Answered step by step

Verified Expert Solution

Question

1 Approved Answer

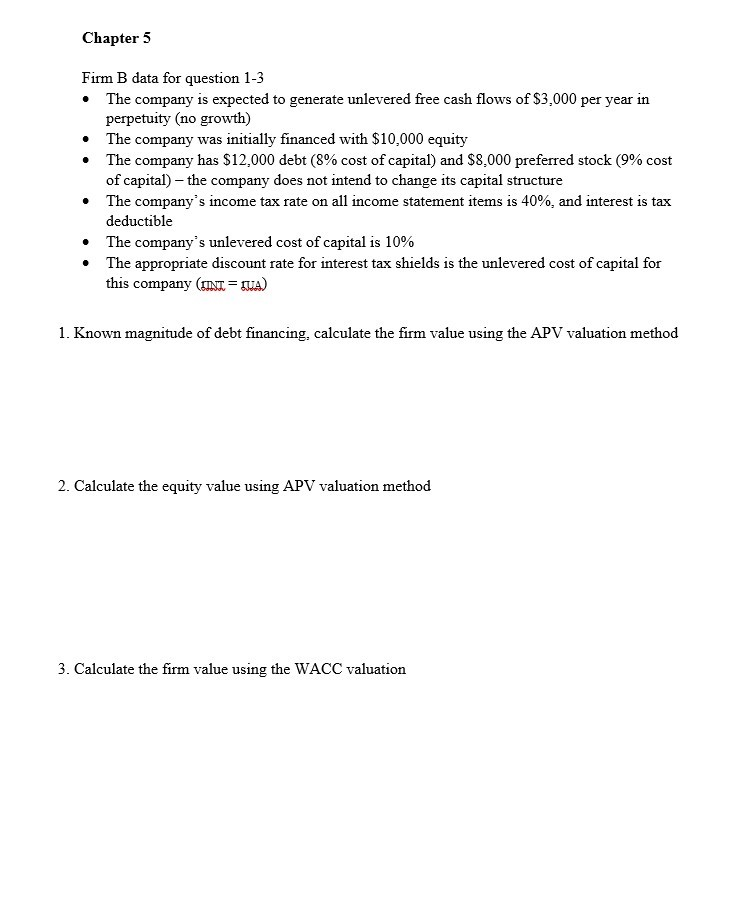

Please show work and formulas used. Chapter 5 Firm B data for question 1-3 The company is expected to generate unlevered free cash flows of

Please show work and formulas used.

Chapter 5 Firm B data for question 1-3 The company is expected to generate unlevered free cash flows of $3,000 per year in perpetuity (no growth) The company was initially financed with $10,000 equity The company has $12,000 debt (8% cost of capital) and $8.000 preferred stock (9% cost of capital) - the company does not intend to change its capital structure The company's income tax rate on all income statement items is 40%, and interest is tax deductible The company's unlevered cost of capital is 10% The appropriate discount rate for interest tax shields is the unlevered cost of capital for this company (IINI = JUA) . 1. Known magnitude of debt financing, calculate the firm value using the APV valuation method 2. Calculate the equity value using APV valuation method 3. Calculate the firm value using the WACC valuationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started