Question

Please show work and explanation. Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales data for DVD players are as follows: November 1 Inventory 64

Please show work and explanation.

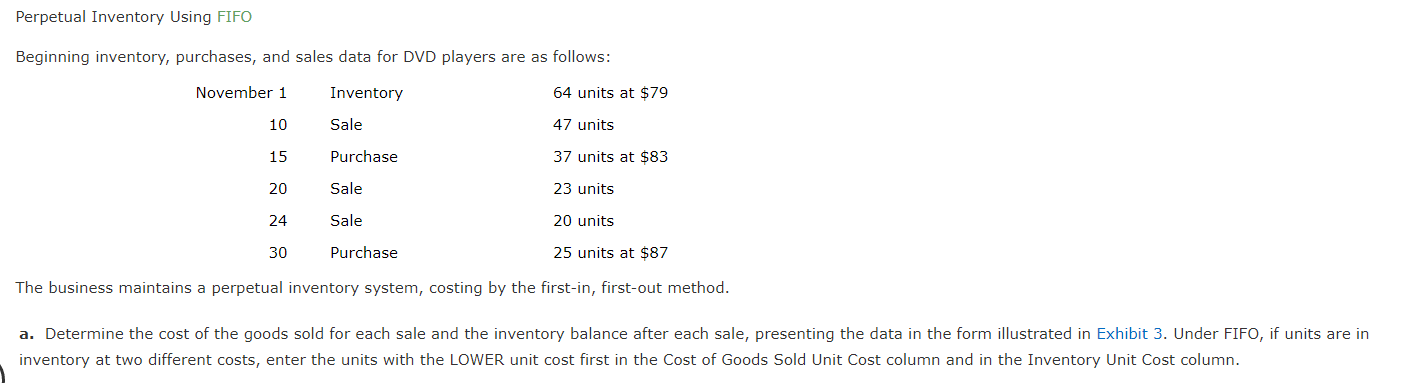

Perpetual Inventory Using FIFO

Beginning inventory, purchases, and sales data for DVD players are as follows:

| November 1 | Inventory | 64 units at $79 | |

| 10 | Sale | 47 units | |

| 15 | Purchase | 37 units at $83 | |

| 20 | Sale | 23 units | |

| 24 | Sale | 20 units | |

| 30 | Purchase | 25 units at $87 |

The business maintains a perpetual inventory system, costing by the first-in, first-out method.

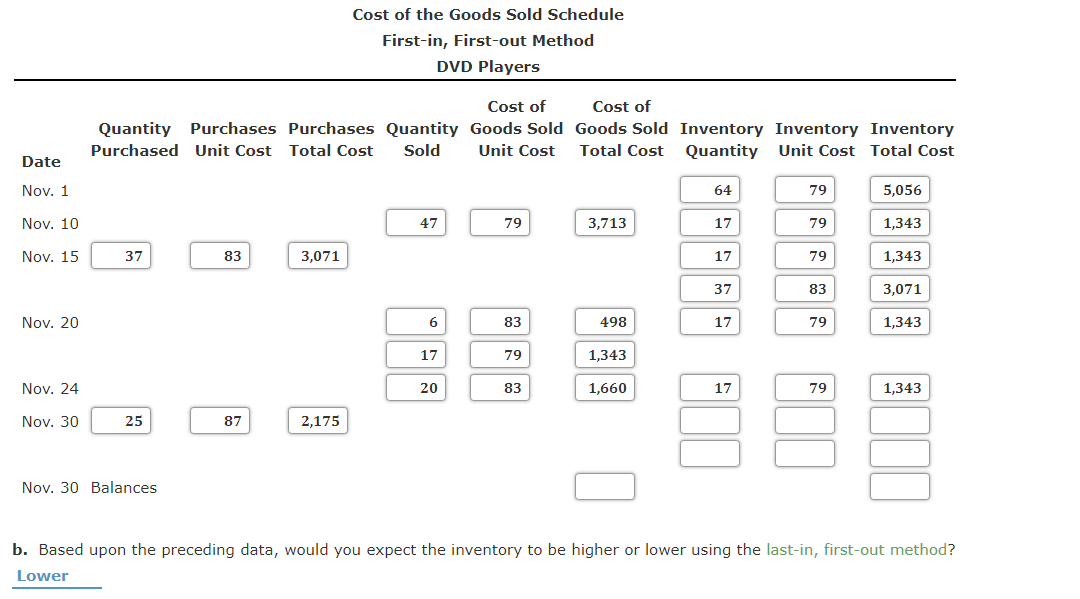

a. Determine the cost of the goods sold for each sale and the inventory balance after each sale, presenting the data in the form illustrated in Exhibit 3. Under FIFO, if units are in inventory at two different costs, enter the units with the LOWER unit cost first in the Cost of Goods Sold Unit Cost column and in the Inventory Unit Cost column.

| Cost of the Goods Sold Schedule | |||||||||

| First-in, First-out Method | |||||||||

| DVD Players | |||||||||

| Date | Quantity Purchased | Purchases Unit Cost | Purchases Total Cost | Quantity Sold | Cost of Goods Sold Unit Cost | Cost of Goods Sold Total Cost | Inventory Quantity | Inventory Unit Cost | Inventory Total Cost |

| Nov. 1 | |||||||||

| Nov. 10 | |||||||||

| Nov. 15 | |||||||||

| Nov. 20 | |||||||||

| Nov. 24 | |||||||||

| Nov. 30 | |||||||||

| Nov. 30 | Balances | ||||||||

b. Based upon the preceding data, would you expect the inventory to be higher or lower using the last-in, first-out method?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started