Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work. ACCOUNTING FOR MANAGERS CHAPTER 13 PROBLEMS Problem 1 Bird's Pharmacy has purchased a small auto for delivery of prescriptions. The auto cost

Please show work.

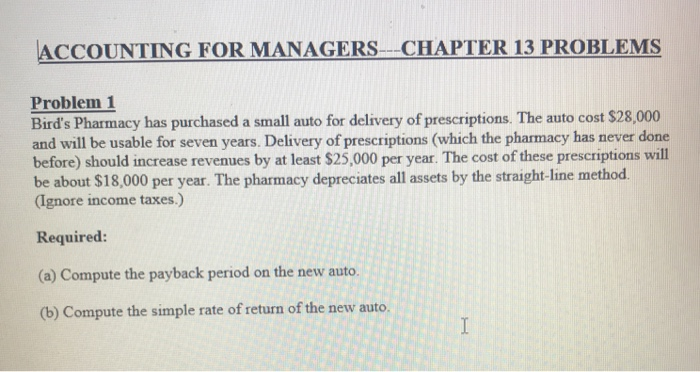

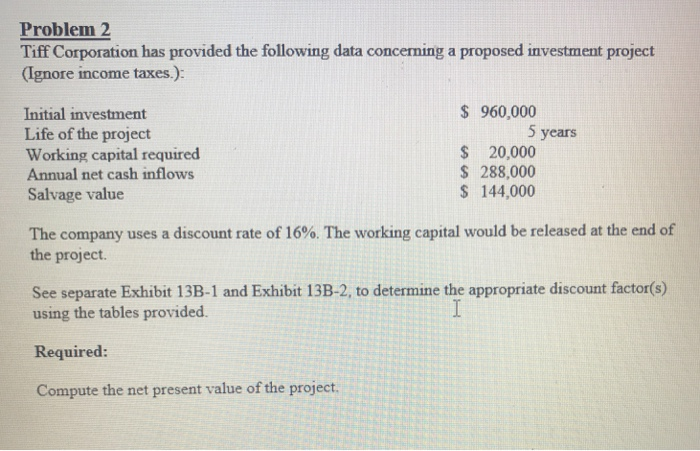

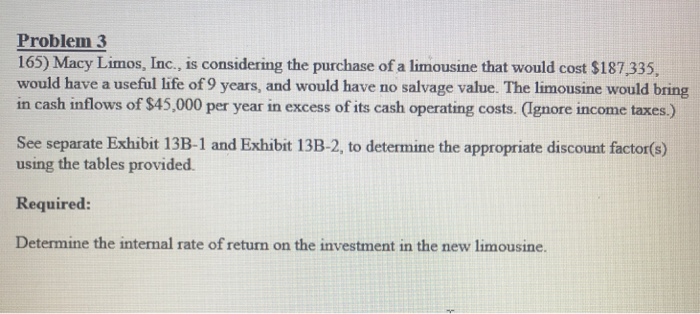

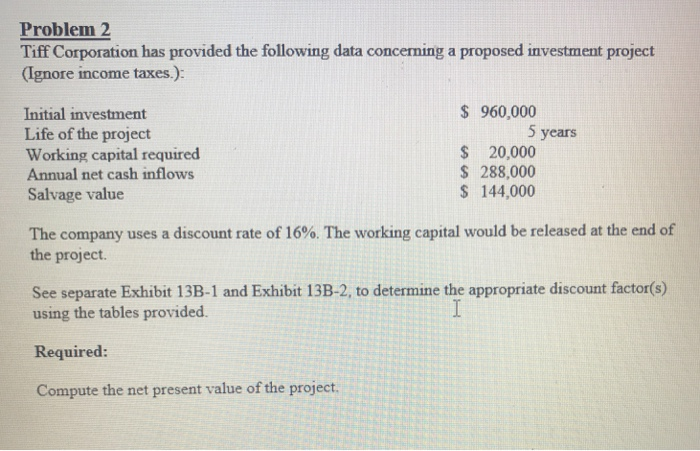

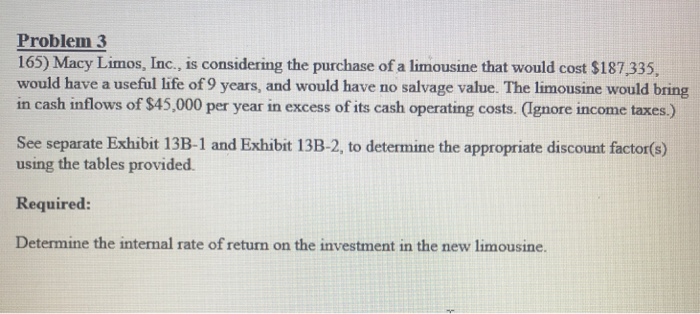

ACCOUNTING FOR MANAGERS CHAPTER 13 PROBLEMS Problem 1 Bird's Pharmacy has purchased a small auto for delivery of prescriptions. The auto cost $28,000 and will be usable for seven years. Delivery of prescriptions (which the pharmacy has never done before) should increase revenues by at least $25,000 per year. The cost of these prescriptions will be about $18,000 per year. The pharmacy depreciates all assets by the straight-line method (Ignore income taxes.) Required: (a) Compute the payback period on the new auto. (b) . Compute the simple rate of return of the new auto Problem2 Tiff Corporation has provided the following data concerning a proposed investment project Ignore income (Ignore income taxes.): Initial investment Life of the project Working capital required Annual net cash inflows Salvage value $ 960,000 5 years 20,000 S 288,000 S 144,000 The company uses a discount rate of 16%. The working capital would be released at the end of the project See separate Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using the tables provided Required: Compute the net present value of the project. Problem 3 165) Macy Limos, Inc., is considering the purchase of a limousine that would cost $187335, would have a useful life of 9 years, and would have no salvage value. The limousine would bring in cash inflows of $45,000 per year in excess of its cash operating costs. (Ignore income taxes) See separate Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using the tables provided Required Determine the internal rate of return on the investment in the new limousine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started