Please show work and which numbers you used to get the answer please and thank you!

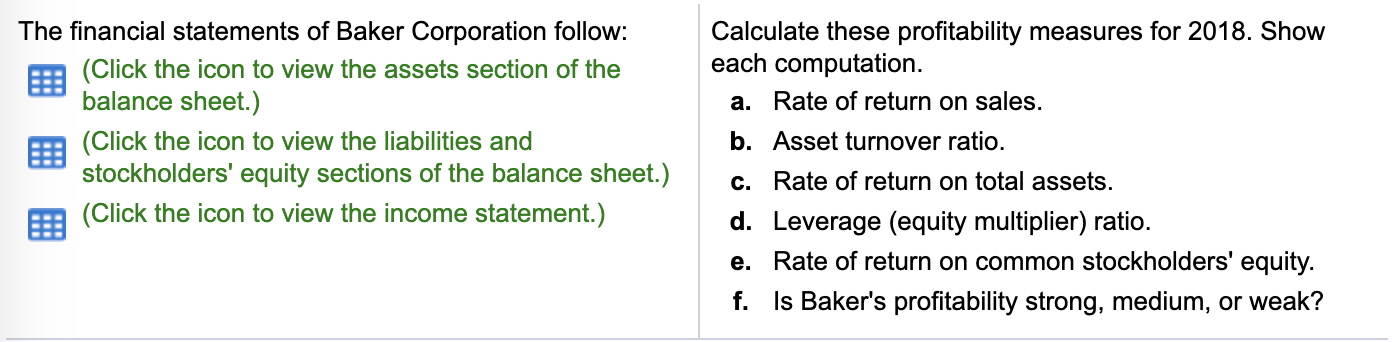

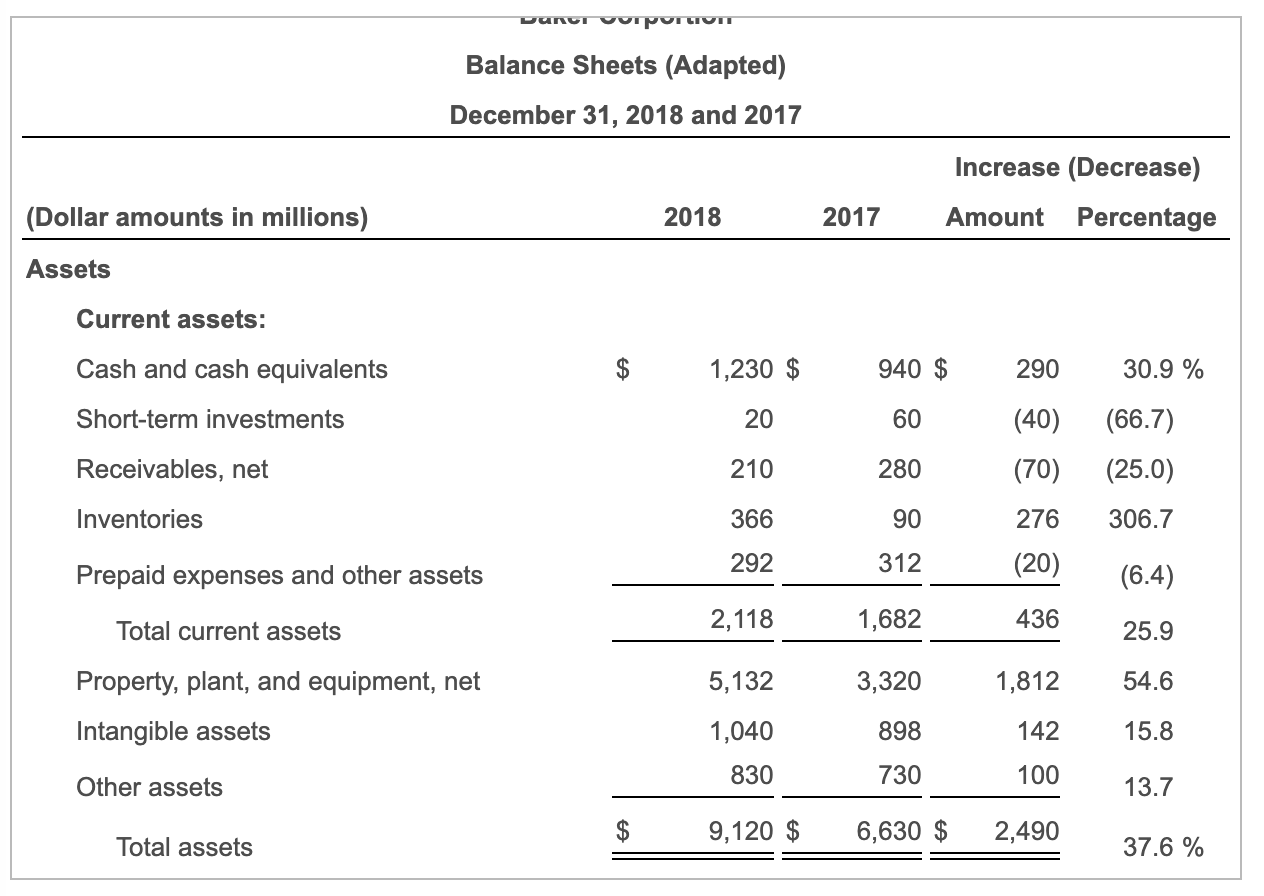

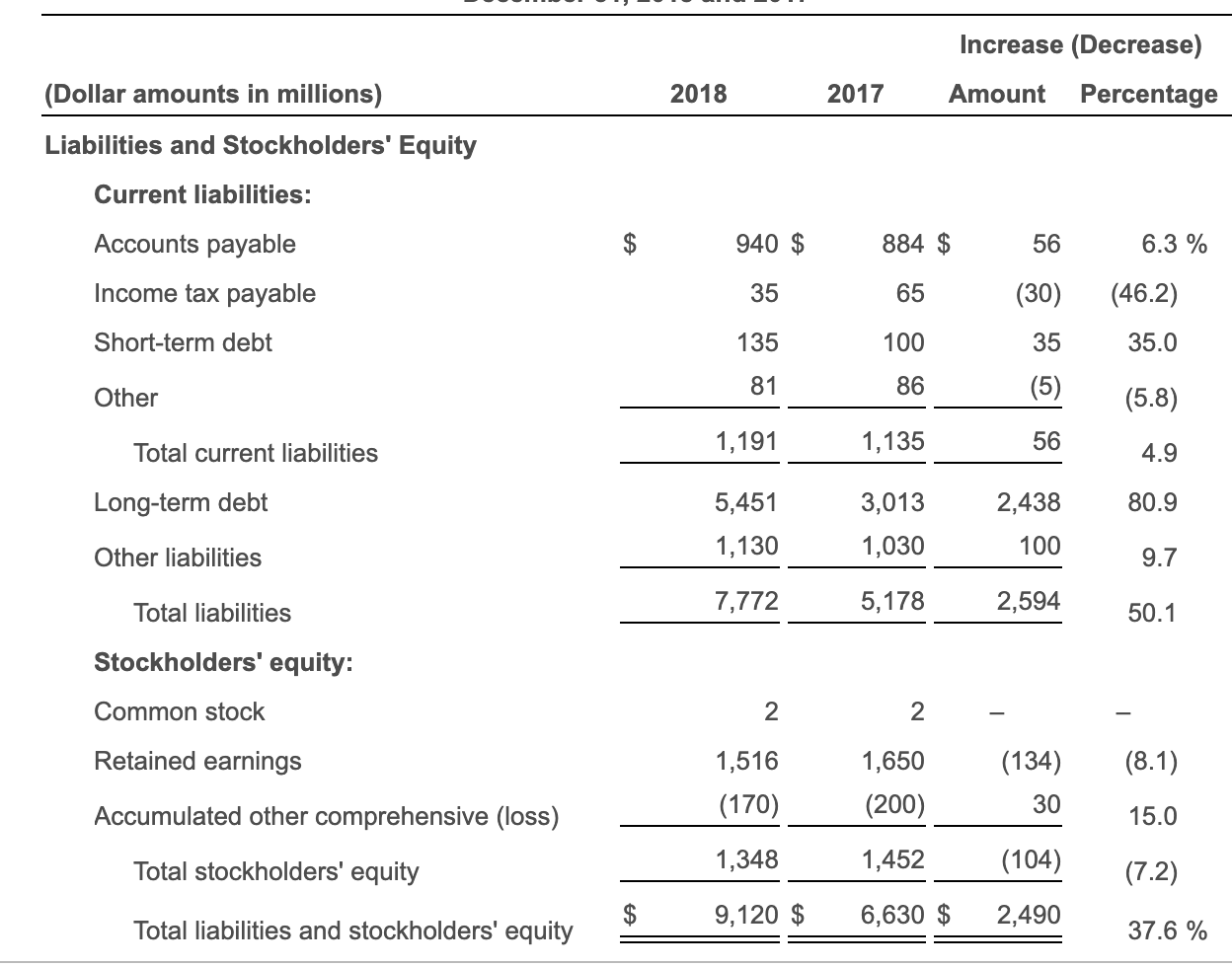

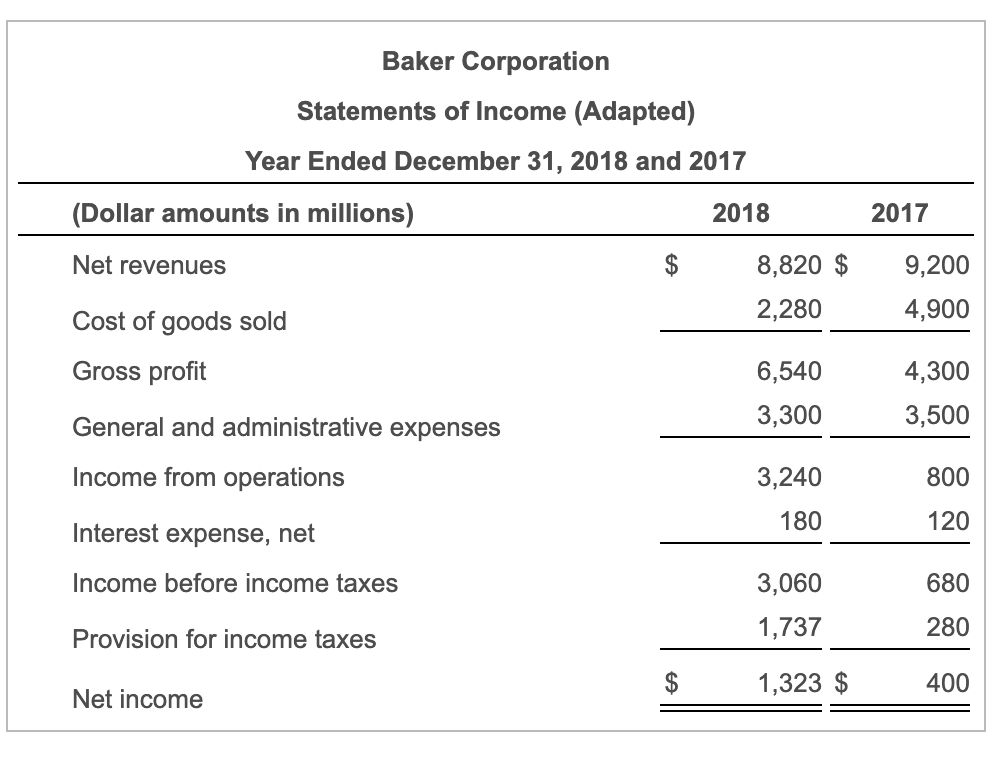

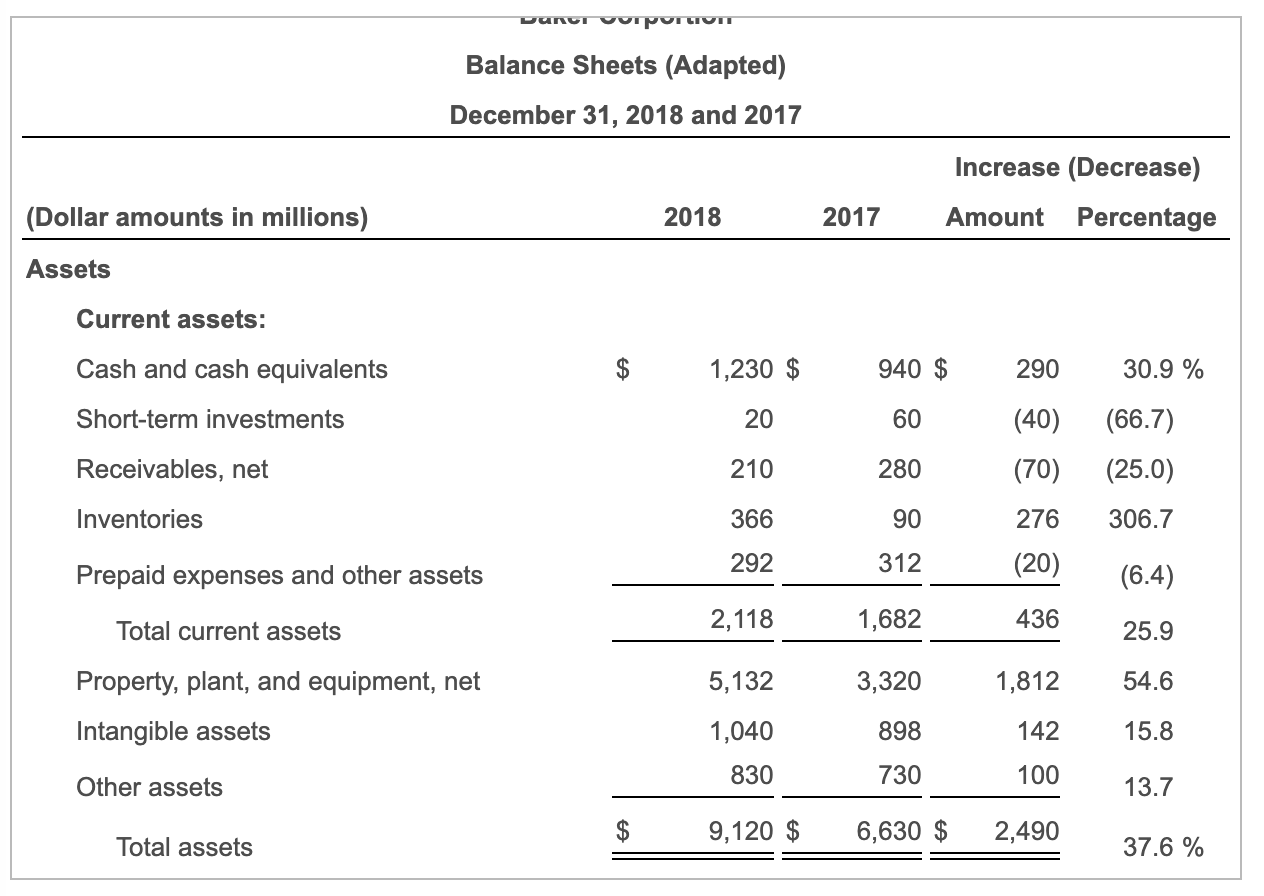

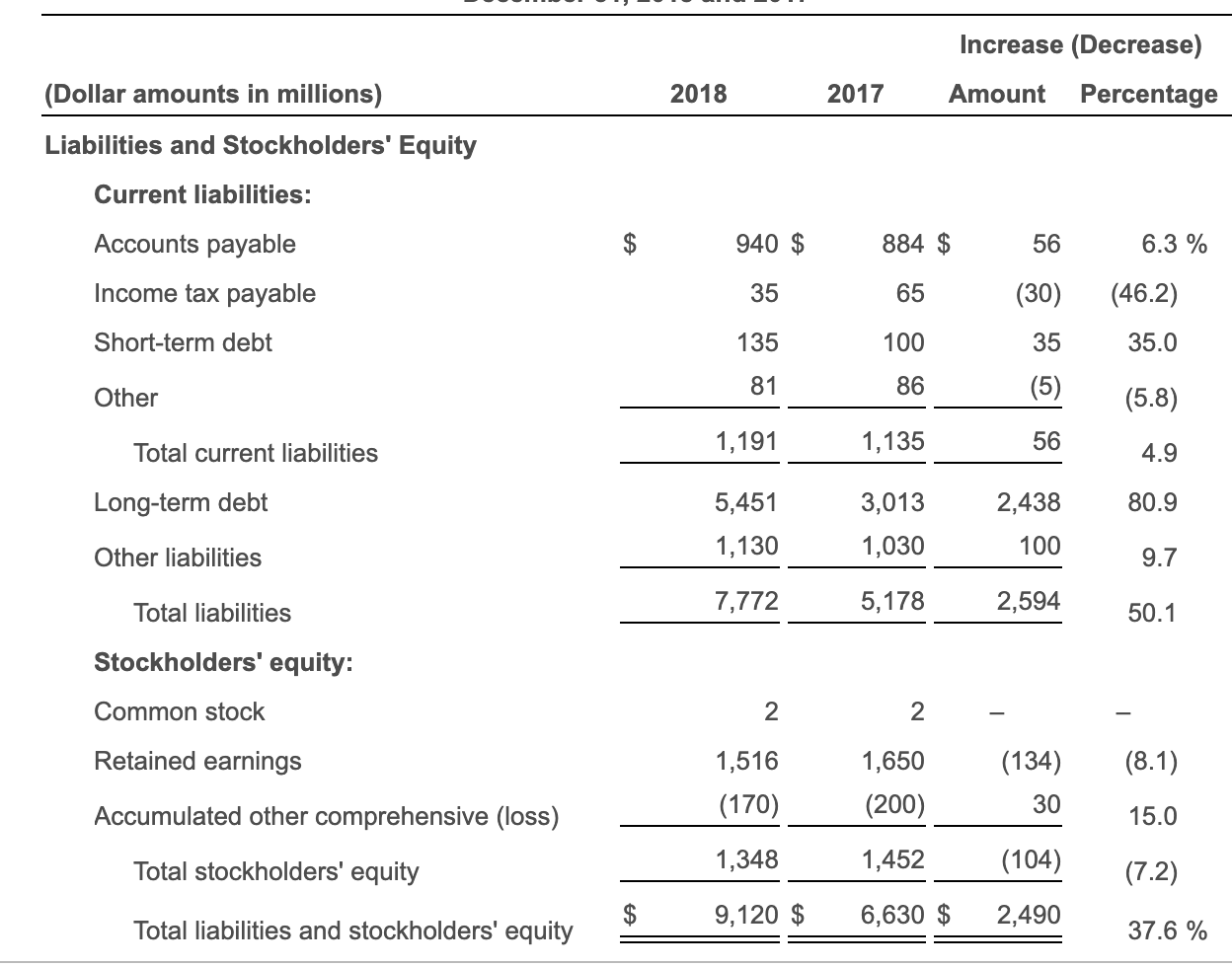

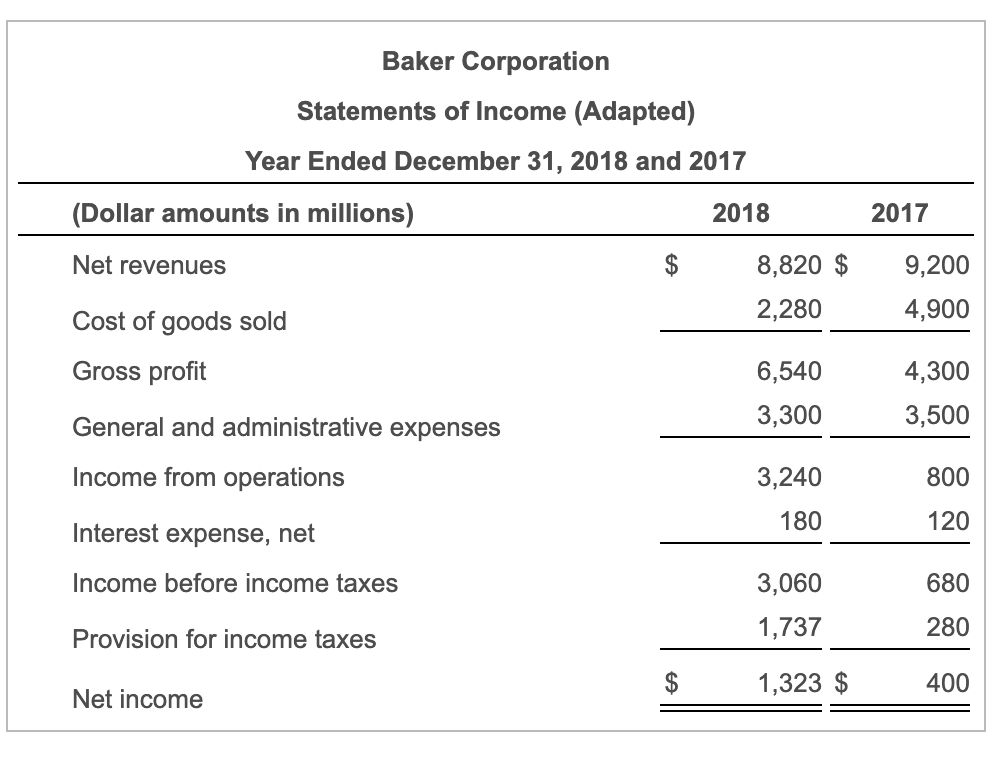

The financial statements of Baker Corporation follow: (Click the icon to view the assets section of the balance sheet.) (Click the icon to view the liabilities and stockholders' equity sections of the balance sheet.) (Click the icon to view the income statement.) Calculate these profitability measures for 2018. Show each computation. a. Rate of return on sales. b. Asset turnover ratio. c. Rate of return on total assets. d. Leverage (equity multiplier) ratio. e. Rate of return on common stockholders' equity. f. Is Baker's profitability strong, medium, or weak? Balance Sheets (Adapted) December 31, 2018 and 2017 Increase (Decrease) Amount Percentage (Dollar amounts in millions) 2018 2017 Assets Current assets: Cash and cash equivalents 1,230 $ 940 $ 290 30.9 % Short-term investments 20 60 (40) (70) (66.7) (25.0) Receivables, net 210 280 Inventories 366 90 276 306.7 292 312 Prepaid expenses and other assets (20) (6.4) 2,118 Total current assets 1,682 436 25.9 5,132 3,320 1,812 54.6 Property, plant, and equipment, net Intangible assets 1,040 898 142 15.8 830 730 100 Other assets 13.7 $ 9,120 $ 6,630 $ 2,490 Total assets 37.6 % Increase (Decrease) Amount Percentage 2018 2017 (Dollar amounts in millions) Liabilities and Stockholders' Equity Current liabilities: Accounts payable Income tax payable 940 $ 884 $ 56 6.3 % 35 65 (30) (46.2) Short-term debt 135 100 35 35.0 81 86 Other (5) (5.8) 1,191 Total current liabilities 1,135 56 4.9 Long-term debt 2,438 80.9 5,451 1,130 3,013 1,030 100 Other liabilities 9.7 Total liabilities 7,772 5,178 2,594 50.1 Stockholders' equity: Common stock 2 2 Retained earnings (8.1) 1,516 (170) 1,650 (200) (134) 30 Accumulated other comprehensive (loss) 15.0 Total stockholders' equity 1,348 1,452 (104) (7.2) 9,120 $ 6,630 $ 2,490 Total liabilities and stockholders' equity 37.6 % Baker Corporation Statements of Income (Adapted) Year Ended December 31, 2018 and 2017 (Dollar amounts in millions) 2018 2017 Net revenues $ 8,820 $ 2,280 9,200 4,900 Cost of goods sold Gross profit 6,540 3,300 4,300 3,500 General and administrative expenses Income from operations 3,240 800 180 120 Interest expense, net Income before income taxes 680 3,060 1,737 280 Provision for income taxes $ 1,323 $ 400 Net income