Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work and explain how to solve - options highlighted are correct answers 16) In 2011, Sev en Seas sold $20,000 w orth of

Please show work and explain how to solve - options highlighted are correct answers

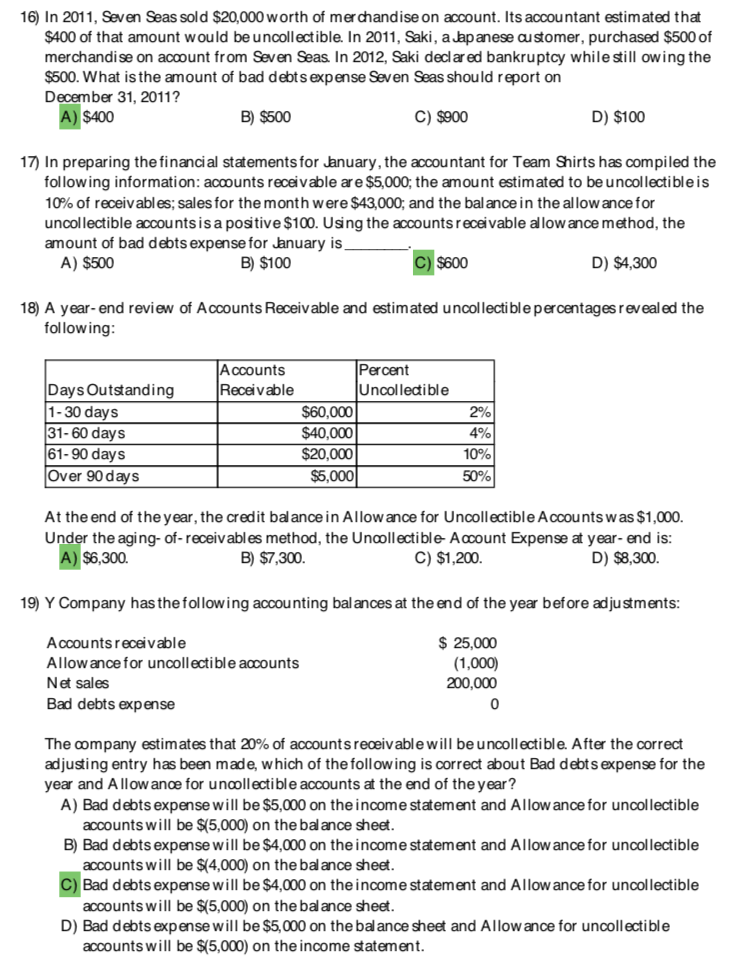

16) In 2011, Sev en Seas sold $20,000 w orth of merchand ise on account. Its accou ntant estimated that $400 of that amount wou ld be uncoll ectible. In 2011, Saki, a Japanese austomer, purchased $500 of merchandise on account from Seven Seas. In 2012, Saki declared bankruptcy while still owing the $500. What is the amount of bad debtsexpense Seven Seas should report on December 31, 2011? A) $400 B) $500 C) $900 D) $100 17) In preparing the financi al statements for January, the accou ntant for Team Shirts has com pi led the following information: accounts receivable are $5,000; the amount estimated to be uncol lectibleis 10% of receivabl es; sales for the month were $43,000; and the bal ance in the al low ance for uncollectible accountsis a positive $100. Using the accounts receivable allowancemethod, the amount of bad debts expense for January is A) $500 C) $600 B) $100 D) $4,300 18) A year-end review of Accounts Receivable and estimated uncollecti bl e percentages reveal ed the following: Accounts Receivable Percent Uncolledtible Days Outstanding 1-30 days 31-60 days $60,000 $40,000 $20,000 $5,000 2% 4% 61-90 days Over 90 days 10% 50% At the end of the year, the cred it bal ance in Al low ance for Uncollectible A ccou nts w as $1,000. Under the aging- of-receivabl es method, the Unoll ectible- A ccount Expense at year- end is: A) $6,300 D) $8.300 C) $1,200 B) $7,300. 19) Y Company has the fol low ing accounting bal ances at the end of the year before adjustments: A ccounts recei vable $ 25,000 Allowance for uncoll ectible accounts (1,000) 200,000 Net sales Bad debts expense 0 The company estimates that 20% of accounts receivable will be u ncoll ectibl e. After the correct adjusting entry has been made, which of the follow ing is correct about Bad debts expense for the year and Allow anoe for unollectible accounts at the end of the y ear? A) Bad debts expense will be $5,000 on the income statem ent and Allow ance for uncol lectible accounts will be $(5,000) on the bal ance sheet. B) Bad debts expense w ill be $4,000 on the incom e statem ent and Allow ance for uncollectible accounts will be $(4,000) on the balance sheet. C) Bad debts expense will be $4,000 on the incom e statem ent and Allow ance for uncollectible accounts will be $(5,000) on the bal ance sheet. D) Bad debts expense will be $5,000 on the balance sheet and Allow ance for uncollectible accounts will be $(5,000) on the income statementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started