Please show work and formulas in excel.

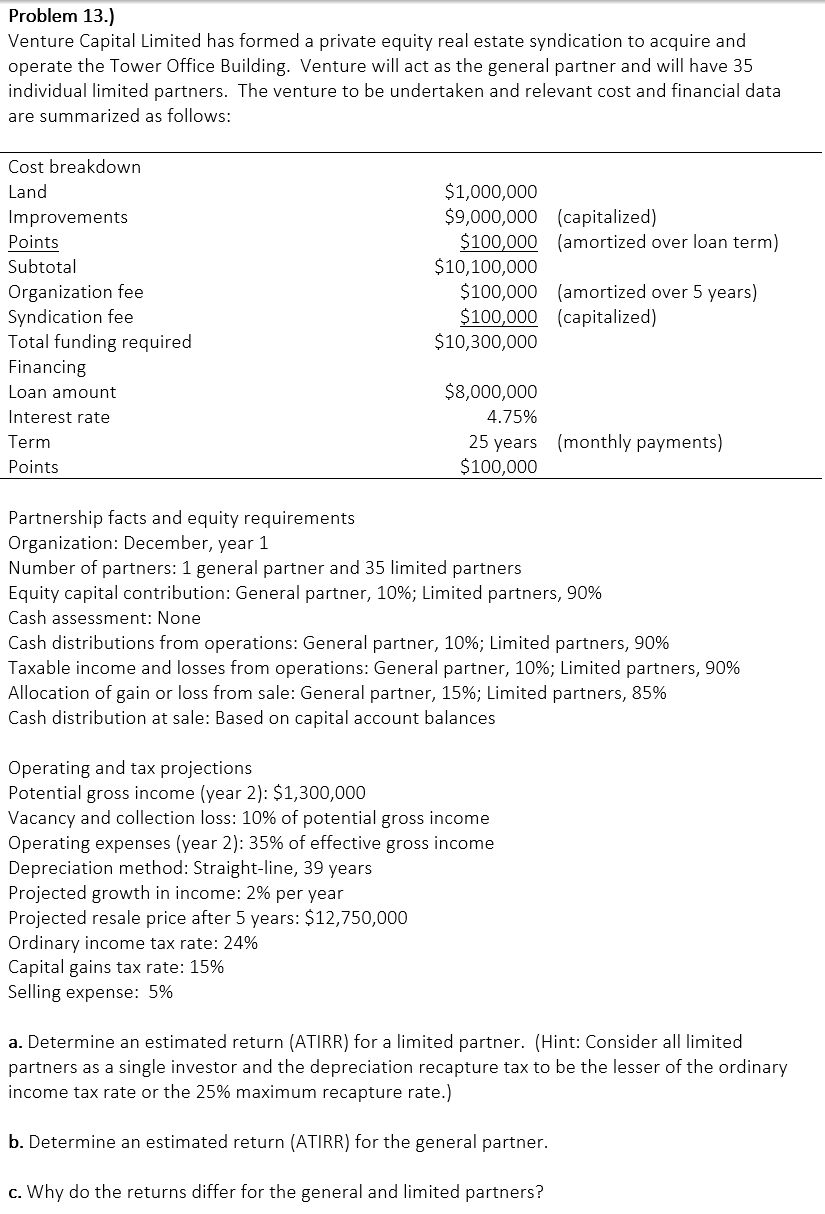

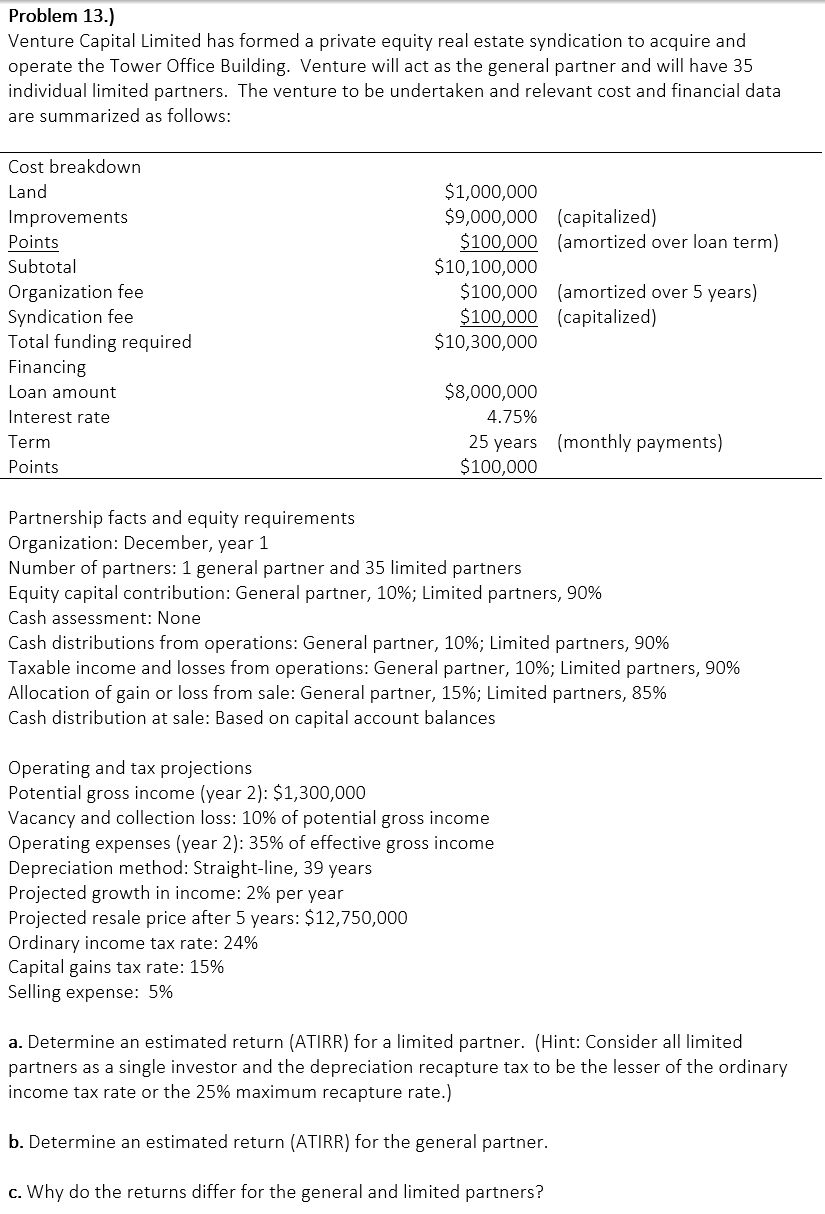

Problem 13.) Venture Capital Limited has formed a private equity real estate syndication to acquire and operate the Tower Office Building. Venture will act as the general partner and will have 35 individual limited partners. The venture to be undertaken and relevant cost and financial data are summarized as follows: Operating and tax projections Potential gross income (year 2): $1,300,000 Vacancy and collection loss: 10% of potential gross income Operating expenses (year 2): 35% of effective gross income Depreciation method: Straight-line, 39 years Projected growth in income: 2% per year Projected resale price after 5 years: $12,750,000 Ordinary income tax rate: 24% Capital gains tax rate: 15% Selling expense: 5% a. Determine an estimated return (ATIRR) for a limited partner. (Hint: Consider all limited partners as a single investor and the depreciation recapture tax to be the lesser of the ordinary income tax rate or the 25% maximum recapture rate.) b. Determine an estimated return (ATIRR) for the general partner. c. Why do the returns differ for the general and limited partners? Problem 13.) Venture Capital Limited has formed a private equity real estate syndication to acquire and operate the Tower Office Building. Venture will act as the general partner and will have 35 individual limited partners. The venture to be undertaken and relevant cost and financial data are summarized as follows: Operating and tax projections Potential gross income (year 2): $1,300,000 Vacancy and collection loss: 10% of potential gross income Operating expenses (year 2): 35% of effective gross income Depreciation method: Straight-line, 39 years Projected growth in income: 2% per year Projected resale price after 5 years: $12,750,000 Ordinary income tax rate: 24% Capital gains tax rate: 15% Selling expense: 5% a. Determine an estimated return (ATIRR) for a limited partner. (Hint: Consider all limited partners as a single investor and the depreciation recapture tax to be the lesser of the ordinary income tax rate or the 25% maximum recapture rate.) b. Determine an estimated return (ATIRR) for the general partner. c. Why do the returns differ for the general and limited partners