Answered step by step

Verified Expert Solution

Question

1 Approved Answer

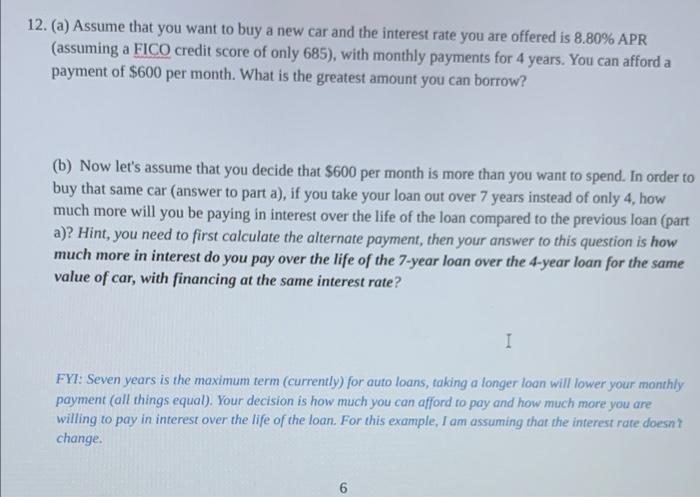

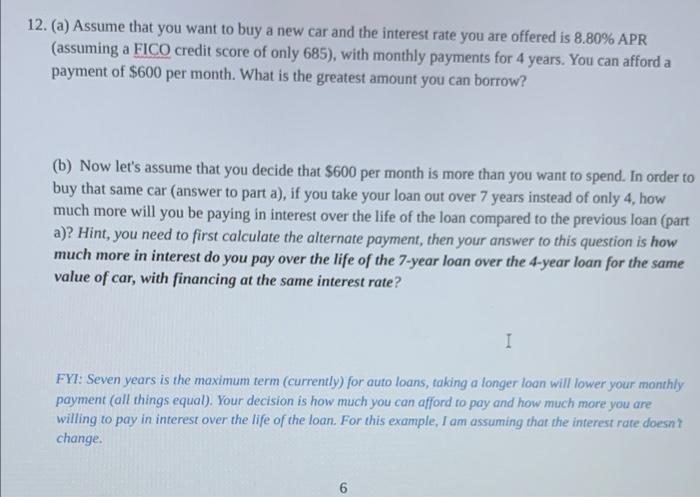

Please show work 12. (a) Assume that you want to buy a new car and the interest rate you are offered is 8.80% APR (assuming

Please show work

12. (a) Assume that you want to buy a new car and the interest rate you are offered is 8.80% APR (assuming a FICO credit score of only 685 ), with monthly payments for 4 years. You can afford a payment of $600 per month. What is the greatest amount you can borrow? (b) Now let's assume that you decide that $600 per month is more than you want to spend. In order to buy that same car (answer to part a), if you take your loan out over 7 years instead of only 4 , how much more will you be paying in interest over the life of the loan compared to the previous loan (part) a)? Hint, you need to first calculate the alternate payment, then your answer to this question is how much more in interest do you pay over the life of the 7-year loan over the 4-year loan for the same value of car, with financing at the same interest rate? FYI: Seven years is the maximum term (currently) for auto loans, taking a longer loan will lower your monthly payment (all things equal). Your decision is how much you can afford to pay and how much more you are willing to pay in interest over the life of the loan. For this example, I am assuming that the interest rate doesn? change

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started