Answered step by step

Verified Expert Solution

Question

1 Approved Answer

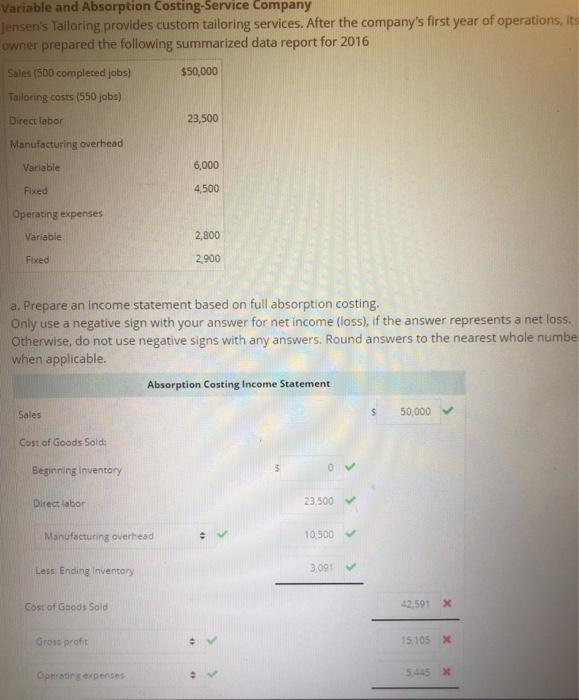

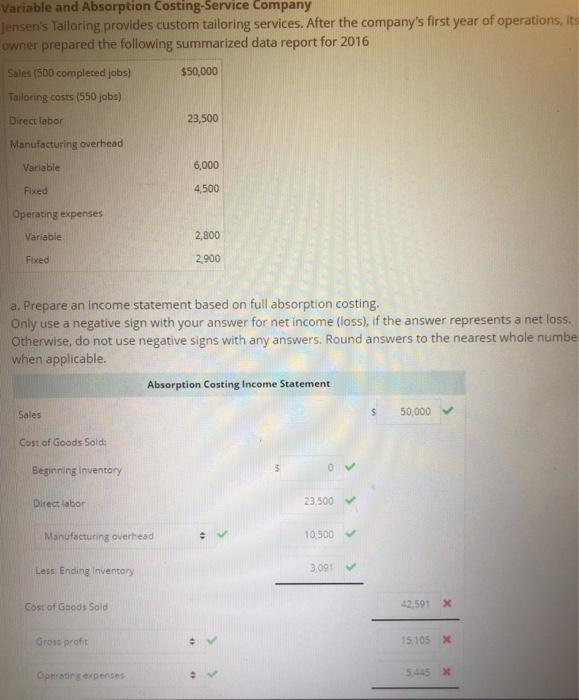

Please show work Costing-Service Company Variable and Absorption jensen's Tailoring provides custom tailoring services. After the company's first year of operations, its owner prepared the

Please show work

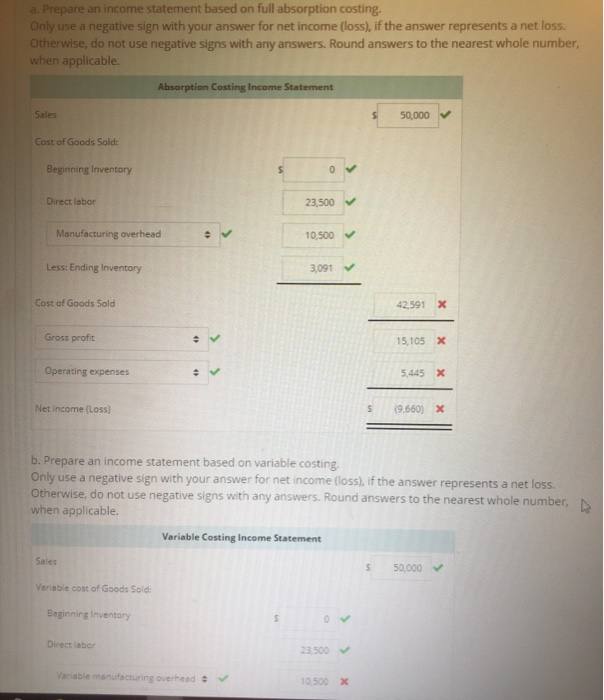

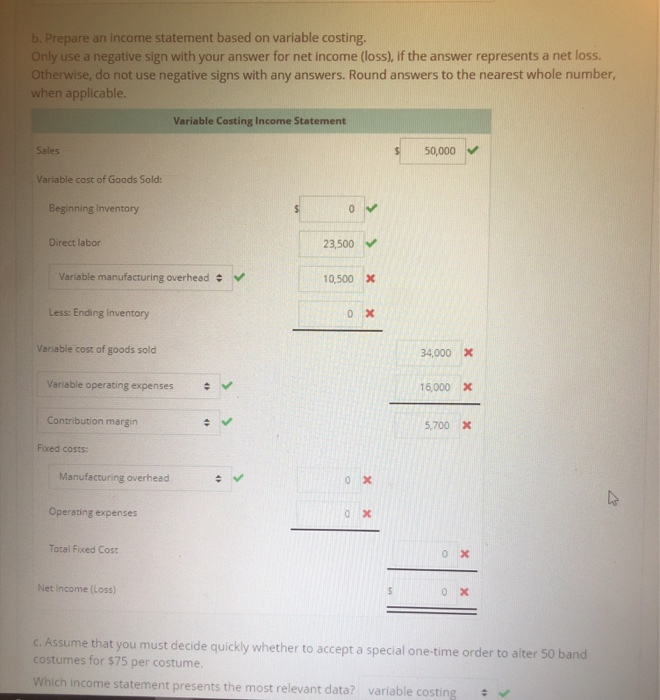

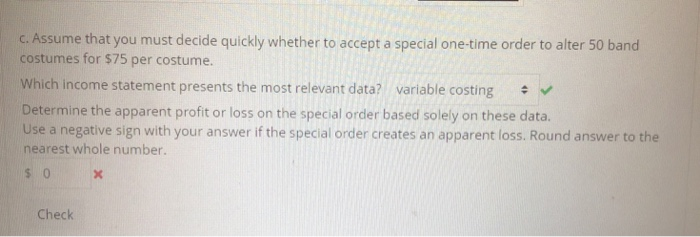

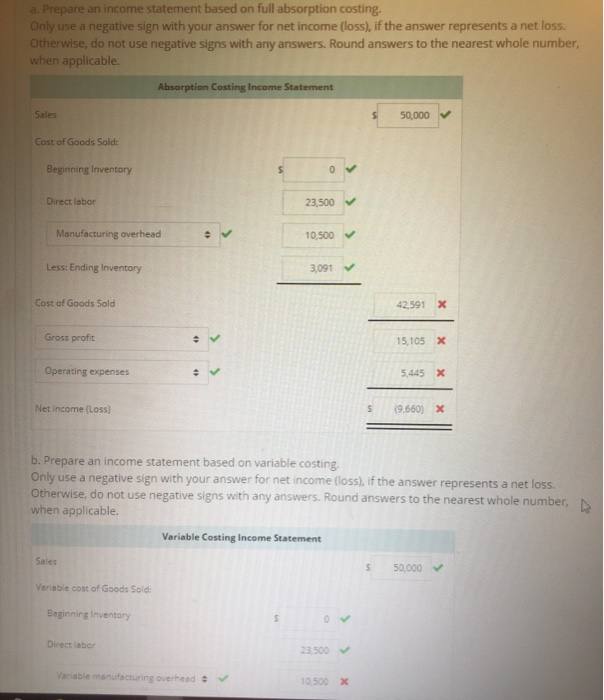

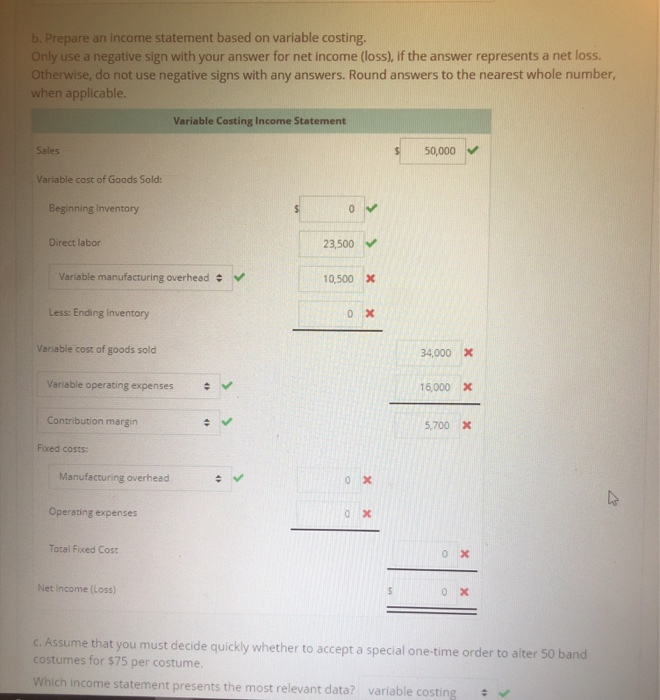

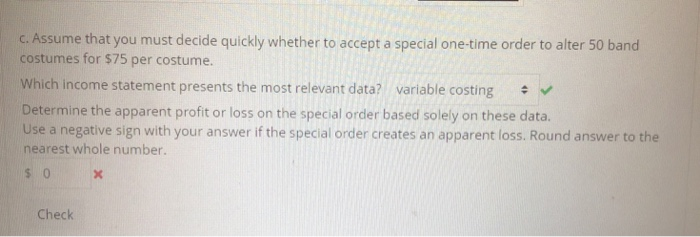

Costing-Service Company Variable and Absorption jensen's Tailoring provides custom tailoring services. After the company's first year of operations, its owner prepared the following summarized data report for 2016 50,000 Sales (500 completed jobs) Tailoring costs (550 jobs) Direct labor Manufacturing overheard 23,500 Variable 6,000 Fixed 4,500 Operating expenses Variable 2,800 Fixed 2,900 a. Prepare an income statement based on full absorption costing. Only use a negative sign with your answer for net income (loss), if the answer represents a net loss. Otherwise, do not use negative signs with any answers. Round answers to the nearest whole numbe when applicable. Absorption Costing Income Statement Sales S 50,000 Cost of Goods Sold: Beginning Inventory Direct labor 23,500 Manufacturing overhead 10,500 Less Ending Inventory 3.091 Cost of Goods Sold 42,591 x Gross proft 15,105 5,445 Operating expenses an income statement based on full absorption costing a. Prepare Only use a negative sign with your answer for net income (loss), if the answer represents a net loss. Otherwise, do not use negative signs with any answers. Round answers to the nearest whole number, when applicable. Absorption Costing Income Statement Sales 50,000 Cost of Goods Sold: Beginning Inventory Direct labor 23,500 0,500 3,091 Manufacturing overhead Less: Ending Inventory Cost of Goods Sold 42,591 X Gross proft 15,105 X Operating expenses 5,445 X Net Income (Loss) S (9,660) b. Prepare an income statement based on variable costing. Only use a negative sign with your answer for net income (loss), if the answer represents a net loss. Otherwise, do not use negative signs with any answers. Round answers to the nearest whole number, when applicable. Variable Costing Income Statement Sales 50,000 Variable cost of Goods Sold: Beginning Inventory Direct labor 23500 Variable manufacturing overhead 0500 X b. Prepare an income statement based on variable costing. Only use a negative sign with your answer for net income (loss), if the answer represents a net loss. Otherwise, do not use negative signs with any answers. Round answers to the nearest whole number, when applicable. Variable Costing Income Statement Sales 50,000 V Variable cost of Goods Sold: Beginning Inventory Direct labor 23,500 Variable manufacturing overhead # 10,500 Less: Ending Inventory Variable cost of goods sold 34,000 x Variable operating expenses 16,000 x Contribution margin 5,700 x Fixed costs: Manufacturing overhead Operating expenses Total Fixed Cost Net Income (Loss) c. Assume that you must decide quickly whether to accept a special one-time order to alter 50 band costumes for $75 per costume. which income statement presents the most relevant data? variable costing c. Assume that you must decide quickly whether to accept a special one-time order to alter 50 band costumes for $75 per costume. which income statement presents the most relevant data? variable costing # V Determine the apparent profit or loss on the special order based solely on these data. Use a negative sign with your answer if the special order creates an apparent loss. Round answer to the nearest whole number. $0 Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started