Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work and explanations. Thank you ! Inc, is a fast-growing financial consulting company. Management forecasts that in the next three years, the company's

Please show work and explanations. Thank you !

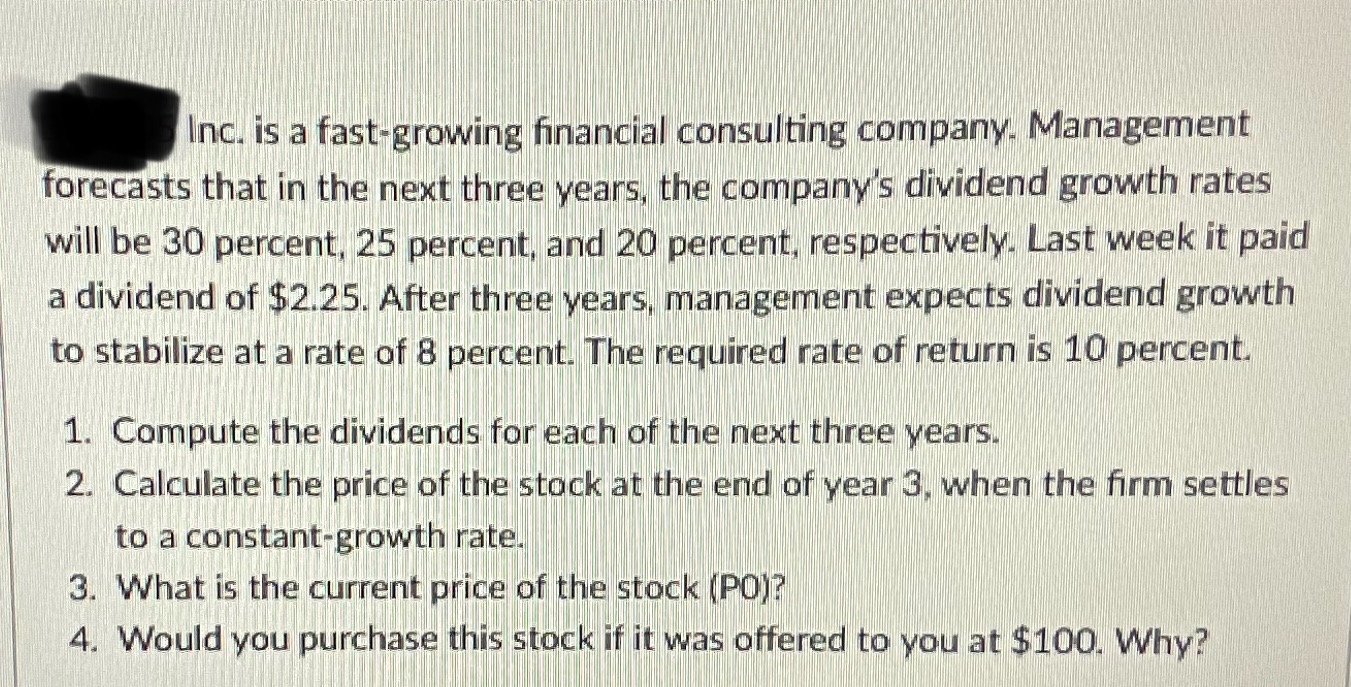

Inc, is a fast-growing financial consulting company. Management forecasts that in the next three years, the company's dividend growth rates will be 30 percent, 25 percent, and 20 percent, respectively. Last week it paid a dividend of $2.25. After three years, management expects dividend growth to stabilize at a rate of 8 percent. The required rate of return is 10 percent. 1. Compute the dividends for each of the next three years. 2. Calculate the price of the stock at the end of year 3, when the firm settles to a constant-growth rate. 3. What is the current price of the stock (PO) ? 4. Would you purchase this stock if it was offered to you at $100. WhyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started