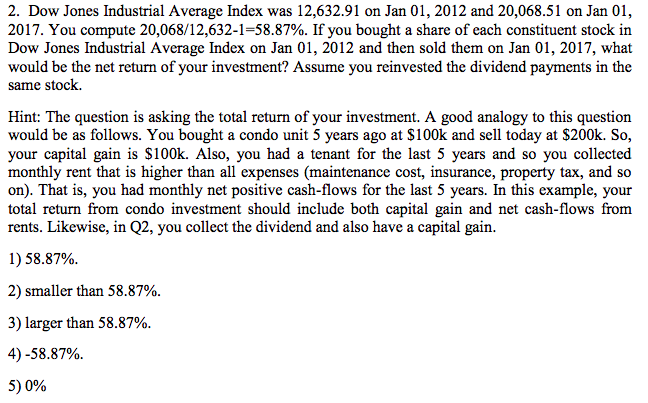

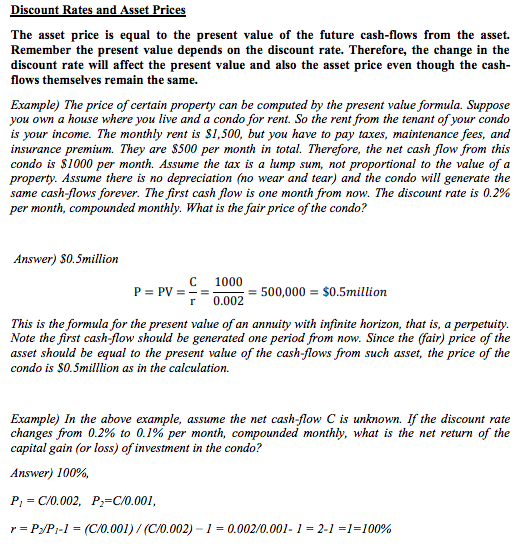

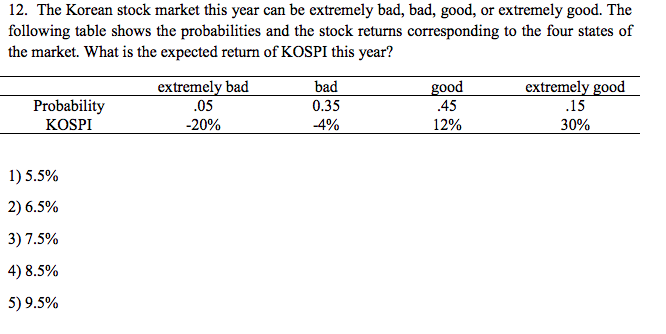

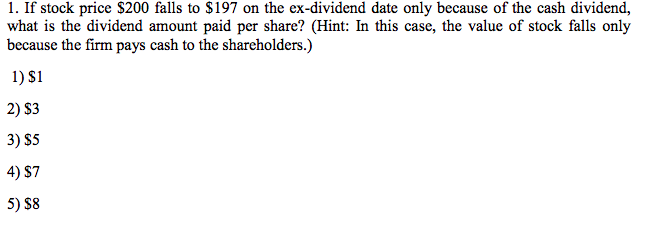

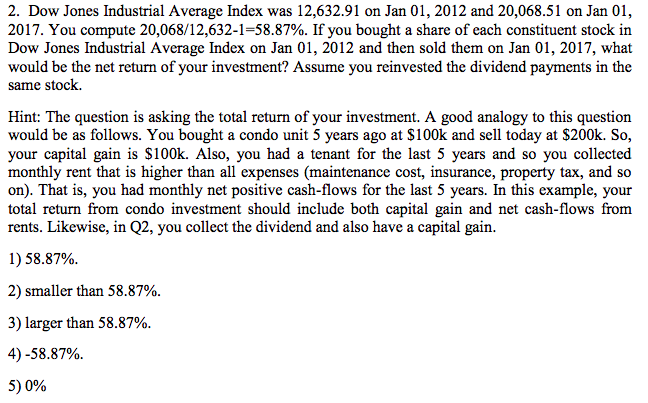

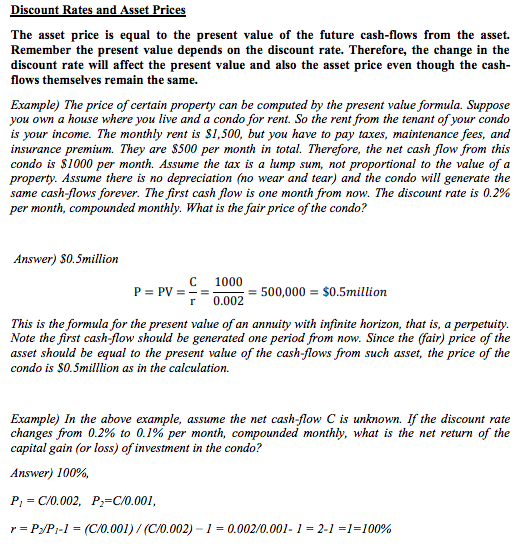

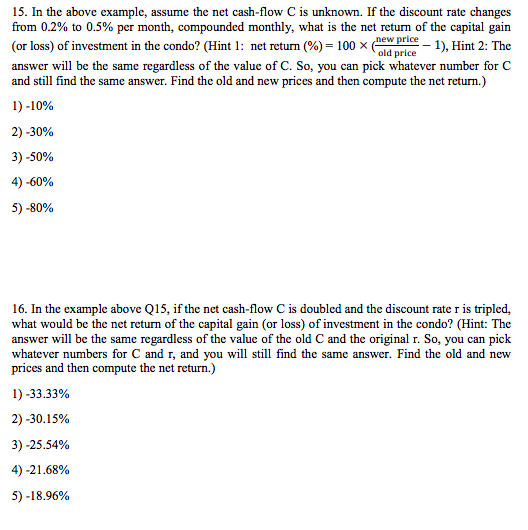

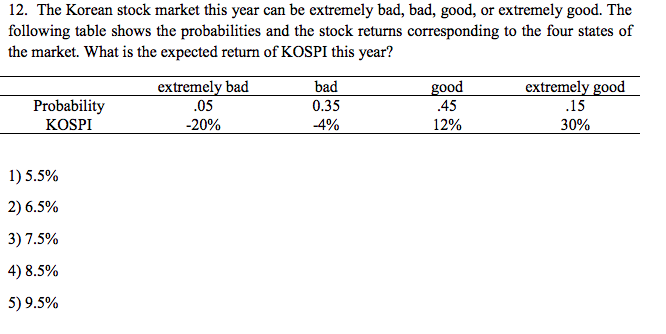

1. If stock price S200 falls to S197 on the ex-dividend date only because of the cash dividend, what is the dividend amount paid per share? (Hint: In this case, the value of stock falls only because the firm pays cash to the shareholders.) 1) S1 2) S3 3) SS 4) S7 5) S8 2. Dow Jones Industrial Average Index was 12,632.91 on Jan 01, 2012 and 20,068.51 on Jan 01, 2017. You compute 20,068/12,632-1-58.87%. If you bought a share of each constituent stock in Dow Jones Industrial Average Index on Jan 01, 2012 and then sold them on Jan 01, 2017, what would be the net return of your investment? Assume you reinvested the dividend payments in the same stock. Hint: The question is asking the total return of your investment. A good analogy to this question would be as follows. You bought a condo unit 5 years ago at S100k and sell today at $200k. So, your capital gain is S100k. Also, you had a tenant for the last 5 years and so you collected monthly rent that is higher than all expenses (maintenance cost, insurance, property tax, and so on). That is, you had monthly net positive cash-flows for the last 5 years. In this example, your total return from condo investment should include both capital gain and net cash-flows from rents. Likewise, in Q2, you collect the dividend and also have a capital gain. 1) 58.87%. 2) smaller than 58.87%. 3) larger than 58.87% 4)-58.87%. 5) 0% Discount Rates and Asset Price The asset price is equal to the present value of the future cash-flows from the asset. Remember the present value depends on the discount rate. Therefore, the change in the discount rate will affect the present value and also the asset price even though the cash flows themselves remain the same. Example) The price of certain property can be computed by the present value formula. Suppose you own a house where you live and a condo for rent. So the rent from the tenant of your condo is your income. The monthly rent is SI,500, but you have to pay taxes, maintenance fees, and insurance premium. They are S500 per month in total. Therefore, the net cash flow from this condo is S1000 per month. Assume the tax is a lump sum, not proportional to the value of a property. Assume there is no depreciation (no wear and tear) and the condo will generate the same cash-flows forever. The first cash flow is one month from now. The discount rate is 0.2% per month, compounded monthly. What is the fair price of the condo? Answer) SO.5million 1000 500,000 $0.5million This is the formula for the present value of an annuity with infinite horizon, that is, a perpetuity. Note the first cash-flow should be generated one period from now. Since the (fair) price of the asset should be equal to the present value of the cash-flows from such asset, the price of the condo is S0.5milllion as in the calculation. Example) In the above example, assume the net cash-flow C is unknown. If the discount rate changes from 0.2% to 0.1% per month, compounded monthly, what is the net return of the capital gain (or loss) of investment in the condo? Answer) 100%, P, = C/0.002, P2=C/0.001, r = P2/P1-1 = (C/0.001) / (C/0.002)-1 = 0.002/0.001-1 = 2-1 =1=100% 15. In the above example, assume the net cash-flow C is unknown. If the discount rate changes from 0.2% to 0.5% per month, compounded monthly, what is the net return of the capital gain (or loss) of investment in the condo? (Hint 1 : net return (%)-100 1) Hint 2: The answer will be the same regardless of the value of C. So, you can pick whatever number for C and still find the same answer. Find the old and new prices and then compute the net return.) 1)-10% e old price dp 2)-30% 3) .50% 4)-60% 5)-80% 16. In the example above Q15, if the net cash-flow C is doubled and the discount rate r is tripled, what would be the net return of the capital gain (or loss) of investment in the condo? (Hint: The answer will be the same regardless of the value of the old C and the original r. So, you can piclk whatever numbers for C and r, and you will still find the same answer. Find the old and new and then compute the net return.) 1)-33.33% 2)-30.15% 3)-25.54% 4)-21 .68% 5)-18.96% 12. The Korean stock market this year can be extremely bad, bad, good, or extremely good. The following table shows the probabilities and the stock returns corresponding to the four states of the market. What is the expected return of KOSPI this year? Probability KOSPI extremely bad 05 20% bad 0.35 -4% ood 45 12% extremely good 15 1) 5.5% 2) 6.5% 3) 7.5% 4) 8.5% 5) 9.5%