Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work! (a) Pamela is the CEO of the Party Planning Corporation, a publicly traded corporation. She began working for them in 2023. That

Please show work!

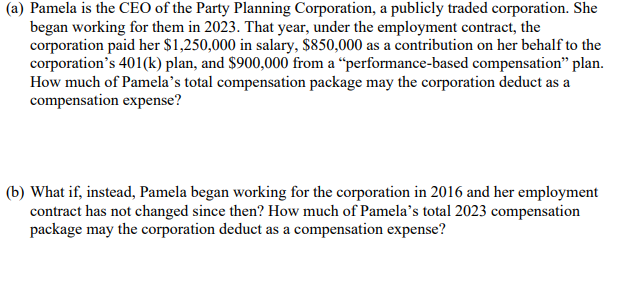

(a) Pamela is the CEO of the Party Planning Corporation, a publicly traded corporation. She began working for them in 2023. That year, under the employment contract, the corporation paid her $1,250,000 in salary, $850,000 as a contribution on her behalf to corporation's 401(k) plan, and $900,000 from a "performance-based compensation" plan. How much of Pamela's total compensation package may the corporation deduct as a compensation expense? (b) What if, instead, Pamela began working for the corporation in 2016 and her employment contract has not changed since then? How much of Pamela's total 2023 compensation package may the corporation deduct as a compensation expenseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started