Answered step by step

Verified Expert Solution

Question

1 Approved Answer

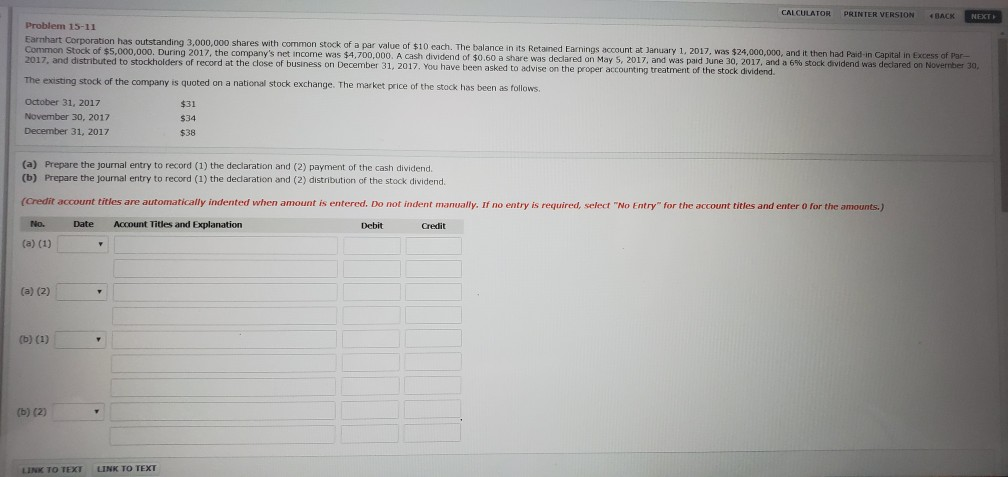

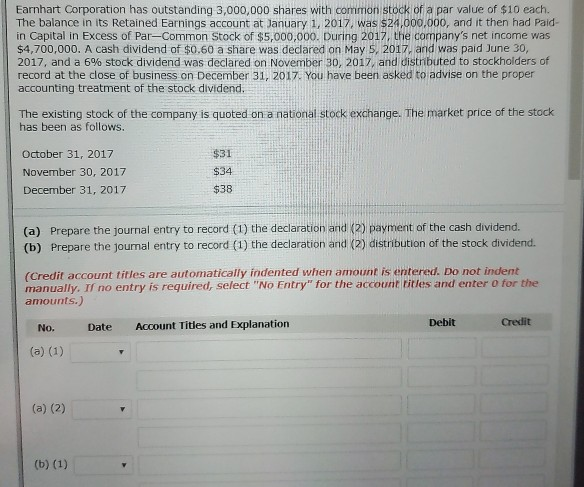

Please show work! CALCULATOR PRINTER VERSION BACK NEXT Problem 15-11 Earhart Corporation has outstanding 3,000,000 shares with common stock of a par value of $10

Please show work!

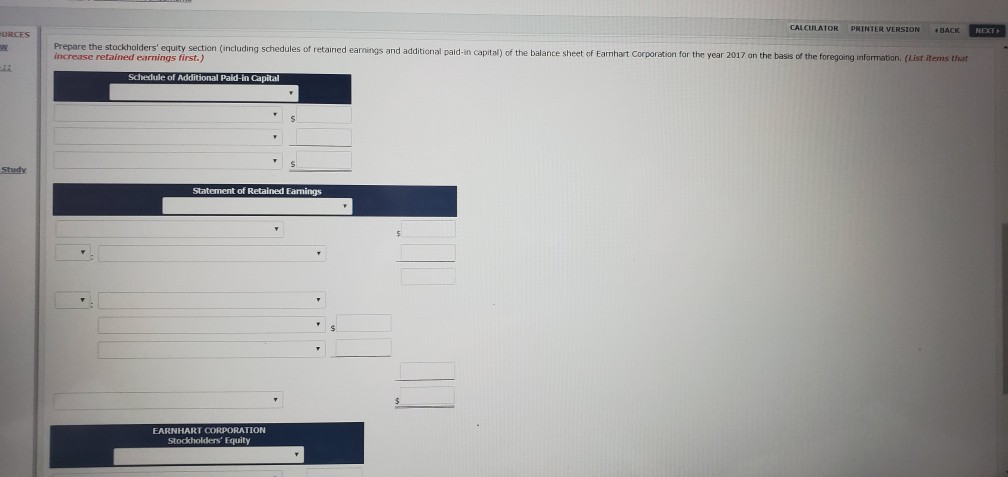

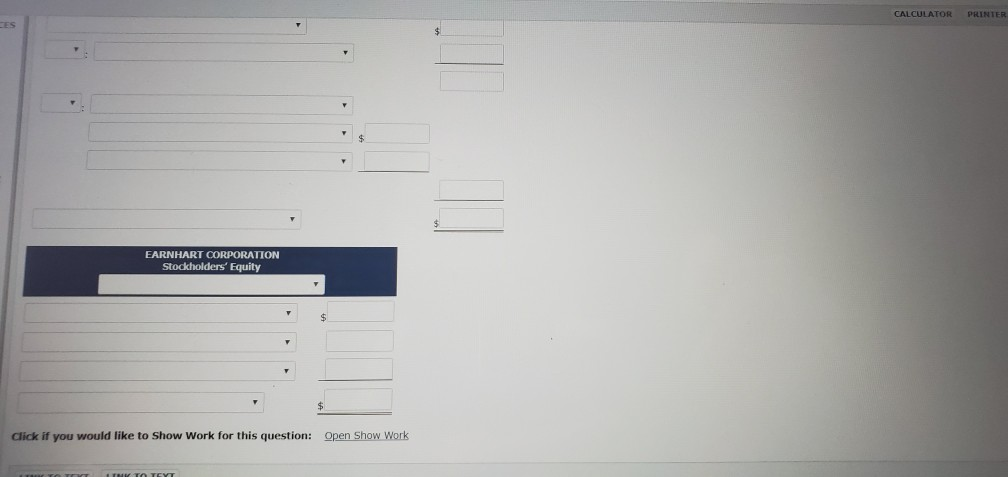

CALCULATOR PRINTER VERSION BACK NEXT Problem 15-11 Earhart Corporation has outstanding 3,000,000 shares with common stock of a par value of $10 each. The balance in its R uned Earnings account at January 1, 2017, was $24,000,000, and it then had Paid in Capital in Excess of Par Common Stock of $5,000,000. During 2017, the company's net income was $4,700,000. A cash dividend of $0.60 a share was declared on May 5, 2017, and was paid June 30, 2017, and a 6% stock dividend was declared on November 30, 2017, and distributed to stockholders of record at the close of business on December 31, 2017. You have been asked to advise on the proper accounting treatment of the stock dividend. The existing stock of the company is quoted on a national stock exchange. The market price of the stock has been as follows $31 October 31, 2017 November 30, 2017 December 31, 2017 $34 $38 (a) Prepare the journal entry to record (1) the declaration and (2) payment of the cash dividend. (6) Prepare the journal entry to record (1) the declaration and (2) distribution of the stock dividend. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) No. Date Account Titles and Explanation Debit Credit (a) (2) (b) (2) CALCULATOR PRINTER VERSION BACK NEXT URCES Prepare the stockholders' equity section (including schedules of retained earings and additional pald-in capital of the balance sheet of Earnhart Corporation for the year 2017 on the basis of the foregoing information. (List items that increase retained earnings first.) Schedule of Additional Paid-in Capital Study Statement of Retained Earnings EARNART CORPORATION Stockholders' Equity CALCULATOR PRINTER EARNHART CORPORATION Stockholders' Equity Click if you would like to Show Work for this question: Open Show Work TTCVT Eamhart Corporation has outstanding 3,000,000 shares with common stock of a par value of $10 each. The balance in its Retained Earnings account at January 1, 2017, was $24.000.000, and it then had Paid in Capital in Excess of Par-Common Stock of $5,000,000. During 2017, the company's net income was $4,700,000. A cash dividend of $0.60 a share was declared on May 5, 2017 and was paid June 30, 2017, and a 6% stock dividend was declared on November 30, 2017, and distributed to stockholders of record at the close of business on December 31, 2017. You have been asked to advise on the proper accounting treatment of the stock dividend. The existing stock of the company is quoted on a national stock exchange. The market price of the stock has been as follows. October 31, 2017 November 30, 2017 December 31, 2017 $31 $34 $38 (a) Prepare the journal entry to record (1) the declaration and (2) payment of the cash dividend. (b) Prepare the journal entry to record (1) the declaration and (2) distribution of the stock dividend. (Credir account titles are automatically indented when amount is entered. Do not indent manually. Il no entry is required, select "No Entry" for the accountles and enter for the amounts.) No. Date Account Titles and Explanation Debit Credit (a) (2) (b) (1)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started