Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show work A Company recorded the following data for last year: Sales margin 19% Sales revenue $100,000 Residual income 10,211 If the company has

please show work

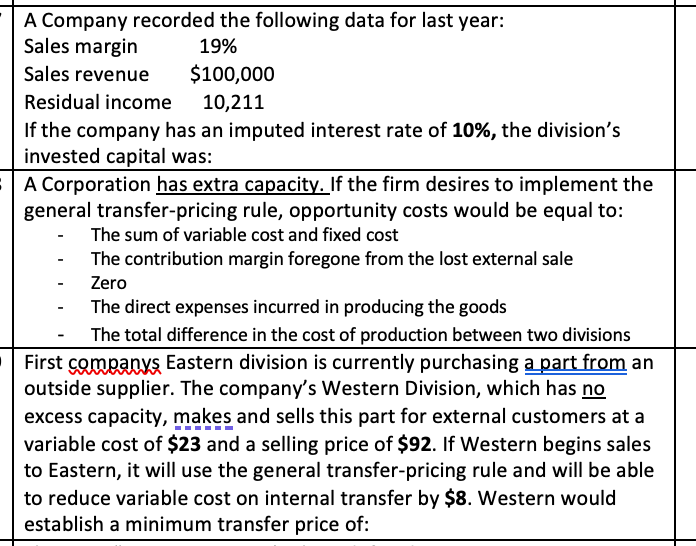

A Company recorded the following data for last year: Sales margin 19% Sales revenue $100,000 Residual income 10,211 If the company has an imputed interest rate of 10%, the division's invested capital was: A Corporation has extra capacity. If the firm desires to implement the general transfer-pricing rule, opportunity costs would be equal to: The sum of variable cost and fixed cost The contribution margin foregone from the lost external sale Zero The direct expenses incurred in producing the goods The total difference in the cost of production between two divisions First companys Eastern division is currently purchasing a part from an outside supplier. The company's Western Division, which has no excess capacity, makes and sells this part for external customers at a variable cost of $23 and a selling price of $92. If Western begins sales to Eastern, it will use the general transfer-pricing rule and will be able to reduce variable cost on internal transfer by $8. Western would establish a minimum transfer price ofStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started