Please show work ans give final answer

This is what Mc-Graw hill gave me, please show work and give me the final answer

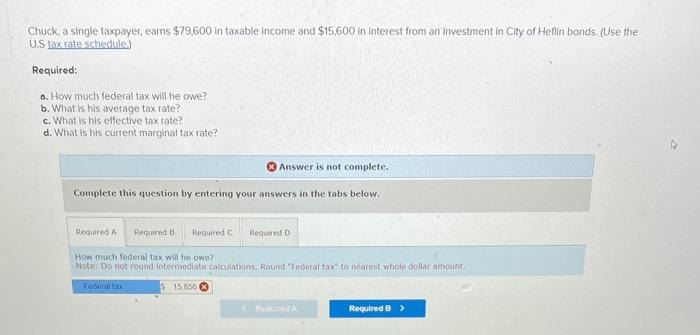

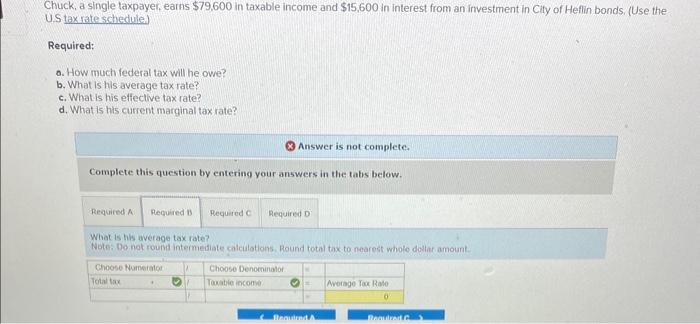

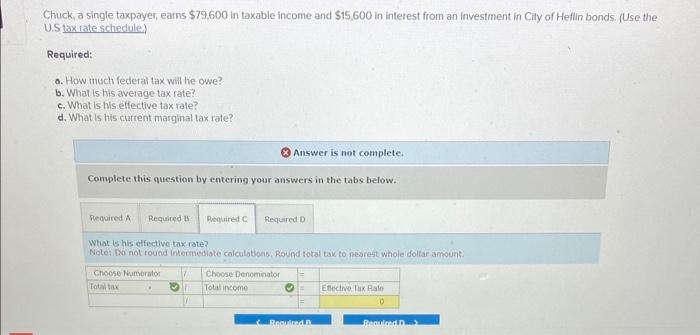

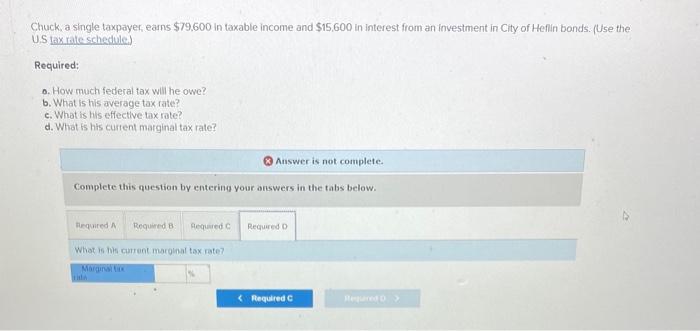

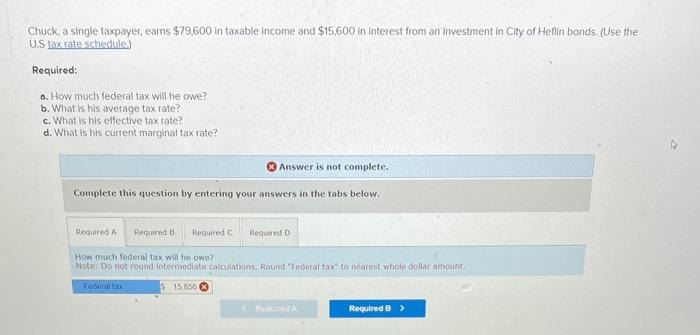

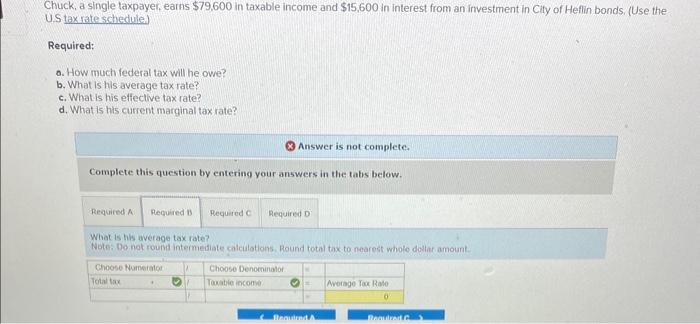

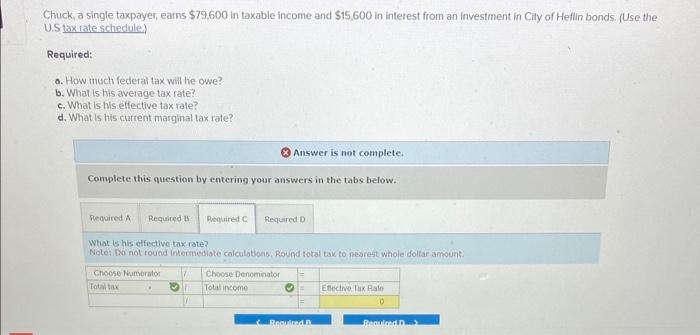

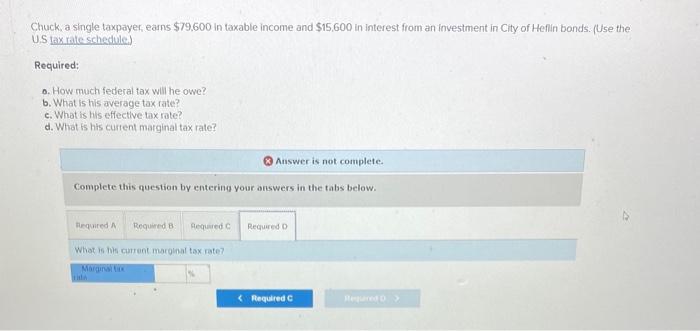

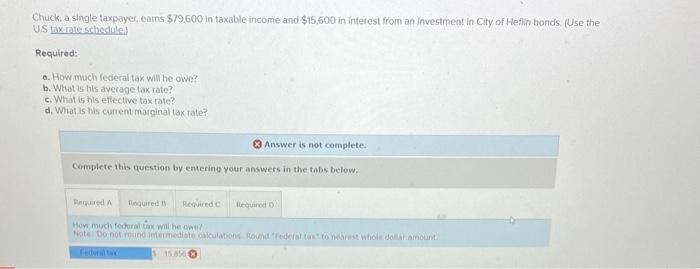

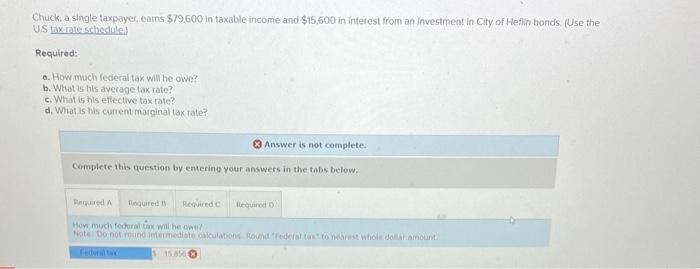

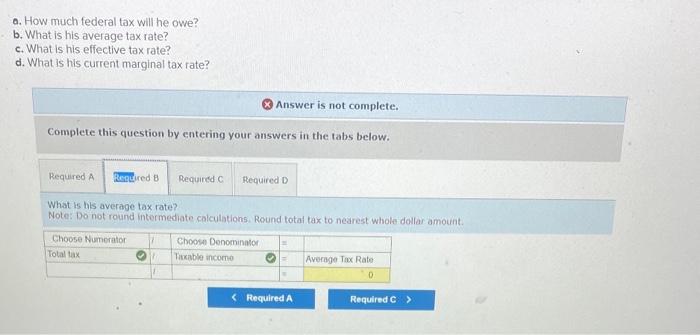

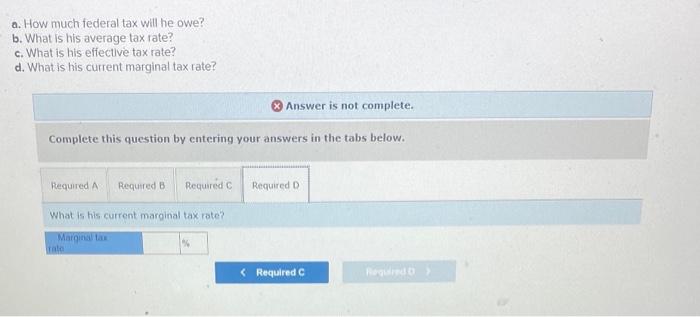

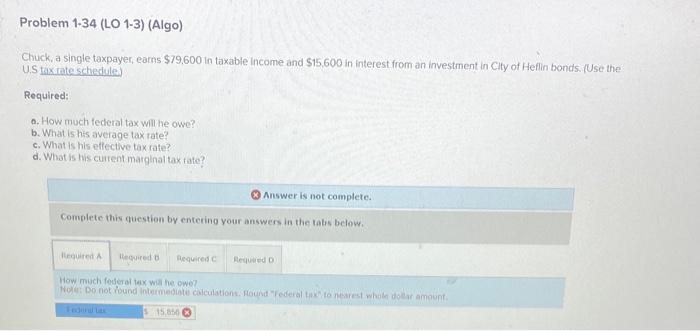

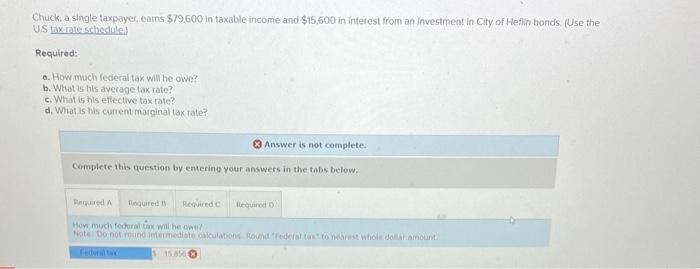

Chuck, a single taxpayer, earns $79,600 in taxable income and $15,600 in interest from an investment in City of Heflin bonds. (Use the US tax rate schedule) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? (x) Answer is not complete. Complete this question by entering your answers in the tabs below. How much federal tax will the owe? Note: Do not round intermediate calculations. Round "Federal tox'" to nosrect whole dollar amoune. Chuck, a single taxpayer, earns $79,600 in taxable income and $15,600 in interest from an investment in City of Heflin bonds, (Use the US tax rate schedule) Required: o. How much fecderal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Answer is not complete. Complete this question by entering your answers in the tabs below. What is his average tax rate? Notes Do not round intermediale colculotions. Round total tax to nearest whole dollar amount. Chuck, a single taxpayer, earns $79,600 in taxable income and $15,600 in interest from an investment in City of Heflin bonds. (Use the US 1 ax iate schedule.) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? 8 Answer is not complete. Complete this question by entering your answers in the tabs below. What is his effective tax rate? Note: Do not round intermediate calculations. Round total tax to nesrest whole dollar amount: Chuck, a single taxpayer, earns $79.600 in taxable income and $15,600 in interest from an investment in City of Hefin bonds. (Use the U.S iax rateseheduled Required: o. How much federal tax will he owe? b. What is his average tax rate? c. What is his effectlve tax rate? d. What is his curtent marginal tax rate? 8 Answer is not complete. Complete this question by entering your answers in the tabs below. What is his cumant macginal tax rate? Chuck, a single taxpayer, earns $79,600 in taxable income and $15,600 in interest from an investment in City of theflin bonds. (Use the US tax rates schedule.) Required: o. How much federal tax wiln he owe? b. What is his average tax rate? c. What is his eftective tax rate? d. What is his current marginal tax rate? Answer is not complete. Complete this question by entering your answers in the tabs below. Hen mudi forharai iax mil be onily a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Answer is not complete. Complete this question by entering your answers in the tabs below. What is his average tax rate? Note: Do not round intermediate colculations. Round total tax to nearest whole dollar amount. o. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax iate? d. What is his current marginal tax rate? Answer is not complete. Complete this question by entering your answers in the tabs below. What is his effectlve tax rate? Note: Do not round intermediate calculations. Round total tax to nearest whole dollar arnount. a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effectlve tax rate? d. What is his current marginal tax rate? Answer is not complete. Complete this question by entering your answers in the tabs below. What is his current marginal tax rate? Chuck, a single taxpayer, eams $79,600 in taxable income and $15,600 in interest from an investment in City of Heflin bonds. (Use the U.S tax rateschedule) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his curent marglnal tax fate? Complete this question by entering your answers in the tals below. How much foderal tax wal he owe? Nog: Do not round intermediete calculations. Hound "federal tikn to nearest what dolar amount. Chuck, a single taxpayer, earns $79,600 in taxable income and $15,600 in interest from an investment in City of Heflin bonds. (Use the US tax rate schedule) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? (x) Answer is not complete. Complete this question by entering your answers in the tabs below. How much federal tax will the owe? Note: Do not round intermediate calculations. Round "Federal tox'" to nosrect whole dollar amoune. Chuck, a single taxpayer, earns $79,600 in taxable income and $15,600 in interest from an investment in City of Heflin bonds, (Use the US tax rate schedule) Required: o. How much fecderal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Answer is not complete. Complete this question by entering your answers in the tabs below. What is his average tax rate? Notes Do not round intermediale colculotions. Round total tax to nearest whole dollar amount. Chuck, a single taxpayer, earns $79,600 in taxable income and $15,600 in interest from an investment in City of Heflin bonds. (Use the US 1 ax iate schedule.) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? 8 Answer is not complete. Complete this question by entering your answers in the tabs below. What is his effective tax rate? Note: Do not round intermediate calculations. Round total tax to nesrest whole dollar amount: Chuck, a single taxpayer, earns $79.600 in taxable income and $15,600 in interest from an investment in City of Hefin bonds. (Use the U.S iax rateseheduled Required: o. How much federal tax will he owe? b. What is his average tax rate? c. What is his effectlve tax rate? d. What is his curtent marginal tax rate? 8 Answer is not complete. Complete this question by entering your answers in the tabs below. What is his cumant macginal tax rate? Chuck, a single taxpayer, earns $79,600 in taxable income and $15,600 in interest from an investment in City of theflin bonds. (Use the US tax rates schedule.) Required: o. How much federal tax wiln he owe? b. What is his average tax rate? c. What is his eftective tax rate? d. What is his current marginal tax rate? Answer is not complete. Complete this question by entering your answers in the tabs below. Hen mudi forharai iax mil be onily a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Answer is not complete. Complete this question by entering your answers in the tabs below. What is his average tax rate? Note: Do not round intermediate colculations. Round total tax to nearest whole dollar amount. o. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax iate? d. What is his current marginal tax rate? Answer is not complete. Complete this question by entering your answers in the tabs below. What is his effectlve tax rate? Note: Do not round intermediate calculations. Round total tax to nearest whole dollar arnount. a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effectlve tax rate? d. What is his current marginal tax rate? Answer is not complete. Complete this question by entering your answers in the tabs below. What is his current marginal tax rate? Chuck, a single taxpayer, eams $79,600 in taxable income and $15,600 in interest from an investment in City of Heflin bonds. (Use the U.S tax rateschedule) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his curent marglnal tax fate? Complete this question by entering your answers in the tals below. How much foderal tax wal he owe? Nog: Do not round intermediete calculations. Hound "federal tikn to nearest what dolar amount