Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show work and calculations. 6 marks Problem 5 Short answer questions. Answer the questions asked clearly and concisely in two to three sentences. Hint:

please show work and calculations.

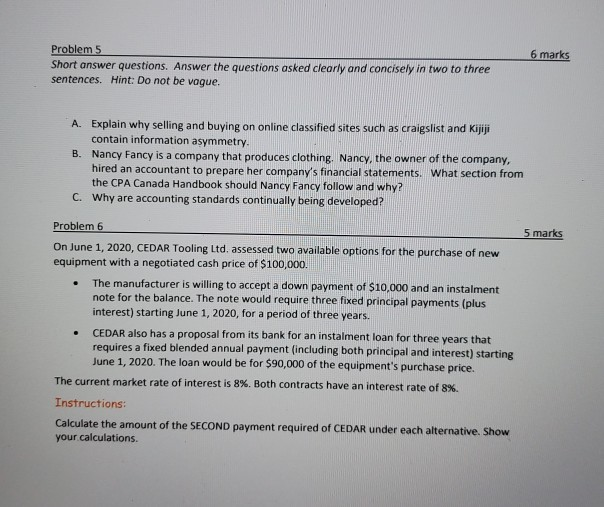

6 marks Problem 5 Short answer questions. Answer the questions asked clearly and concisely in two to three sentences. Hint: Do not be vague. A. Explain why selling and buying on online classified sites such as craigslist and Kijiji contain information asymmetry. B. Nancy Fancy is a company that produces clothing. Nancy, the owner of the company, hired an accountant to prepare her company's financial statements. What section from the CPA Canada Handbook should Nancy Fancy follow and why? C. Why are accounting standards continually being developed? Problem 6 5 marks On June 1, 2020, CEDAR Tooling Ltd. assessed two available options for the purchase of new equipment with a negotiated cash price of $100,000. The manufacturer is willing to accept a down payment of $10,000 and an instalment note for the balance. The note would require three fixed principal payments (plus interest) starting June 1, 2020, for a period of three years. CEDAR also has a proposal from its bank for an instalment loan for three years that requires a fixed blended annual payment (including both principal and interest) starting June 1, 2020. The loan would be for $90,000 of the equipment's purchase price. The current market rate of interest is 8%. Both contracts have an interest rate of 8%. Instructions: Calculate the amount of the SECOND payment required of CEDAR under each alternative. Show your calculations. 6 marks Problem 5 Short answer questions. Answer the questions asked clearly and concisely in two to three sentences. Hint: Do not be vague. A. Explain why selling and buying on online classified sites such as craigslist and Kijiji contain information asymmetry. B. Nancy Fancy is a company that produces clothing. Nancy, the owner of the company, hired an accountant to prepare her company's financial statements. What section from the CPA Canada Handbook should Nancy Fancy follow and why? C. Why are accounting standards continually being developed? Problem 6 5 marks On June 1, 2020, CEDAR Tooling Ltd. assessed two available options for the purchase of new equipment with a negotiated cash price of $100,000. The manufacturer is willing to accept a down payment of $10,000 and an instalment note for the balance. The note would require three fixed principal payments (plus interest) starting June 1, 2020, for a period of three years. CEDAR also has a proposal from its bank for an instalment loan for three years that requires a fixed blended annual payment (including both principal and interest) starting June 1, 2020. The loan would be for $90,000 of the equipment's purchase price. The current market rate of interest is 8%. Both contracts have an interest rate of 8%. Instructions: Calculate the amount of the SECOND payment required of CEDAR under each alternative. Show your calculationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started