Answered step by step

Verified Expert Solution

Question

1 Approved Answer

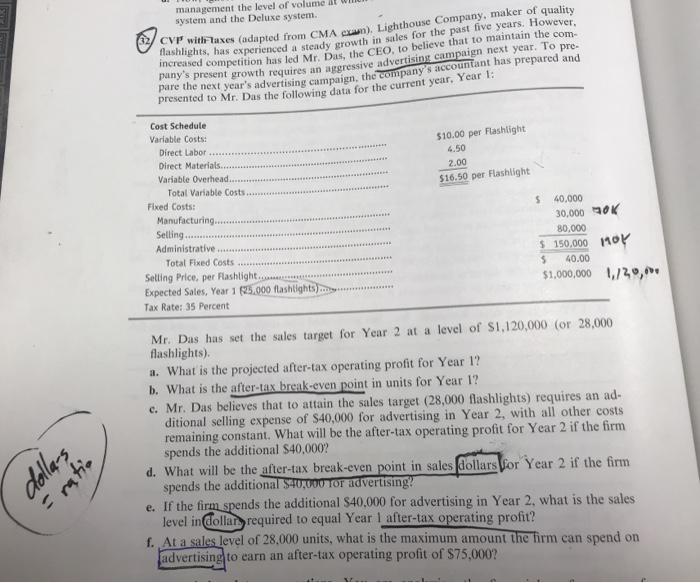

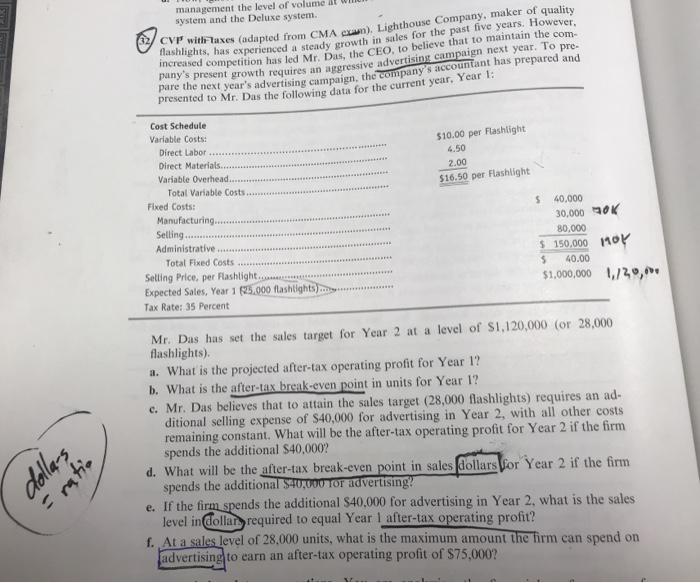

please show work for each step management the level of volume it system and the Deluxe system. CV withTaxes (adapted from CMA). Lighthouse Company, maker

please show work for each step

management the level of volume it system and the Deluxe system. CV withTaxes (adapted from CMA). Lighthouse Company, maker of quality flashlights, has experienced a steady growth in sales for the past five years. However, pare the next year's advertising campaign, the company's accountant has prepared and pany's present growth requires an aggressive advertising campaign next year. To pre presented to Mr. Das the following data for the current year. Year 1: $10.00 per Flashlight 4.50 2.00 $16.50 per Flashlight $ 40.000 Cost Schedule Variable Costs: Direct Labor Direct Materials... Variable Overhead.. Total Variable Costs Fixed Costs: Manufacturing........ Selling.. Administrative Total Fixed Costs Selling Price per Flashlight. Expected Sales, Year 125.000 flashlights)... Tax Rate: 35 Percent 30,000 SOK 80,000 $ 150.000 $ 40.00 11 ********** $1,000,000 0739, dollars Mr. Das has set the sales target for Year 2 at a level of S1,120,000 (or 28,000 flashlights). a. What is the projected after-tax operating profit for Year 1? b. What is the after-tax break-even point in units for Year 1? c. Mr. Das believes that to attain the sales target (28,000 flashlights) requires an ad- ditional selling expense of $40,000 for advertising in Year 2, with all other costs remaining constant. What will be the after-tax operating profit for Year 2 if the firm spends the additional $40,000? d. What will be the after-tax break-even point in sales dollars for Year 2 if the firm spends the additional $40,000 Tor advertising! e. If the firm spends the additional $40.000 for advertising in Year 2. what is the sales level in dollar required to equal Year 1 after-tax operating profit? f. At a sales level of 28.000 units, what is the maximum amount the firm can spend on advertising to earn an after-tax operating profit of $75,000? = ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started