Answered step by step

Verified Expert Solution

Question

1 Approved Answer

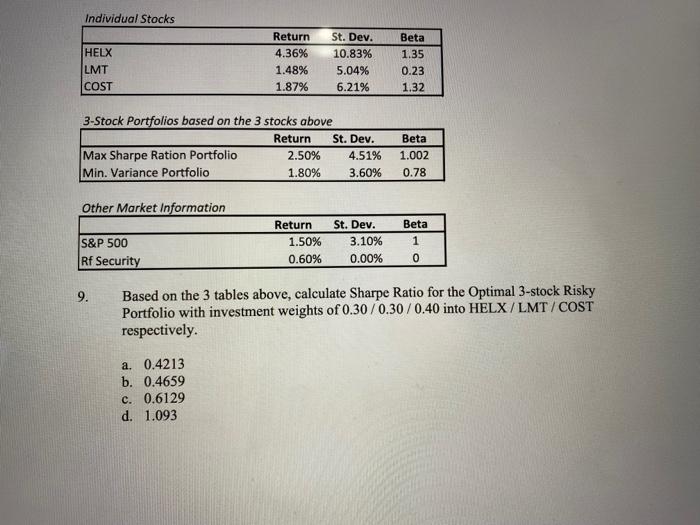

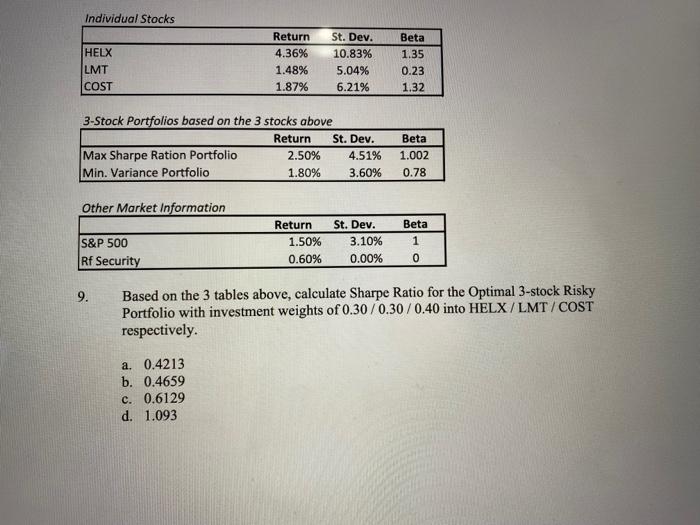

Please show work and the formulas. 3-Stock Portfolios based on the 3 stocks above Other Market Information 9. Based on the 3 tables above, calculate

Please show work and the formulas.

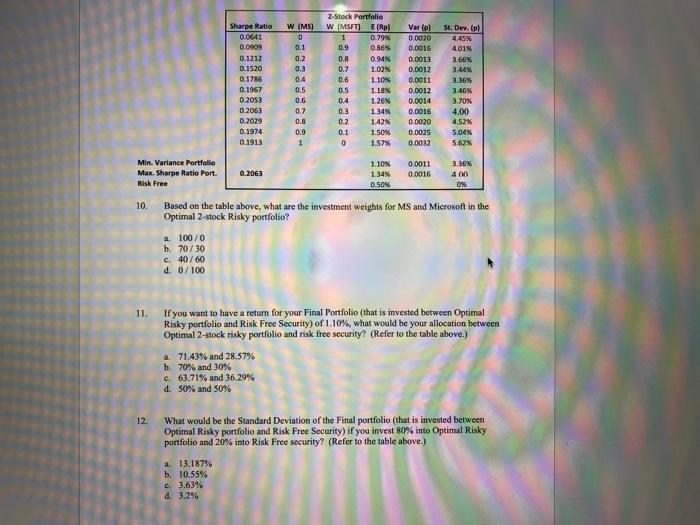

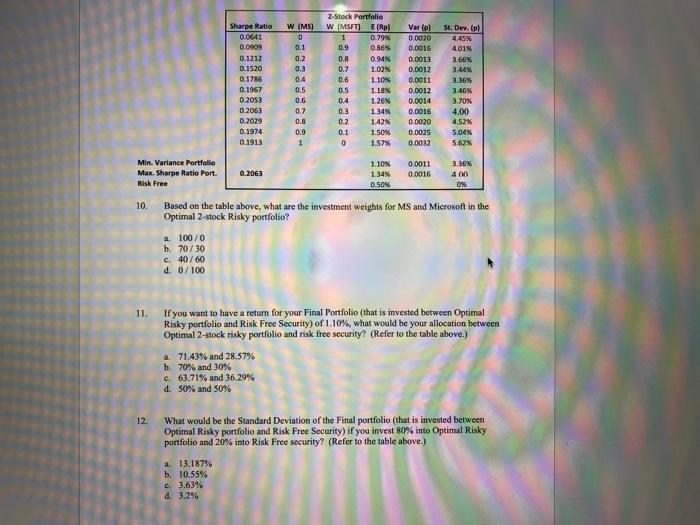

3-Stock Portfolios based on the 3 stocks above Other Market Information 9. Based on the 3 tables above, calculate Sharpe Ratio for the Optimal 3-stock Risky Portfolio with investment weights of 0.30/0.30/0.40 into HELX / LMT / COST respectively. a. 0.4213 b. 0.4659 c. 0.6129 d. 1.093 Min. Variance Portfolio Max, Sharpe Aatio Port. Risk Free 10. Based on the table above, what are the investment weights for MS and Microsoft in the Optimal 2-stock Risky portfolio? a. 100/0 b. 70/30 c. 40/60 d. 0/100 11. If you want to have a return for your Final Portfolio (that is invested between Optimal Risky portfolio and Risk Free Security) of 1.10%, what would be your allocation between Optimal 2-stock risky portfolio and risk free security? (Refer to the table above.) a. 71.43% and 28.57% b. 70% and 30% c. 63.71% and 36.29% d. 50% and 50% 12. What would be the Standard Deviation of the Final portfolio (that is invested between Optimal Risky portfolio and Risk Free Security) if you invest 80% into Optimal Risky portfolio and 20% into Risk Free security? (Refer to the table above.) a. 13.187% b. 10.55% c. 3.63% d. 3.2% 3-Stock Portfolios based on the 3 stocks above Other Market Information 9. Based on the 3 tables above, calculate Sharpe Ratio for the Optimal 3-stock Risky Portfolio with investment weights of 0.30/0.30/0.40 into HELX / LMT / COST respectively. a. 0.4213 b. 0.4659 c. 0.6129 d. 1.093 Min. Variance Portfolio Max, Sharpe Aatio Port. Risk Free 10. Based on the table above, what are the investment weights for MS and Microsoft in the Optimal 2-stock Risky portfolio? a. 100/0 b. 70/30 c. 40/60 d. 0/100 11. If you want to have a return for your Final Portfolio (that is invested between Optimal Risky portfolio and Risk Free Security) of 1.10%, what would be your allocation between Optimal 2-stock risky portfolio and risk free security? (Refer to the table above.) a. 71.43% and 28.57% b. 70% and 30% c. 63.71% and 36.29% d. 50% and 50% 12. What would be the Standard Deviation of the Final portfolio (that is invested between Optimal Risky portfolio and Risk Free Security) if you invest 80% into Optimal Risky portfolio and 20% into Risk Free security? (Refer to the table above.) a. 13.187% b. 10.55% c. 3.63% d. 3.2%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started